Forgive me a moment of schadenfreude (taking pleasure in another’s misery) if you will.

But last week’s fall in the Apple Inc [NASDAQ:AAPL] share price means Warren Buffett’s Berkshire Hathaway Inc [NYSE:BRK/A] is down US$3.8 billion on its investment.

Apple is Berkshire’s biggest holding and makes up 21% of their total portfolio.

Buffett first started buying Apple in February 2017. On Feb. 1, 2017, Apple shares were trading around $129, so the first portion of stock he bought is still in profit.

But unfortunately for Buffett, Berkshire added to that stake significantly during the last two years, at much higher prices.

The recent falls in Apple have in turn hurt Berkshire’s share price which is down 12% in just one month.

So why am I gloating about this?

Well, I’m not. Not really. Buffett remains an idol of mine and I’d give my right arm to be a tenth as good as he is at picking stocks.

But that doesn’t mean he’s perfect. And it doesn’t mean he can’t make mistakes.

Huge mistakes even.

That’s both a comfort and a warning for you and me.

Here’s one area where I think he’s got it dead wrong.

And his Apple investment sort of proves it…

Technology is rat-poisoned squared for Buffett

Let’s get to the real source of my schadenfreude…

If you’ll recall, Buffett called bitcoin ‘rat-poisoned squared’ last year.

He added at the time:

‘In terms of cryptocurrencies, generally, I can say with almost certainty that they will come to a bad ending.’

Strong words. But I can’t help but think Buffett by his own admission is straying from his ‘circle of expertise’.

He has, it has to be said, a dismal record in picking high-growth technology stocks.

As Buffett himself admitted in Getting There, a fantastic book of mentors I picked up recently at my local bookstore:

‘…I’ve still made a few major mistakes of omission. There have been things that I’ve known about but either didn’t participate in or did on a small scale. I was sucking my thumb, basically, instead of writing checks. There is no place that lists ‘missed opportunities’ but I have passed up some big ones.’

A comprehensive list may not exist, but I’ve certainly been taking note of a few.

He’s lost out on some of the best performing stocks over the last decade including Google, Amazon, Netflix, Nvidia, Adobe, Broadcom and Facebook. All technology stocks Buffett admits he didn’t understand well enough to invest in.

And that’s despite computing legend Bill Gates being one of his best friends!

Even Apple is only a comparatively recent investment.

Which is why I find it pretty easy to dismiss Buffett’s comments on bitcoin and cryptocurrencies. I’m actually a bit disappointed he even made them.

He’d have been better off saying he doesn’t understand it rather than actively railing against it.

Although — and this is my inner conspiracy theorist talking perhaps — as a huge backer of traditional financiers like Bank of America, Well Fargo and JP Morgan, perhaps like most investors do, it’s just him talking his own book.

Funnily enough, these banking bets aren’t doing too well for Buffett recently either. Bank of America which makes up 11% of the Berkshire portfolio is down 17% over the year while Well Fargo is down 24%.

But is Buffett worried?

Probably not.

After all he has often said he wouldn’t care if the stock market shut down for 10 years, such is his investing timeline. You’ve got to give it to him — he treats it like a sport. The guy loves it. He’s not going to bow out because of his mistakes or the unpredictable market.

And that’s a good lesson for you too. If you’re investing in long-term trends, don’t be worried too much about the daily and weekly gyrations in the stock market.

If the great Warren Buffett can be down 24% on an investment in one year, you certainly can too!

Investing and trading is a long game. A game for life if you can get it right. If one bad quarter or one bad year shakes you out; you (like me) a mere mortal and certainly not a Warren Buffett, then this game is not for you. [openx slug=inpost]

The main lesson we can learn from Buffett

But the main lesson I think is this…

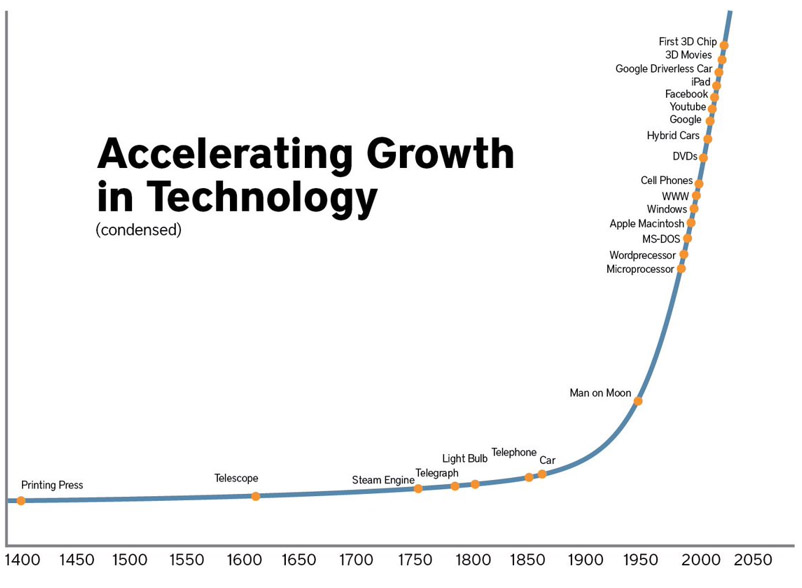

No one — not even Buffett — knows the future. And as technology starts to disrupt every single industry at an increasing pace, it will get harder for the Buffett style of investing to work.

After all, who can say where Apple will be in 10 years? Or bitcoin? Or Bank of America?

Technology will shape them all.

Technology can no longer be ignored as it was in the past. It will affect most industries over the next decade in some shape or form, whether you want to acknowledge that or not.

As the following graph shows:

|

| Source: PBS |

And the one thing I’m sure of is that blockchain technology — and cryptocurrencies — will play a huge role in driving this disruption along.

Because what Buffett doesn’t get is that cryptocurrencies are a technological collision point as big as the microchip processor was in the 1960s.

In my opinion, it’s something you need to understand if you’re to stand a chance investing in the biggest trends of the 21stCentury.

Hope that all makes sense — I look forward to sharing my findings with you in this fresh new year.

Good investing,

Ryan Dinse

Ryan Dinse is a contributing editor at Money Morning New Zealand. He has worked in finance and investing for the past two decades as a financial planner, senior credit analyst, equity trader and fintech entrepreneur. With an academic background in economics, he believes that the key to making good investments is investing appropriately at each stage of the economic cycle. Different market conditions provide different opportunities. Ryan combines fundamental, technical and economic analysis with the goal of making sure you are in the right investments at the right time.