You can never lose money with real estate.

This is something you have probably heard often.

But trust me, you can.

Just ask the people in Japan.

Back in the 1980s, Japan went through a period of record low interest rates that fuelled an asset bubble to record highs…sound familiar?

The bubble pushed the stock market and real estate prices to new heights…and then it burst in 1992.

It was devastating.

As The Washington Post described it last year:

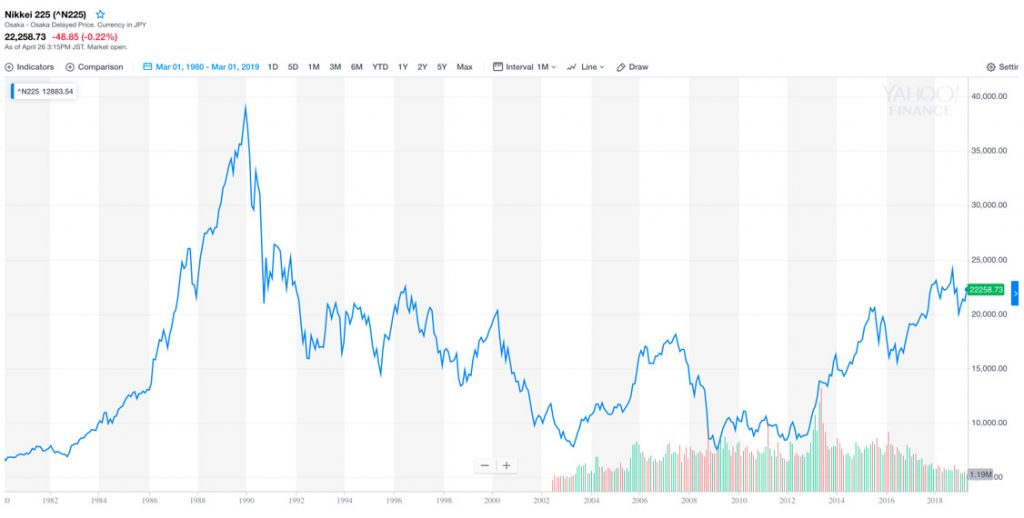

‘[Japan’s] boom-and-bust cycle happened a full 16 years before the rest of the world’s did. Not only that, but it was far larger than anything that followed it. To give you an idea of the scale of it, Japan’s stock market peaked in 1989 at what’s still an all-time high of 38,916; today, it’s 22,475. Indeed, according to Nomura economist Richard Koo, Japan’s crash wiped out three times more wealth as a share of its economy than the United States’ did in 1929.’

And, neither Japan’s stock nor property market has recovered yet.

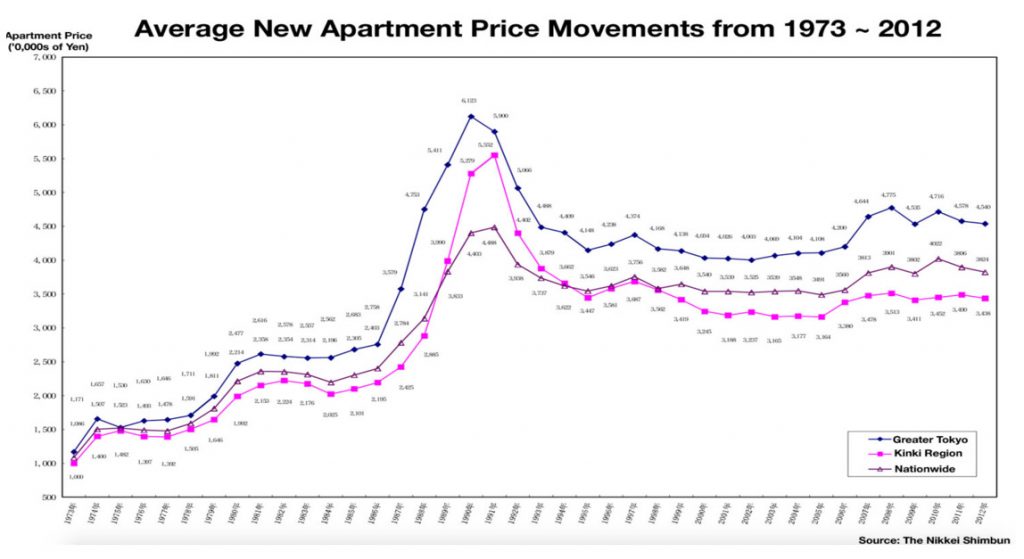

The graph below shows average price for new apartments between 1973 and 2012. As you can see, prices spiralled out of control in the mid-80s and then collapsed. They then went stagnant for decades.

And here is Japan’s Nikkei 225 index:

It is nowhere near the heights of the 1980s.

The thing is, Japan is ageing. That is, people are getting older, and its population is shrinking.

This from a recent Bloomberg article:

‘A record 8.46 million Japanese homes are sitting vacant as builders keep adding stock in a country where the population is shrinking.

