People are rolling around in large plastic balls in Victoria Park. I see the zorbers from the motorway overbridge as we pass over above. And wonder why people choose to spend their Saturday morning this way.

Why not head for a café, grab a coffee, and read the paper?

Source: Pilot Guides

Zorbing is a relatively expensive activity. Niche. Not much competition. You can pay several hundred dollars for a Zorb ball, or $50 for a short time in one.

My experience: it looks more fun than it is. Because inside the ball is hot, sweaty, and smells like a footy locker.

Breakfast at a café is more economic and enjoyable in my book. Plenty of cafés to choose from. Even deals up to 50% off menu prices using sites like First Table, GrabOne, or Groupon.

So, for me, eggs benedict at a café with the family — great value. Zorbing the morning away — not so much.

The reason for the value gap (beyond perception) comes down to a powerful force

It’s a force you could use to become a wealthier investor: Competition.

The trouble is most people get negative value from competition. Rather than harnessing it to their advantage.

Take how you approach holidays, for example. I know plenty of people with baches. (Vacation homes, if you’re reading in the States).

And I know many people who’re always on the lookout to buy one. Near a favoured lake. Or beach. Because they’re afraid of missing out.

Baches at prime spots have gotten expensive. Due to competition.

Let’s back up. The whole point of holidays — indeed, travel — is to broaden your mind with new experiences.

Not to keep going back to the same place.

So you arrive, ready to chill out with a few beers. And find the gutters need clearing. Or a rat has died in the pantry. Or the neighbours are playing house music that rattles the furniture.

Sell the bach. Run the $500,000 in the markets. And, properly invested, you could stay at a fine and different establishment every quarter.

Consider competition in everything you buy or sell

So, I was due for a new car. An SUV. Because you can almost see the boy’s legs growing.

I had my heart set on an Italian make with a Ferrari-built engine.

Alfa Romeo Stelvio. Source: Driving Line

Now, if I could get a used one a couple years old with less than 15,000 on the clock, the sticker shock could be borne by someone else. But still a great car.

Few and far between. Not enough competition or dealers to get a good enough deal.

I switch to looking into used Mercedes. Plenty around. Lots of competition amongst dealers. And much greater opportunity for value.

When it comes to finding value on the market, you want to harness the power of competition too

Guess the most profitable investing strategy over the past decade?

Finding hot new tech? Small caps about to ramp up? Companies involved with lithium?

No. According to Bank of America, ‘Picking stocks with high dividend yields was the best strategy for investors over the last decade.’

Larger companies that pay stable dividends are often considered boring investments. Many trade at average P/Es. Big funds sit in them. And competition is seldom extreme.

Yet, due to low interest rates and steady economic growth, dividend stocks quadrupled in value last decade. And outpaced the S&P 500 by 120%.

So how do you find stocks with great dividends but not too much competition?

Well, you want little competition when you buy.

But then plenty of buyers competing if it comes time to sell.

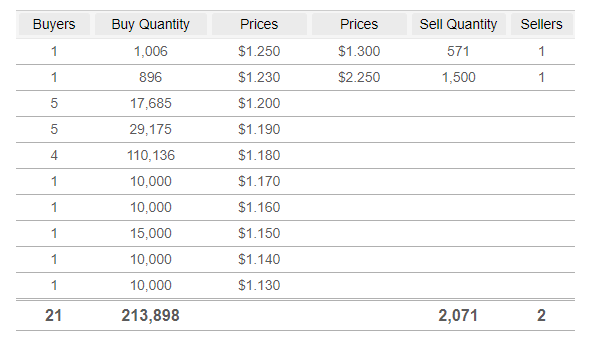

The key is to monitor market depth over a long period of time. Typically, you can access this depth on your online brokerage platform.

You then get a feel for how tightly held a stock may be.

If there’s economic opportunity to buy in at a point of low competition, that’s great.

For example, here’s the market depth the other day from one of our Vistafolio holdings:

Source: ASB Securities

Source: ASB Securities

What do you notice here? Many traders wanting to buy this stock. Very few wanting to sell. Suggesting that the price could continue upward soon.

Not guaranteed, of course. Other sellers may jump in.

But, over time, you may see a paucity of sellers. Or buyers. And get a feel for a stock’s competition and demand.

If you can buy such stock at a time of less competition, you’ve got in early. You’ve missed the competition. And you should experience value escalation when the situation changes.

But more important is understanding that the underlying business is sound. Has potential. And ideally shares its profits in the form of a growing dividend yield.

Of course, low-competition dividend stocks are not for everybody. Luckily. The bulk of Kiwi investors will likely consider rental properties. With slender yields. Gutters to clear. And brisk competition in the current housing famine.

Sell during famine. Buy during feast. You’ll get the best prices and build some wealth. So you could go buy a bach and do some zorbing.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is commentary and the author’s personal opinion only. It is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please consult a licensed Financial Advice Provider.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.