If you’re below 30 years old, you have an amazing advantage over your senior generation.

You might not have as much cash. You probably don’t have as much experience either. But you have something you can’t learn, buy, or dare to waste: time.

A 28 year old blogger recently worked out his future retirement fund. He had saved up $345,000 already. Most of which was earnings of 6-7% in a low cost index fund.

Even if he saves nothing from now on, this 28-year old is still looking at about $3 million by retirement.

It’s not a fortune. But it’s certainly not chump change.

The lesson here: start saving and invest early on!

Of course, all this means nothing if you’re on the final lap of your investing career.

So what can you do when time is not in your favour?

Growth galore

One option is to look for opportunities in growing regions.

Take China for example.

Yes, the government has a controlling influence. And yes, there are tensions between China and the US right now.

But China has so many variables working in their favour.

First, and maybe the most obvious, is their massive consumer base that continues to grow larger each year.

In 2012, about 54% of consumers were earning $9,000-16,000. In the next four years, most of those consumers will be earning $16,000-34,000 annually.

What are they going to do with an extra $7,000-18,000?

Most will spend it.

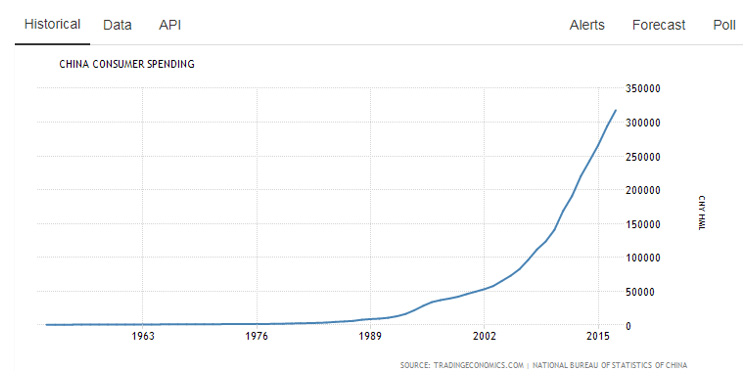

They’ll buy branded goods, cars, holidays, real estate, and spend lavishly on nights out and other lifestyle goods. We’ve already seen Chinese consumer spending skyrocket.

Since 2012, total consumer spending has already risen by a factor of 5.

|

Source: Trading Economics |

It’s why so many businesses are jostling to jump into China. Magellan wrote in mid-2018:

‘On December 6 last year, as a long line of Chinese waited to be let in, Starbucks opened a 2,800-square-metre roastery in the coastal city’s retail hub that people describe as about half a football field in area.

‘Opening the outlet proved a bonanza because the Shanghai Roastery became Starbucks’s biggest revenue earner on day one. “We shattered every sales record in the history of the company,” said Starbucks chairman Howard Schultz. Such a result explains the Starbucks ambition to nearly double the number of outlets in China from 3,200 now to 6,000 by 2022, which would entail opening more than a store a day.

‘The Starbucks plans for China mimic the strategy of countless other multinationals since China modernised its economy from the late 1970s – namely, to seek a slice of the 1.4 billion strong consumer market that is growing in wealth every year. The World Economic Forum this year forecast Chinese consumption to grow 6% p.a. from 2016 to 2027, to nearly double in size to US$8.2 trillion over that time. (For perspective, US consumption is about US$20.0 trillion.)’

[openx slug=inpost]

China also has the advantage of fast modernisation.

You wouldn’t think second is an advantage. But by seeing what worked and what didn’t, China’s entrepreneurs can replicate success.

For example, after seeing the creation of Google, Robin Li thought it was a no brainer to create Baidu, China’s search giant, two years later.

And when you’ve got a whole country willing to work hard and achieve success, great things happen.

You could say many of the same things about India.

Unlike China, India’s population is extremely young. Like China, they have a massive consumer base. And of course there are entrepreneurs which are arguably willing to work longer and harder to achieve success.

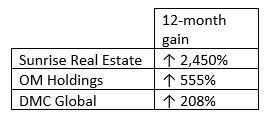

Had you been looking into China or India, you might have come across winners like Sunrise Real Estate Group [OTC:SRRE], OM Holdings [ASX:OM] or DMC Global Inc. [NASDAQ:BOOM], all of which have exposure to China or India.

|

Source: Bloomberg |

If you can bag a couple of these winners, they’ll do wonders with just a few thousand dollars.

But of course, trying to find rocketing stocks is far harder than investing in a low cost index fund. And because it’s harder (you’re dealing with multiple unknowns) it’s arguably risker.

The speed bumps along the way

I believe the current trade tensions are an example of temporary speed bumps. Tariffs will hurt a country like China.

From The Australian Financial Review:

‘China’s economy is showing further signs of cooling as the US prepares to impose even tougher trade tariffs, with investment in the first seven months of the year slowing to a record low and retail sales softening, data showed on Tuesday.

‘Fixed-asset investment growth slowed more than expected to 5.5 per cent in January-July, highlighting weakening domestic demand and faltering business confidence as the US trade war adds to domestic pressures from Beijing’s crackdown on debt and pollution.’

But I believe this will only be a temporary effect. An all-out trade war isn’t on the cards in my opinion. While trade benefits China, it’s also crucial for the US as well.

In time, you’ll see tariffs lifted and businesses pile into China as their economy booms.

So if you’ve got limited time, maybe it’s worth thinking about getting yourself exposure to markets like China and India.

Once these economies mature, you won’t see another two like them.

Your friend,

Harje Ronngard

Harje Ronngard is one of the editors at Money Morning New Zealand. With an academic background in finance and investments, Harje knows how difficult investing is. He has worked with a range of assets classes, from futures to equities. But he’s found his niche in equity valuation. There are two questions Harje likes to ask of any investment. What is it worth? And how much does it cost? These two questions alone open up a world of investment opportunities which Harje shares with Money Morning New Zealand readers.