What do you think of MakeItSo.com? What about Bookmall.com?

No good?

Both of these were possible names when Jeff Bezos was naming his start up. He would settle on Amazon.com, naming it after the largest river (by volume) in the world.

Like the river, Amazon.com, Inc. [NASDAQ:AMZN] might soon become the world’s largest company. Their current market cap is ever so close to a trillion dollars. It has taken time to get to this point. But who could have imagined it sprouted from books. From The New York Times in 2013:

‘Amazon started out modestly as a Seattle-based online bookseller in 1995…[and then] branched out into selling music, movies, electronics and toys during the dot-com boom of the late 1990s; and made it through the dot-com bust of 2000 and 2001.’

Five years later, the company is as strong as ever. Not only are they the dominant online retailer. Amazon has mastered self-landing rockets and selling other people’s stuff (third party business). It looks like they’ll control the cloud industry (data storage) too.

Is there anything they can’t do?

What is Google jealous about?

Can you hear that? It sounds like Alphabet Inc. [NASDAQ:GOOG] is green with envy.

Of course, Google is no push over.

The company is absolutely minting money. It costs very little to keep things in ship shape at Google headquarters. They also have so much cash they end up pouring billions into side projects for fun.

The problem with success is that you always want more of it.

Unlike Amazon, Google doesn’t exactly have a diverse range of revenue channels. In the most recent quarter, 86% of sales came from ads, 13.5% came from ‘other’ sales, which was made up of TV and internet services.

Amazon on the other hand, had 51.4% of sales come from selling things online. A further 18.3% came from selling other people’s stuff and about 11.5% was from their cloud business.

This isn’t what Google’s jealous about though. They are potentially far more jealous of Amazon’s potential markets.

Online retail is already a trillion dollar business. And as more people jump online, the industry continues to grow. Data storage, while not as big as retail, is one of the fastest growing multi-billion dollar industries out there. The market grows at about 24% annually.

Compare that to digital ads, a US$270 billion industry, of which search makes up about US$100 billion. Probably seems rather obvious why Amazon trades at a much, much higher PE than Google. There’s just more potential upside for the Everything Store. [openx slug=inpost]

In an interview with Fox Business, famed fund manager Bill Miller said:

‘Amazon compared to great companies like Facebook and Google for example is that Amazon’s addressable market is so much larger. Google and Facebook are fighting over the global ad market, which is about US$500 billion. Amazon is attacking the global retail market, which is trillions and trillions of dollars, as well as…the cloud.’

There’s even talk of Amazon muscling Google for a share of the ad market. The Wall Street Journal wrote earlier this year:

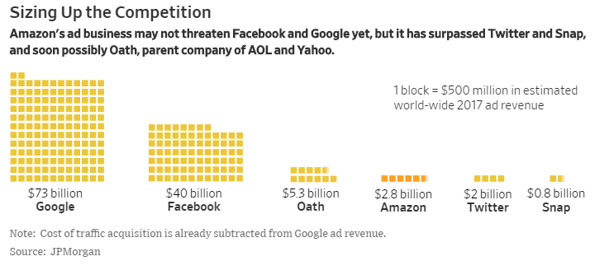

‘Amazon doesn’t break out advertising as a separate business, but according to a new report by J.P. Morgan analyst Doug Anmuth, the company racked up an estimated $2.8 billion in 2017 ad revenue. That’s small compared with his estimate for Google’s ad revenue in 2017: $73 billion. Yet in 2019, he expects Amazon’s revenue to more than double to $6.6 billion.

‘Amazon’s advertising success is directly related to its retail business. Consumer packaged-goods companies now spend more on digital advertising than all varieties of non-digital advertising combined, according to Cadent Consulting Group. Google’s search ad business leans on the premise that a customer researching a purchase will click relevant ads that will lead to a sale. Google has incredibly rich data from our search and browsing histories, and Facebook lets advertisers combine our social graph with other data, like where we’ve been and what we’ve bought.

‘But Amazon has a huge set of data that Facebook and Google can’t access—namely, its own. Already, more than half of all online searches for products start on Amazon, and of those a majority end there, according to various surveys. That figure has grown every year that pollsters have tracked it.’

|

Source: WSJ |

It’s why Google is quickly trying to carve out a chuck of another billion dollar industry: online games.

Gimme some profits, Tencent

Before you start slagging the industry, consider the following.

The average gamer is 31 years old. There are more gamers over the age of 36 than there are between 18 and 35. The male/female split is almost down the middle. Purchasing games has also become a whole lot easier over time.

What we’ve got now is a target market with lots of money, willing and able to spend on good games. Most of that money, in China at least, winds up in the hands of Tencent Holdings Ltd [HKG:0700].

In just one quarter, Tencent can generate sales of US$4 billion from online games. Many believe that figure will continue to grow.

Safe to say Google wants in. The search giant went as far as developing a whole new service, game-streaming. From Tech Crunch:

‘Earlier this year, we heard rumours that Google was working on a game-streaming service. It looks like those rumours were true. The company today unveiled “Project Stream,” and while Google calls this a “technical test” to see how well game streaming to Chrome works, it’s clear that this is the foundational technology for a game-streaming service.

‘To sweeten the pot, Google is launching this test in partnership with Ubisoft and giving a limited number of players free access to Assassin’s Creed Odyssey for the duration of the test. You can sign up for the test now; starting on October 5, Google will invite a limited number of participants to play the game for free in Chrome.’

Whether this new segment will significantly contribute to sales is still an unknown. But it’s an industry Google can quickly try to dominate before Amazon comes lurking.

Your friend,

Harje Ronngard

Harje Ronngard is one of the editors at Money Morning New Zealand. With an academic background in finance and investments, Harje knows how difficult investing is. He has worked with a range of assets classes, from futures to equities. But he’s found his niche in equity valuation. There are two questions Harje likes to ask of any investment. What is it worth? And how much does it cost? These two questions alone open up a world of investment opportunities which Harje shares with Money Morning New Zealand readers.