He’s worth over $5 billion. One of Australasia’s richest people. I’ve just finished his biography. And it rocked me to learn that, at one point, he was drinking a bottle of vodka a day just to get through the day.

You may have a private jet lifestyle, beautiful homes and the ability to travel wherever you want to go. But money provides little protection from anxiety or unhappiness. Sometimes it can make things worse.

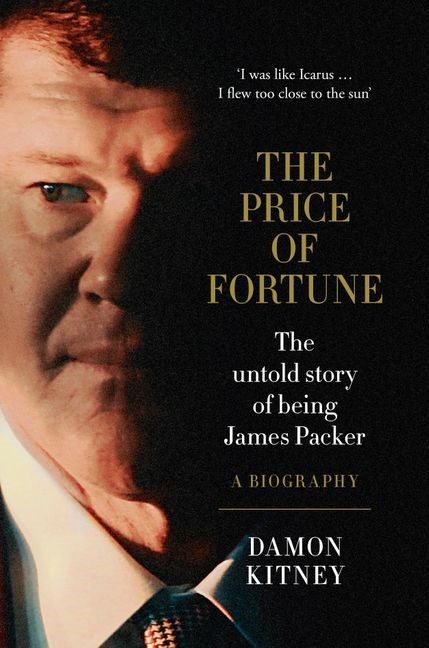

The candid story of James Packer’s life and brush with near destruction is documented in Damon Kitney’s book, ‘The Price of Fortune’.

As an analyst and investor, this book caused me to think. We invest to grow wealth and generate income for the future. But through that process, it’s important to have a healthy attitude to money.

The market itself is a teacher. If you’re investing in stocks, you must be prepared to weather the tides of both rising and falling prices. That can impact you mentally.

Over the long-run, you may be blessed to build some wealth. And then you need a healthy attitude to it.

The good and bad of money

Money is a tool, like any other. A hammer can be used to build a home or commit a murder.

I learnt enduring lessons of money working in the finance industry in Europe.

Drive across the island of Jersey, an offshore finance centre for trusts and investment, and you’ll feel as though you’re in a very safe, wealthy place. The main supermarkets are the upscale Waitrose and Marks & Spencer. The green lanes are teeming with Range Rovers and Mercedes. And there are three Michelin Star restaurants for a population of only 100,000.

Yet, stay for any length of time and you’ll learn that poverty and deprivation may not only be financial, they can also be emotional.

At an expensive private school, family breakdown is anecdotally common. There is a high suicide rate on the island. Alcohol consumption per capita is among the highest in Europe. There are twice as many problem drug users than in the UK.

More than one in three people have been categorised as having high anxiety. Over 50% of households experience ‘rental stress’, where housing costs are high relative to income. And the island scored the lowest for civic engagement in a report comparing 36 OECD countries.

Things are not how they look. And wealth can be a dangerous cover. Possessing or being surrounded by wealth and comfort can be as hazardous as it is advantageous. When it’s combined with high rates of inequality and very expensive housing, that can exacerbate social problems.

There is a powerful lesson that money can create as many problems as it solves.

So, when it comes to your own wealth and happiness, a few things to consider:

Loss of anticipation

Remember the joy of saving for something? Looking forward to a holiday you’ve planned? Sometimes the anticipation of a savoured event can nearly match the joy of experiencing it.

Reading Packer’s biography, it’s indicative that a lifestyle of limitless wealth can remove the joy of anticipation. You can buy anything you want, now. You can go anywhere you want, now. Any problem — including mental, can be fixed by buying something.

Wealth can take away the joys of anticipation. And pose the dangers of easy fixes. [openx slug=inpost]

The paradox of wealth

Wealth is about owning things. A larger home. A luxury car. Perhaps a yacht?

It is said that the two happiest moments of a yacht owner’s life are the day he buys his boat and the day he sells it.

There is a burden in the ownership of most assets. They need to be maintained and housed. Of course, you can employ others to assist but then those people need to be managed.

You may look and feel richer with more things. But with that comes more stress and work. Work that isolates you rather than connects you.

The little things

Warren Buffett enjoys a daily breakfast routine. On the five-minute drive to his office he’s been taking the past 50 years, he stops at McDonald’s and orders a simple breakfast costing around $3.

He lives in the same comfortable suburban home in Omaha, Nebraska that he bought in 1958 for $31,500. He says, ‘For me, that’s the happiest house in the world. And it’s because it’s got memories, and people come back…’

In his spare time, he reads or plays bridge.

Although Buffett is the world’s 3rd wealthiest person, it would appear he understands that most of the simple joys in life require little of his money. Instead he has committed to give most of his fortune to charity.

$75,000 test

You’ve likely seen the surveys pointing to no increase in happiness once a household has US$75,000 of income?

That’s because once you’ve earnt a reasonable amount to live on, money can’t buy you more happiness.

Through good saving and investing, it can be possible to achieve an income at this level by building up a sound dividend-paying portfolio over time. That’s a good long-range target to aim for.

But it’s not necessarily going to make you happy.

The single biggest predictor of happiness

Studies in psychology show ‘the single biggest predictor of human happiness is the quality of [a person’s] relationships.’

Similarly, the Pew Research Centre found that people who were ‘civically engaged’ through community activities and a faith had higher rates of happiness.

What will make us happy beyond a reasonable standard of living cannot be bought: Time with those we care about.

If you want to be happy, that’s probably the best investment you can make.

Purpose of investing in the markets

Some people think the purpose of investing is to get rich. Yet, investing in the share market does not guarantee this will happen.

All it guarantees is that you will own a piece of some businesses and on the upside — share their income and growth, while on the downside, sharing their risks and challenges.

If you’re investing for happiness, then the purpose of investing is to create a portfolio that can help support your family and free up more of your time to spend with them. But you also want to be investing in businesses you believe in.

Here at Money Morning NZ, I’m going to continue sharing with you businesses I believe in. Businesses that deliver worthwhile products and services but also offer income and growth upside.

And there’s a purpose that goes beyond money. That purpose is a free and happy future.

Regards,

Simon Angelo

Analyst, Money Morning New Zealand

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.