‘Many of the properties are for future sale or rental or vacation. However, some are abandoned, posing hazards, the news service reported. Vacancy rates were highest in a prefecture that’s home to the northern part of Mount Fuji, which is a popular area for holiday homes. However more people moving from rural areas to metropolitan ones is also driving the increase, according to the news report.’

By the way, there was also something interesting the article pointed out:

‘Stashes of cash are also often discovered when these houses are taken down, the Nikkei Asian Review said. The equivalent of more than $200,000 was found at one Tokyo demolition site in 2018.’

Japan’s demand for homes has gone negative

Japan’s interest rates have been set too close to zero for decades. The Japanese have been stashing cash as the Bank of Japan set rates to negative.

A negative interest rate works kind of like a tax. Keeping your money in the bank means that you lose money. The idea is to get people spending, instead of saving.

Yesterday I wrote about how the property bubble had long-term implications for Spain. This is also true for Japan.

Japan’s demand for homes has gone negative. There are more homes than people.

Japan gives us a more extreme example of the long-term effects a property bubble and poor demographics have on an economy.

Demographics is something Harry Dent talks about often.

I had the pleasure of meeting Harry yesterday. We spent a good hour and a half talking about the effects of demographics on the economy and where we could be heading.

While many consider his views bearish, what he told me is that he is a realist. He likes to look at sets of data, with no preconceived ideology.

Harry thinks the whole world is heading towards Japan.

People in Japan are dying faster than children are born. And the thing is, as Harry said, there is something different about real estate. It can last forever.

He has a point.

The developed world is ageing. One of the biggest cohorts, the Baby Boomers, are getting older.

