In the final weeks of 2018, the US blew enough froth off the market to make it a conversation piece over the Christmas holidays.

‘Should I stay or go?’

Versions of this question (about whether to exit the market or not) have been asked of me more times than I can remember in the past few weeks.

The one-word response was (and still is) ‘go’.

Unfortunately, the conversations never ended there.

More information was sought.

‘The market eventually recovers, why not wait it out?’

‘If I sell, where do I put the money?’

‘Money in the bank earns nothing, what will I do for income?’

It was exhausting.

Challenging years and decades of conditioning are no way to spend your holidays.

Their questions were answered with these questions…

What if the market doesn’t recover? What if it turns Japanese and stays down for decades? Isn’t it better to get 2–3% on 100% of your money, than 6% on half (or even less) of it?

‘Yes, but…’

That’s when it was time to change topic.

My holiday conversations indicated to me that people are in that ‘betwixt and between’ state of mind. The losses haven’t been enough to fully dent the confidence in the market’s redemptive powers…but there’s a degree of uncertainty.

Sit and wait. Don’t panic. Keep a close eye on things.

That seemed to be the consensus of opinion.

Big mistake.

The US market is toying with investors

The US market is toying with investors. A period of down days is followed by a big spike up.

Every rebound is met with a sigh of relief. The talking heads offer us hope in the form of ‘stronger US job numbers…a breakthrough in tariff talks’.

These ‘reasons’ temporarily soothe the nerves…but the next day or next week the downside action takes us to a new low point.

The reality is the market is headed lower…much, much lower than anyone could ever imagine.

This market collapse has been decades in the making.

Nothing the Fed or ECB or PBOC or BoJ does, is going to stop it from correcting decades of excess.

The fact there’s a collective mindset that central banks can cure all market ills, is the reason the coming collapse is going to be so devastating.

Very few people recognise that the central bankers are the problem…not the solution. They are serial bubble blowers.

This latest bubble is by far the greatest ever blown. Based on the premise of ‘equal and opposite force’, it stands to reason the inevitable bursting of this current bubble is destined for the history books…The Greater Depression of 2020.

This rather depressing (no pun intended) story is not one you want to share over the Festive Season…hence the one-word answer of ‘go’.

But you’re different…you want to know the reason why this has the potential to rival the events of 90-years ago…the 1929 collapse.

Here’s a quick history lesson on a disaster that’s been decades in the making.

Why you could regret staying

The debt super cycle that began in 1950 has two distinct periods — pre 1980 and post 1980.

Prior to 1980, the frugal depression era generation had a more responsible and respectful attitude towards debt. Lending institutions were far more stringent in their lending criteria. And, the rising interest rates of the 1970s (culminating in 20% interest rates in the early 1980’s) all combined to keep a lid on debt accumulation.

After 1980, these dynamics changed. Baby boomer consumers (eager to break the shackles from their austere parents) started to outnumber the older generation. Financial institutions relaxed lending standards. And interest rates fell.

Every graph on debt accumulation, shares and property markets shows a distinct upward trajectory after 1980. Credit creation flowed through to asset price appreciation.

Wealth was being generated like never before. The boomers were on a roll.

In the midst of becoming wealthier, we rarely questioned why. The world of prosperity — steadily increasing economic activity, increased share markets and rising property values — was taken for granted. This was how our world functioned.

It’s with hindsight we can see this was a period of make-believe. An economic and investment purple patch made possible by credit creation on a scale never before seen.

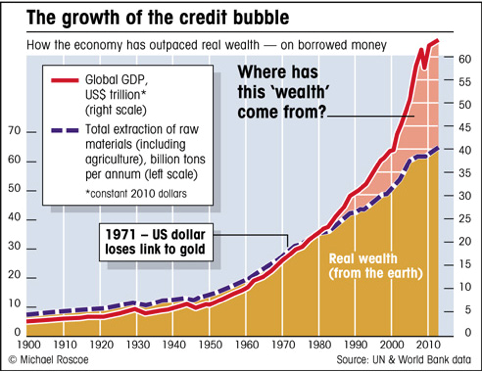

The following chart on real wealth vs. paper wealth, shows (again) a disconnect with reality in 1980.

|

| Source: Mike Roscoe |

The dotted purple line is the volume (billion tons per annum) of total global raw material extractions.

The red line is the value (in US$) of global GDP (economic activity).

Prior to 1980, the two lines track each other.

Everything we use in this world is traced back to commodities — the chair we sit on, the TV we watch, our morning coffee, electricity, food, motor vehicles, petrol and clothing. Therefore, it stands to reason economic activity (GDP) is linked to our usage of these raw materials.

However, since 1980 there’s been a disconnect between what we extract and the activity generated.

The abandonment of the gold standard in 1971 put in place the ability for the one thing that CANNOT be traced back to a commodity…printing money from thin air. The financialisation of the global economy has created a false sense of prosperity.

Freed from the moorings of the gold standard, the ‘wealth’ hot air balloon has floated higher and higher. Terra firma (the Earth and its raw materials) is becoming a distant speck.

Icarus learnt a painful lesson about gravity when he flew too close to the sun.

This is the same fate that awaits the wealth balloon — filled with the hot air of central bankers, politicians and ‘too big to fail’ banks.

The atmospheric pressure at higher altitudes is vastly different to those on earth. These altered and very dangerous conditions are why previous wealth balloons (debt crises) have all ended with a bang.

The thud back to earth will make a laughing stock of those who predicted the balloon can float higher and higher forever.

Earth’s gravitational pull will result in a financial disaster on an epic scale for those who fail to apply a degree of common sense on the sustainability of this artificial wealth.

Phoney money and phoney wealth are two wrongs…and two wrongs do not make for right projections.

Basing the future on the past is a serious mistake…especially when what we’ve experienced has been a massive fraud.

The recent US market volatility and the other stresses (US Corporate debt problems, China’s faltering economy, Europe’s insolvent banks, Australia’s falling home prices etc.) are signs of a system that’s feeling the strain of too much debt.

Once one pressure point goes the others will follow.

The speed with which this can happen will leave many people lamenting the decision to stay rather than go.

Sadly, 2019 is going to be a not-so-happy New Year for those who believed decades of disconnect could continue without serious repercussions.

Regards

Vern Gowdie

Vern Gowdie has been involved in financial planning in Australia since 1986. In 1999, Personal Investor magazine ranked Vern as one of Australia’s Top 50 financial planners. His previous firm, Gowdie Financial Planning, was recognized in 2004, 2005, 2006 & 2007, by Independent Financial Adviser magazine as one of the top five financial planning firms in Australia. He is a feature editor to Money Morning NZ and is Founder and Chairman of the Gowdie Family Wealth and the Gowdie Letter advisory services.