US farmers are no happier in 2019.

There is still a lot of uncertainty around trade and Chinese buyers.

In 2018, farmers got a taste of what it would be like without Chinese demand.

Policy makers put a 25% tax on US soybeans.

Chinese buyers looked elsewhere for their feed stock. Most went to places like Brazil.

As a result, the US government stepped in to give farmers a helping hand.

The BBC called it a US$12 billion ‘trade war bailout’.

But is US$12 billion enough to sustain US farmers through what could be a cold drawn-out trade war?

‘Uncertainty over the lingering trade war between the U.S. and China and North American trading partners is clouding prospects for next year’s corn and soybean crops,’ the Wisconsin State Farmer wrote.

Will they need yet more money as we move from globalism to a localised world?

Global trade is falling

Late last year, exports for most countries were getting weaker or declining.

Business Insider wrote in October:

‘The latest batch of manufacturing PMI reports for September have just been released, providing what is as close to a real-time snapshot of what’s happening in the sector.

‘So what is the main takeaway from what happened last month?

‘Put simply, trade tensions between the United States and China are now clearly starting to impact demand from abroad, especially in Asia.’

This is not exactly what Trump wants with his trade war. He’d rather China buy more US goods. But in the interim, tariffs put pressure on China and serve a purpose.

I believe declining trade will be a continuing trend in 2019 and beyond. It will happen whether China taxes US soybeans or not.

And it’s because everyone is getting far better at producing stuff.

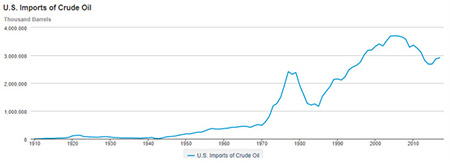

It used to be that North America would buy as much oil as they could get their hands on. In nine years (1970–79), US crude oil imports grew 392%!

While total imports of crude are higher than they were in 1979, growth is far from 392%. In fact, crude imports have declined noticeably since 2004.

|

Source: EIA |

Why you ask? Because the US has become a whole lot better at producing oil themselves.

Forbes writes:

‘Unbeknownst to most people, oil producers were experimenting with a marriage between two established oil drilling technologies — horizontal drilling and hydraulic fracturing.

‘The success of this marriage would unlock oil in tight oil and shale oil deposits that had previously been too expensive to recover, and would result in one of the greatest oil booms the world had ever seen. In fact, the “fracking revolution” caused U.S. oil production to turn upward in 2009, and then rise over the next seven years at the fastest rate in U.S. history.

‘While it is still true that OPEC still produced 42.6% of the world’s oil in 2017, the majority of new oil production since 2008 has come from the U.S.’

This isn’t just happening for oil. It’s happening to cheap manufactured goods. It’s already happened to agricultural products for the most part.

As efficiency gains add up, soon everyone can produce all they need. Trade declines. Cheap labour no longer powers developing countries. Producers become localised. And the only advantage is a local one.

It’s why instead of trying to win in multiple geographies all at once, companies like Swisse Wellness (Aussie vitamins) should try to dominant local economies first.

[openx slug=postx]

A local strategy is usually one that dominates over time

Swisse is taking a leaf out of Treasury Wine Estates Ltd’s [ASX:TWE] book.

They’re not only trying to differentiate their brand. They’re planning to elevate it. They want to sell quality to the masses in Australia and Asia.

From the Australian Financial Review:

‘Oliver Horn, the chief executive of Swisse Wellness says the company will be stepping up its premiumisation push in the $3.5 billion vitamins market as he borrows a little from his previous employer, Treasury Wine Estates, and the way it was able to supercharge Penfolds.

‘Mr Horn said Swisse will unveil between 40 to 50 new products in the market in 2019, the most in the history of the company, which runs neck and neck with ASX-listed Blackmores as the biggest player in the Australian market. They each hold between 18 to 19 per cent of the market.

‘…Mr Horn expected the vitamins category to grow by between 6 to 7 per cent across the industry in 2019, but is positioning for faster growth than that from Swisse as it steps up its advertising and marketing spend, prepares to announce a new celebrity ambassador in the next few weeks and lifts new product development.

‘The other big shift that Mr Horn is also trying to harness is that of premiumisation, where people are prepared to pay more and buy better for high-quality products made by prestigious brands. This is where his wine background and broad fast-moving consumer goods expertise comes in.’

I think it’s a great idea to try and increase market share. After all, quality is not long-term advantage.

What could be a long-term advantage for Swisse is a low-cost structure.

Picture it…

If Swisse can dominate the Aussie vitamin market, not only will they make a boat load of money, they’ll be able to spread their costs over a much larger base.

With more customers and more potential customers lining up to buy Swisse, they can spend many times more than competitors on developing and marketing new products.

Such an advantage would make it that much easier for Swisse to continue dominating the Aussie vitamin market.

Maybe if they’re lucky, they’ll have the chance to dominate more than one market. First it might be Australia. Next it could be New Zealand.

Of course, this is all just wishful thinking. I don’t believe Swisse management will undertake such a strategy. They’re too busy trying to generate sales from as many countries as possible.

Rather, I’ve used Swisse as an example. Swisse could be a far better business if they shifted their focus. So too could many other businesses.

A local strategy is usually one that dominates over time. And as we move to a localised world, I think these locally dominant companies are the ones that will benefit.

Maybe these are the stocks you want to look for in 2019. Forget the Apples and Amazons of the world. Perhaps think about stocks dominating a single product category or a local region.

Chances are, if they dominate that market now, they’ll do so in the future. And they’ll likely get all the benefits that come along with it, rising sales, earnings and stock price.

Local is the only strategy,

Harje Ronngard,

Contributor, Money Morning

Harje Ronngard is one of the editors at Money Morning New Zealand. With an academic background in finance and investments, Harje knows how difficult investing is. He has worked with a range of assets classes, from futures to equities. But he’s found his niche in equity valuation. There are two questions Harje likes to ask of any investment. What is it worth? And how much does it cost? These two questions alone open up a world of investment opportunities which Harje shares with Money Morning New Zealand readers.