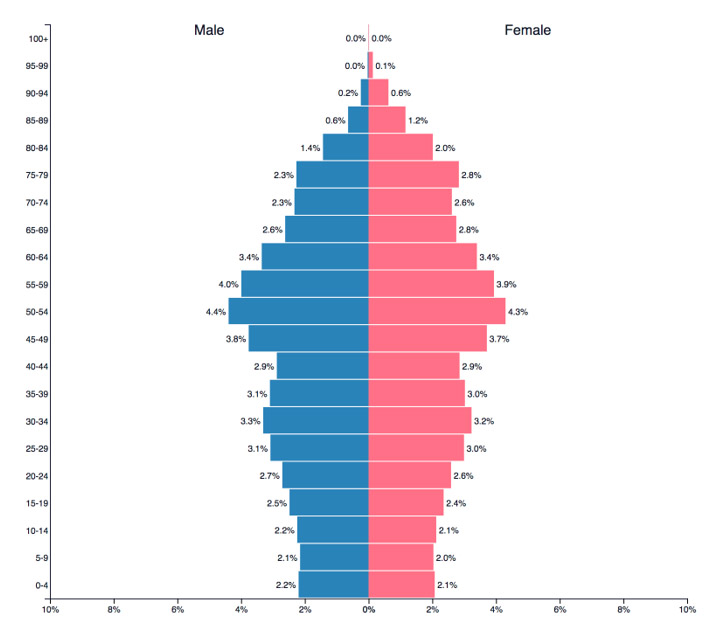

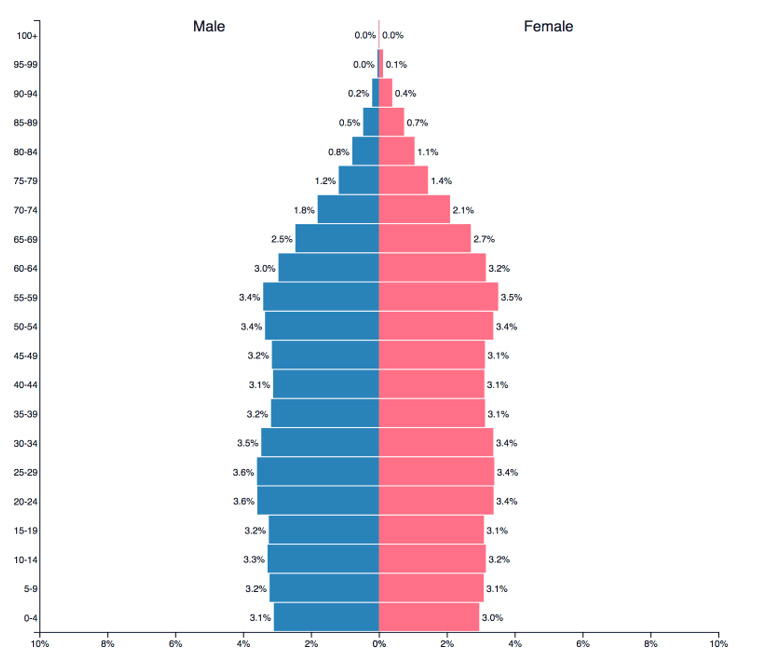

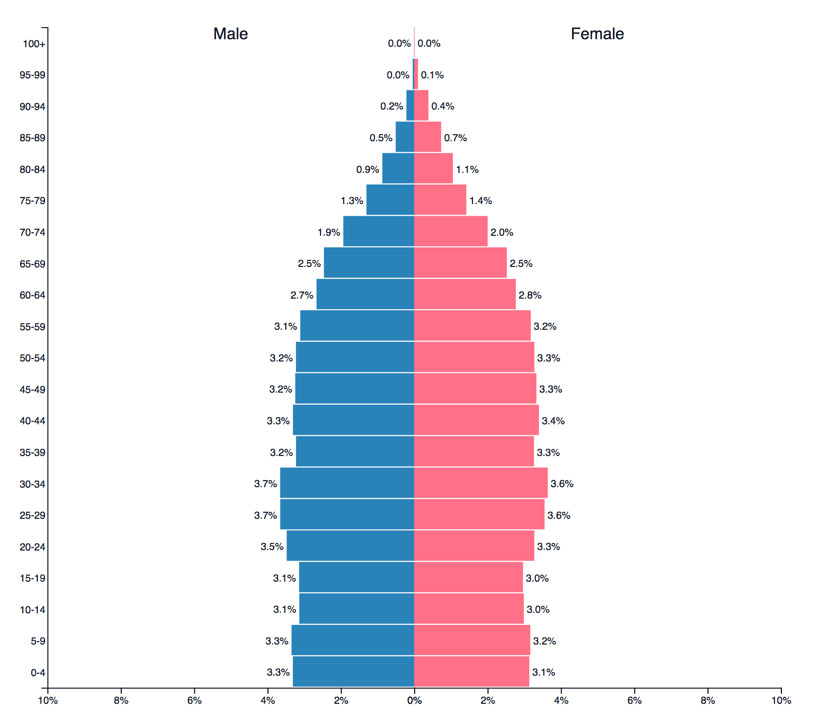

Our population pyramids are now starting to look dodgy. They don’t look like pyramids anymore.

Check out the population pyramid for Germany:

Or the United States:

And here is Australia’s, a bit better:

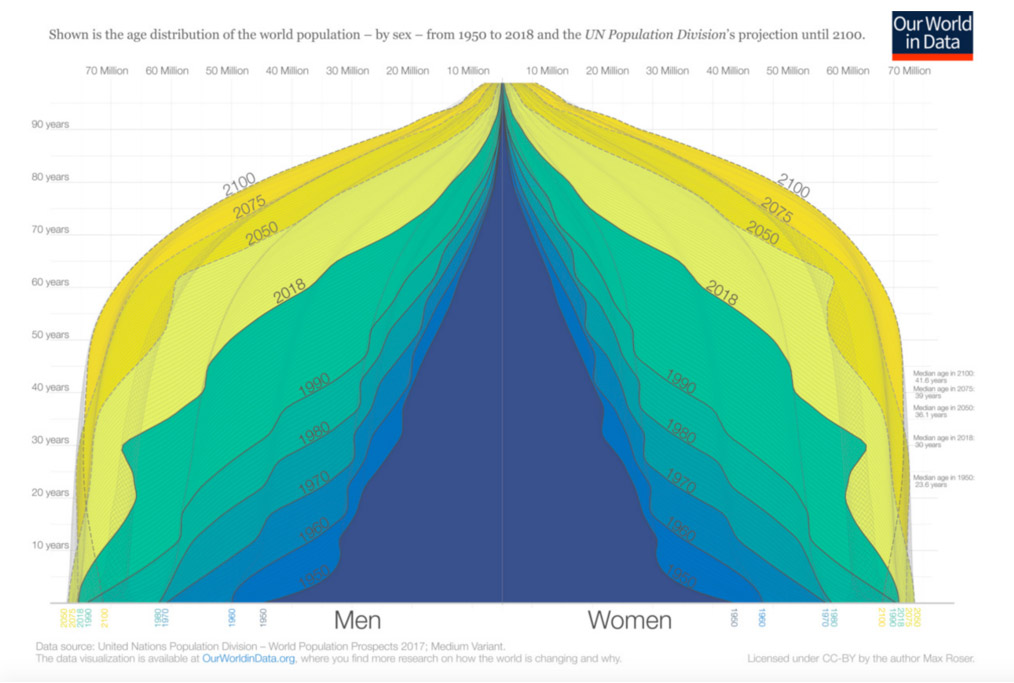

And here’s a graph depicting the projected population divisions up until 2100:

The world is changing.

With less young people coming into the market and boomers getting older, we could very well see real estate demand fall.

In the case of Australia, we have seen property prices go up with lower interest rates, easy credit, high immigration and investor demand.

Harry thinks the market here is overvalued.

I do too.

There are not enough properties, we hear.

But the latest census showed that there are over a million empty homes in Australia. To put that into perspective, there were nine million private dwellings in Australia in 2016.

I mean, just walking around Melbourne you can notice empty apartments.

Where will the demand for all that property come from?

Best,

Selva Freigedo