You’ve just enjoyed your dinner at a restaurant.

You are ready to go, so you ask for the bill.

But, when you tap your bank card…it doesn’t work.

‘That’s odd’, you think. You know there is money in the account.

You try to log onto your bank account to check it…but the system keeps giving you an error message.

So, you decide to go to an ATM to get cash…but the ATM isn’t working either. You try another one, and the same happens.

Banks are closed. What do you do?

Panic starts to set in. Where is your money? And, why can’t you access it?

It’s an unsettling feeling. You have worked hard for your money, and entrusted it to your bank. But now, you can’t access it.

Something similar happened to Wells Fargo customers — an American bank — recently. They couldn’t access their accounts last Thursday, and they were still having problems on Friday.

You may think that having trouble accessing your money is something that doesn’t happen often. But it happened to my family in Argentina during the 2001 credit freeze. It happened to the population in Cyprus in 2012–13.

And, it’s something that could very well happen in Australia too.

In a recent report by the OECD, one of the key recommendations for Australia was to ‘prepare contingency plans for a possible significant correction in the housing market including a loss-absorbing regime (including bail-in provisions) in the case of financial-institution insolvency.’

A bail-in is when creditors and deposit holders take a loss to rescue the banks.

‘Luckily’ for Wells Fargo customers, the problem only lasted for two days. My family couldn’t access their savings for years.

While Wells Fargo customers were understandably fuming, it gave crypto supporters more ammunition for their argument for a decentralised network. As Fast Company reported:

‘With Wells Fargo customers unable to access their accounts Thursday after a “power shutdown” at a bank facility, cryptocurrency advocates on social media quickly argued that their coins’ decentralized networks can better withstand such problems.’

JP Morgan recently released a report. According to the bank, they only see cryptos useful when there is a ‘dystopian’ scenario. As Business Insider reported:

‘“We have long been sceptical of cryptocurrencies’ value in most environments other than dystopia, characterised by a loss of faith in all major reserve assets (dollar, euro, yen, gold) and in the payments system,” JPMorgan analysts wrote in a note dated January 24.

‘”Their boom-bust cycle is similar to the path of gold in the early 1970s, the Nikkei in the 1980s and technology stocks in the 1990s,” the analysts wrote.

‘However, the fact that cryptocurrencies still have a relatively limited correlation to traditional assets could be a positive for investors seeking to diversify. Despite that, Bitcoin’s co-movement with some markets like US equities and EM Bonds (local currency) has risen slightly since early 2018, but remains quite low, according to JPMorgan.’

But, we disagree. [openx slug=inpost]

Aren’t we already living in a dystopian economy?

Our paper money has no relationship to the real economy…it’s tied to nothing. Debt has ballooned, interest rates have been unusually low for a very long time. The unemployment rate is low, yet salaries aren’t increasing. And asset prices are increasing at unsustainable rates.

And, after the 2008 crisis, there is a lot of distrust in the system. In fact, bitcoin was born from that distrust.

Yes, cryptos may be thriving in ‘dystopian situations’ like in Venezuela. In fact, it is thriving in South America as more Venezuelan refugees settle in surrounding countries.

But as distrust on this economy increases, we could see more people using cryptos.

In fact, cryptos keep slowly sifting into the economy.

The latest one is Argentina. Argentina’s public transport card SUBE — similar to Opal in Sydney or Myki in Melbourne — is now allowing users to top it up with bitcoin from your wallet.

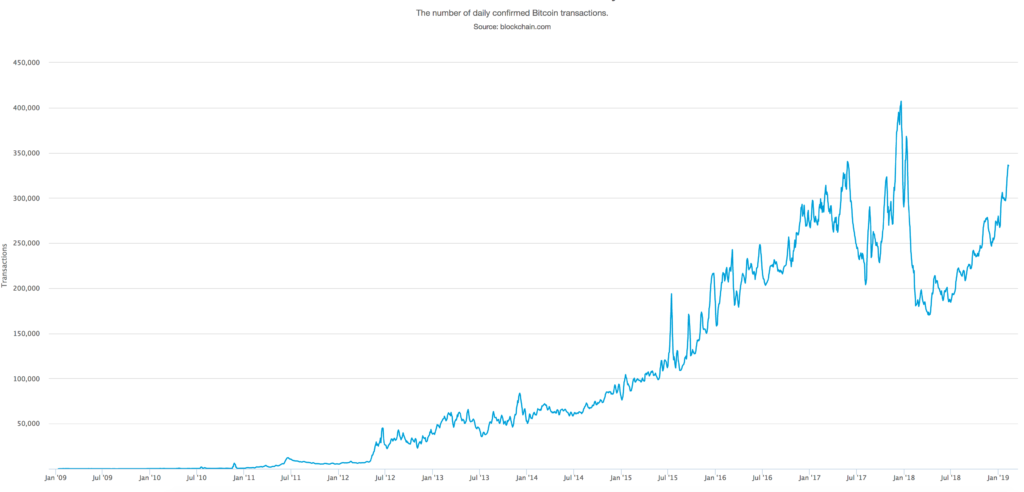

And bitcoin transactions are increasing, at least according to data from Blockchain.com.

As you can see below even with lower prices, daily transactions for bitcoin are reaching the peak levels of 2017.

|

| Source: blockchain.com |

Why? Inverse explains:

‘While the price crash at the start of 2018 was coupled by a decline in usage, the number of transactions per day has gradually risen to return to its previous high levels.

‘While the previous rise in transactions may have been driven by investor speculation, Harvey says that this is “unlikely” the source of this 2019 surge “given the price has been heading downwards.” […]

‘Another source for the rise could be that bitcoin is more useful now. When its value jumped at the end of 2017, the one megabyte limit on block size meant that users had to wait to confirm their transactions. The average time to confirm soared as high as 2,575 minutes, or nearly 48 hours, in January 2018. Today that figure is around 15 minutes, despite the jump in transactions.’

Dystopian situation or not, we still think cryptos could have a space in your portfolio. Obviously, it is a risky tool, so don’t put in more money than you can afford to lose.

But, as distrust keeps growing, we don’t see cryptos going anywhere.

Best,

Selva Freigedo