They say some of the happiest people in life are those who have narrowly missed a bullet. But for a lucky pass, they might’ve been wiped out physically, emotionally, or financially.

To some degree, I am one of those people.

You get back on your feet. And this time, you’re simply excited that you have feet.

Behaviour in the markets works the same way. In late March 2020, as we went into lockdown, fear and panic was evident at every turn. And you quickly realise how unprepared you are for crisis.

With a supermarket down the road, perhaps you’re used to ‘just-in-time’ restocks of the larder. You come to depend on your morning cappuccino and croissant at the café. Being able to get out of the overpopulated city whenever you wish. And see other members of your family.

In March 2020, it was shocking to see queues snaking outside supermarkets. Shelves cleaned out, empty. People behaving erratically. And stock markets around the world imploding. Even defensive companies — even gold — could find no place to hide from this crazed bear on a rampage.

From then — and several months after — fear reined in the markets. We had some dry powder to take advantage. Some courage from memories of the GFC. But, in hindsight, we could’ve done with more. Much more.

Here’s how fear and greed works

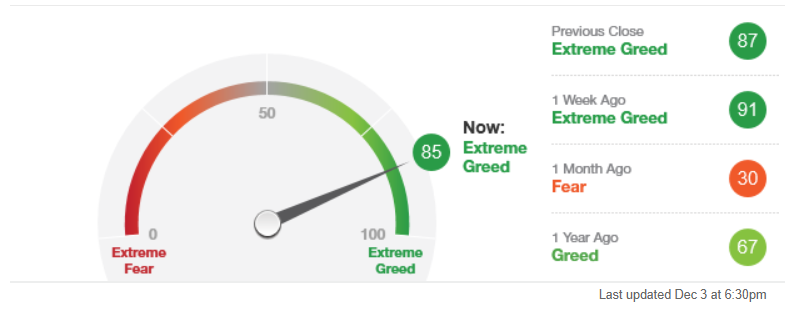

CNN Business publishes a nifty ‘Fear & Greed Index’.

They calculate this based on analysis of stock-price strength, breadth, put v. call options, market momentum, safe-haven demand, market volatility, and junk-bond demand.

Back in December 2020, here’s where we sat:

Source: CNN Business

In the Wholesale portfolios we manage, we had some influx of money from our clients. And we managed to deploy this when the index was set to fear. It boosted returns.

But then the index switched over to greed, and it became far more difficult to invest in this environment.

Because the market started to recover. The risk event was being dealt with. The bear was subdued.

And the pandemic that could’ve wiped out so many businesses — indeed, our very existence — could now be vaccinated against.

So how do you invest in a recovery?

Well, we don’t stop looking for opportunities.

While growth opportunities may be fast disappearing in 2021, there are still income opportunities. Quality businesses with good assets that pay regular dividends. Many above 5 or 6% p.a.

While interest rates stay low, these income picks can provide us some cash flow. Possibly even growth as people realise there are few other places to get yield. And the landlord property bubble now has government artillery trained on it.

But if there’s anything I’ve learnt from the GFC, Brexit, and Covid — it is this…

There will be another ‘black swan event’ along soon enough

This time, I’ve learnt to be better prepared. To have access to more funds to deploy. To act more courageously. Though, I said that last time.

Courage is something hard to learn unless you routinely dodge bullets.

Yet, there are warning signs. And you can begin preparing for ‘what next?’

Let me run through a few to bring a little fear back into your week:

- We are closer to major global conflict than we’ve been for many years. There are now 5 critical flashpoints for the US — that, if ignited, would spill over to its allies and the world. The North Korea Crisis. Tensions in the East China Sea. Territorial disputes in the South China Sea. War in Afghanistan. Confrontation with Iran.

- Closer to home, Wellington is due a major earthquake. Auckland could see volcanic activity at any time. Mount Taranaki is due to erupt maybe in the next 50 years — which would have implications for much of the North Island. And rising sea levels continue to threaten thousands of homes near the sea.

- Covid-19 is the third deadly virus that seems to have originated in China. And spread quickly around the world. It won’t be the last. New viral strains will be more deadly and pose even greater challenges for vaccine scientists.

How can you protect your family and your wealth?

Become more Jewish. Well, I don’t mean convert to the faith. I mean look at what such successful groups of people have done throughout history. Who’ve been under potential threat of being persecuted. Or displaced. The Jews didn’t even have their own country until 1948.

Yet, on the Forbes 400 list of American billionaires, Jews outpace their share of the population many times by taking some 30 of the top 100 spots.

How did they achieve this? Hard work, certainly. But they also develop transportable skills that have value anywhere. In any market. Many have become skilled, global, and diverse investors.

‘I can survive, earn, and thrive anywhere,’ a friend of this persuasion told me.

You can protect yourself from the volatility of the world by investing globally. In quality, dividend-paying companies across different countries and industries.

Be sure you can access much of your wealth in liquid form. Stocks are relatively liquid. Property is not.

Become financially and emotionally resilient. And have a plan.

Greed is back. Thanks to the Pfizer [NYSE:PFE] vaccine and others, the market feels again it has dodged the bullet of total catastrophe. Mass business failures and a market crash.

But fear will be back soon enough. As will the next black swan.

Will you be ready?

Regards,

Simon Angelo

Editor, Wealth Morning

PS: You can access our exclusive programme for Eligible and Wholesale Investors through our Vistafolio Service here.

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.