The problems of the world are your opportunity. Sometimes solving a simple problem can yield attractive rewards.

This point has hit home in the coronavirus catastrophe. The world was threatened with a run of gasping deaths. Then lockdowns closed up most of the businesses that kept economic life humming.

30 years ago, I was a 15-year-old kid trying to make some money to leave my provincial town. Move to the big city and study finance.

Someone said to me, ‘If you want to make some money, find a problem you can solve.’

Every night in our house, there was a time crunch. As we returned home from school or work, there was still the dinner to get on.

I looked around the other homes in the network of streets that made up our neighbourhood. Two cars back in the driveway just after 5pm. Same problem.

So I found a wholesaler of chilled pizzas. Delicious. Well-topped. Good enough for a quick dinner. He had a small commercial kitchen on a nearby farm. And was happy to sell them to me for $2.50 each. I bagged them up and went door-to-door. Four pizzas for $20.

By the time I was done, three years later, after employing several classmates to help, I’d raised a couple years of money to move away and study. And buy a VW Beetle.

Opportunities don’t shout; they whisper

This sentiment just played out again.

In our Lifetime Wealth portfolio, we spotted a property-based business in Australia down on its luck due to coronavirus lockdowns.

Property assets in metropolitan Australasia were carried in the March share price at a 30% discount. Dividends were still on track at around 5%. And we could see — on the other side of coronavirus — that people would still need their facilities.

Of course, federal government support helped us out a bit too!

Then we found another similar pick in a different property class on the London Exchange.

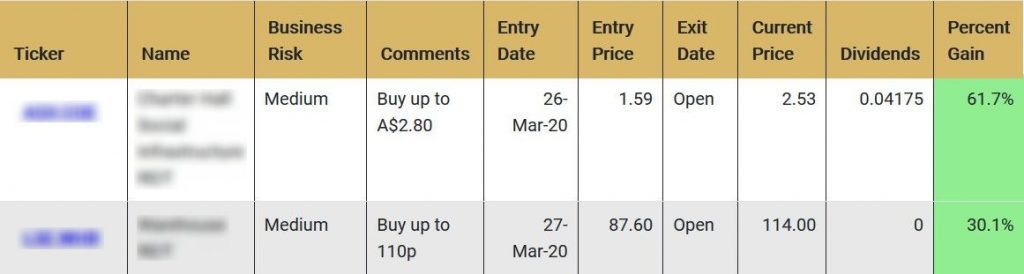

Anyway, here’s what we delivered for subscribers in 2.5 months, with these two in Australia and Britain:

Source: Lifetime Wealth Investor, 10 June 2020. Past performance is not an indicator for future performance.

Now we’re looking into more than 20 such opportunities.

We are considering…

- Capital preservation. Does this business offer downside protection, tangible assets, and margin of safety?

- Can we grow passive income via growing and reliable dividends?

- Is this business mispriced and offering great future earnings upside?

- Where are the problems? Which businesses have the margins and capability to solve them profitably?

- Risk management. To make money, you have to take on some risk. How can we assess the business risk and guide reasonable allocations?

Want to make some money?

Keep solving problems. The world will get better. And fortune, as usual, will favour the brave.

Regards,

Simon Angelo

Editor, Wealth Morning

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.