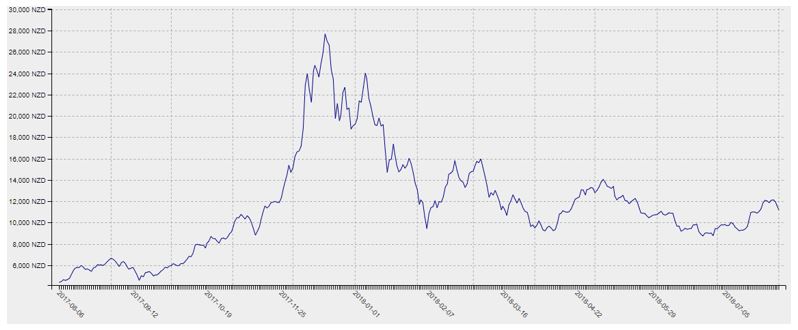

It’s been a rough first half of the year for cryptocurrencies.

|

Source: Cryptocurrency Chart |

From the peak in late December 2017, Bitcoin has tumbled over 60%.

Yet, if you stick out your thumb and cover the spiky part between November 2017 and February 2018, you’ll notice it’s not so kooky after all.

On 12 November, Bitcoin was at NZ$8,812. Today, it’s at NZ$11,190.

A 27% increase over about nine months?

That’s far more sensible…and not a terrible return.

In fact, if you bought Bitcoin any time before November 18th, 2017, you’d be looking at a return on your investment.

But the mainstream has only been spouting revulsion:

‘Bitcoin bloodbath continues as speculative bubble bursts’

NZ Herald, 1 July 2018

‘I lost more money in Bitcoin than most people will earn in a lifetime’

Stuff.co.nz, 16 March 2018

‘Bitcoin’s Hype Vanishes Just Like That: “We’re in the Boring Phase”’

Wall Street Journal, 12 April 2018

‘Is Bitcoin a Waste of Electricity or Something Worse?’

New York Times, 28 February 2018

‘Bitcoin is rat poison’

Warren Buffett, 8 May 2018

Well, tell us how you really feel, Mr Buffett…

The problem is, if cryptocurrencies are dead in the water, why haven’t they gone to zero?

Why did the freefall stop around March?

If there was nothing to it…and cryptos are just ‘a waste of electricity’…why has the market disagreed?

Maybe Ethereum’s founder, Vitalik Buterin, has the right idea…

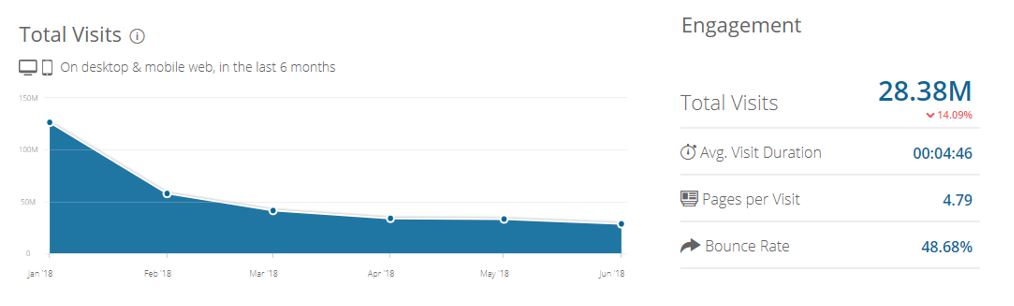

A couple weeks ago, Tim Swanson (Twitter @ofnumbers) noticed that traffic on Coinbase.com has fallen by over 75% in the past six months.

|

Source: SimilarWeb |

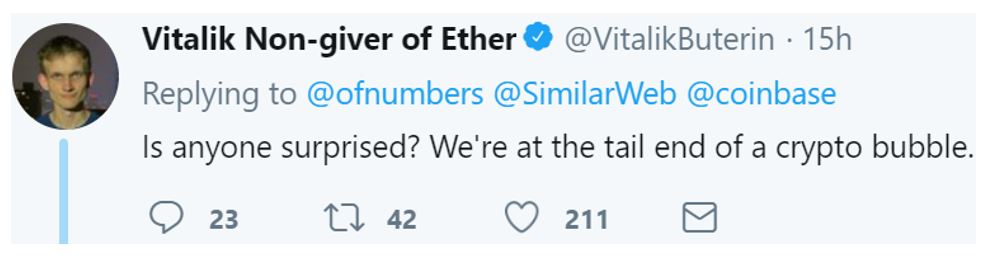

When Tim brought attention to it on Twitter, Vitalik responded:

