Several weeks ago, we discussed the value of your time…and in particular, how your time translates into ‘stuff’.

The conversation started as an exploration into New Zealand’s inflation. We wondered, while the dollar amounts of ‘stuff’ have risen at an acceptable pace, how have the labour-cost of goods changed?

In other words, how many hours of your time do things cost? And is it getting cheaper or more expensive?

In the US, Bill Bonner’s research team carefully examined the historical and current prices of things, like the Ford Ranger, to see how the trend has unfolded…and they found that Americans today have to pay many more hours than generations before.

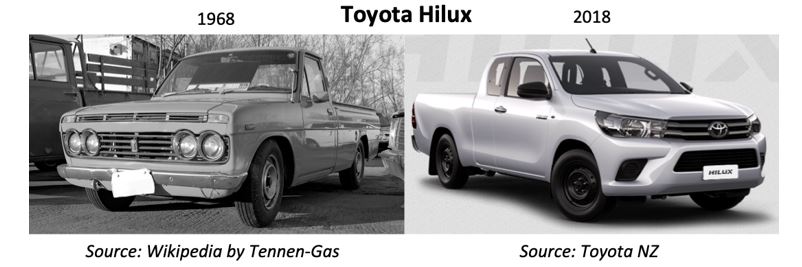

We wanted to do something similar here in NZ, with the price of the Toyota Hilux, but we weren’t able to find the original MSRP for a ’68 Hilux.

Fortunately, one of your fellow readers, Clive, managed to track down that information…which is incredible given that the folks at Toyota didn’t even know.

Thank you, Clive!

He discovered that a 1968 Toyota Hilux Single Cab cost a whopping $2,064 when it first came out in New Zealand.

|

$2,064 in 1968 is the equivalent of $37,117 today.

The 2018 model pictured above — the 2WD Extra Cab Manual — starts at $32,990.

So, at first glance, you’d think that the ute has actually gotten cheaper…and in dollar-terms, you’d be right.

However, a better calculation would be in terms of labour-hours…so we ran the numbers:

In 1968, the rough average weekly income was about $50 per week. It would then take you 41 weeks to make enough for a base model Toyota Hilux.

Today, the average weekly earnings are $997, according to Stats NZ. That translates to 33 weeks.

In other words, a Hilux costs eight weeks less today than it did five decades ago. Our hypothesis — that things are becoming more expensive labour-wise — seems to be untrue!

We even considered that the average workweek has shortened by 2.5 hours in the past five decades, but that still doesn’t flip the results.

The fact is — it is easier to buy a truck today than it was 50 years ago.

Does that mean that today’s millennial crybabies have nothing to complain about?

Not so fast… [openx slug=inpost]

While the price of a truck has surprisingly decreased, Kiwis have watched prices skyrocket in another sector — housing.

According to Stats NZ’s AREMOS dataset, the average price of a home in 1968 was $7,700. In today’s dollar-value, that’s only $129,816. And in terms of labour-hours, that equates to 154 weeks…or around three years.

Today, the average NZ home costs $681,802, according to QV.

That works out to a ridiculous 684 weeks of working to afford an average home…or just over 13 years.

13 years, if you don’t pay a penny for anything else.

So, sure, your Hilux may be a few weeks cheaper, but your house is cancelling that out and more.

And when the Reserve Bank talks about the CPI — Consumer Price Index — as a measure of inflation, you’re only getting half the picture. CPI doesn’t include housing…and that’s where the real heist is happening.

For reference, in the United States, houses have actually stayed steady over the past 50 years.

In 1968, an average house cost US$25,000.

Today, it’s $220,000.

Factor in average incomes and you end up with 3.25 years in 1968 and 3.5 years today to purchase a home.

To recap, in the last 50 years, real home prices have increased by:

- Approximately three months of work in the US.

- Approximately 122 months of work in NZ.

The facts are astonishing…

And they give credence to the millennial whinging about how baby boomers had it easier.

In regards to buying a house, that is certainly true.

From an economics perspective, what are the consequences of this?

For one, it means that young professionals today have to direct more of their income towards saving for a down payment. That, in turn, means lower consumption…and that could eventually cause an economic slowdown.

It also means that most Kiwi savings are funneled into property as opposed to investments like stocks or bonds. While that’s worked well for Kiwis individually, it means that there’s less funding for business to work with…which could slow growth over time.

It could also result in an exodus of New Zealand’s young folks, particularly those with the mobility of a university education under their belts. If they can get a house for nearly 10 years cheaper in the United States, you can see how there would be pressure to leave NZ.

It also means that the young people who stay might opt to withdraw from their KiwiSaver to fund their home purchase. Emptying the nest egg at such a young age could create serious retirement deficits down the road…putting greater pressure on the state’s pension fund.

Finally, the fact that Kiwis have so much of their wealth tied up in property creates a unique vulnerability for the entire economy. If the housing market does indeed crash — as most experts believe it will — you could see millions of New Zealanders underwater…sending ripples throughout the rest of the economy.

Now, we’re not suggesting that you sell your home…or leave New Zealand to build a cabin in Alaska…or swap your bach for a double-cab Hilux.

We don’t know anything about your personal situation.

All we’re saying — and all we can do — is look at the evidence and try to connect the dots.

Then plan accordingly.

Best,

Taylor Kee

Editor, Money Morning New Zealand

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.