|

Source: Twitter |

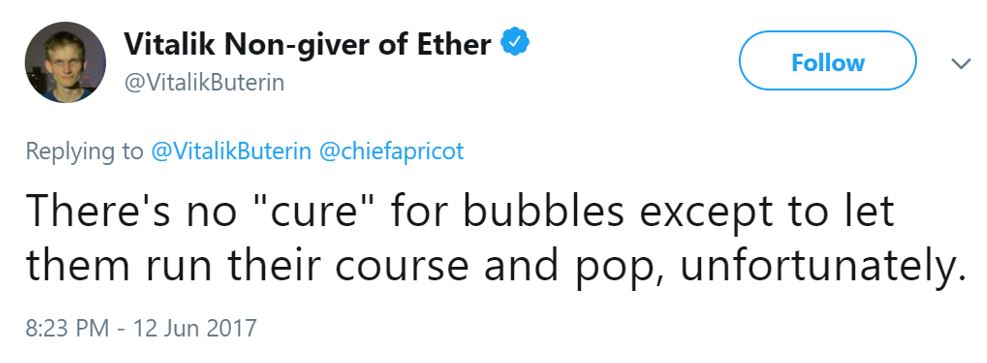

He also said:

|

Source: Twitter |

It’s a bubble. At this point, I doubt many would disagree.

The question is — has the bubble deflated? Or will ethereum and other cryptos crash and burn?

Crypto-heads like our very own Sam Volkering believe that we’re facing a technology revolution.

That the ideas and concepts behind cryptos will lead us to a new era…

But the mainstream only sees cryptocurrency as a speculative investment.

That makes sense. If you only see it as a speculative investment, you don’t care about the opportunities in infrastructure, data, identity and more.

You only care about the trend lines on the chart. Still going up? Good.

It’s that approach that led to the bubble in the first place. And it’s why the sell-off was so spectacular.

Once the speculators saw red, they all jumped ship. It’s how they think. That’s all crypto ever was to them. [openx slug=inpost]

You can imagine how frustrating that entire bubble period was for real crypto-heads. People like Sam appreciate it for the life-changing potential, not as a portfolio gamble.

Sam said:

‘Yes, it has issues and right now it’s not the answer we all seek. But when you see the progression and the grunt work of the people working on it, you can see the huge future potential.’

He sees the Ethereum protocol as holding the keys:

‘When was the last time you had a chance to contribute to the development of the economy? When could you apply innovation to the cash issued by the central bank?

‘When was the last time you got to influence the creation of financial products the banks put together? Our guess is never.

‘But through open source, distributed networks, you can.’

So, when the speculators sold off, ‘true-believers’ like Sam see it as a healthy market correction — a purge of those who are in it for the wrong reasons.

And once the dust settles, the cycle could return to an upward trend.

The CEO of Coinbase, Brian Armstrong, put it well:

‘The crypto industry is like no other I’ve seen — lots of up and down cycles (reaching a new plateau each time). There have been 3 or 4 of these now. It can be scary the first time you see it, but to us who have been in the industry for many years, it feels like old news.

‘When there is hype, people are irrationally exuberant. When there is despair, people are irrationally pessimistic. Neither is true. Reality is always somewhere in the middle, more correlated with real usage (transactions per day) than the price.

‘After many years of this, I’ve come to enjoy the down cycles in crypto prices more. It gets rid of the people who are in it for the wrong reasons, and it gives us an opportunity to keep making progress while everyone else gets distracted.

‘We use the down cycles to build a strong foundation so we can thrive in the next growth cycle.’

For those of us who see the value of the tech…and are seeking to profit…this is an exciting time to get invested.

But that comes with greater risk…the flip side of the coin.

The tech hasn’t been perfected. Developers are still working out the kinks and improving the code.

Regulators are still figuring out how to deal with it.

Businesses are deciding whether it’s too early to start implementing.

There’s still the possibility of the mainstream rejecting the concept.

If that happens, ethereum and friends could very well go to zero.

But isn’t that what tech investing is all about? Judging risk and potential reward?

Where do you stand?

Best,

Taylor Kee

Editor, Money Morning New Zealand

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.