The number of Americans 65 plus going bankrupt is soaring.

The ‘Graying of U.S. Bankruptcy: Fallout from Life in a Risk Society’ report found that:

‘Older Americans are more likely than ever to find themselves in bankruptcy court, seeking protection from creditors. Depending on their age cohort, their rate of bankruptcy has increased between 200 and 300 per cent since 1991. Further, bankrupt households are more likely than ever to be headed by a senior. The percent of bankrupt filers age 65-74 has increased almost 500 percent since 1991, growing from 2.1 percent of the bankrupt population to 12.2 percent in 2016. Even adjusting for increased numbers of older Americans, older people are still more likely to seek protection in bankruptcy courts than in prior decades.’

US population is aging, it is living longer. Yet, as the study continues, that alone doesn’t explain the large increase.

According to the study, one of the culprits is the shift of risk from government backed pension benefits to 401(k)s.

As they wrote ‘With the 401(k)-style of savings, payout during retirement is not defined or predictable, employees bear all of the market risks, and returns depend on employees’ investment skills.’

But there are other factors. Low salary growth, debt and increasing healthcare costs are all starting to become a burden.

Health Expenses are Piling Up…

For one, as people are living longer, health expenses are piling up.

According to the study, ‘out-of-pocket spending among older Americans with Medicare comprises about 20 percent of their income, and the estimated total of all noncovered medical expenses for a 65-year-old retired couple during their retirement years is $200,000.’

Longer life expectancies, higher costs of living and lower salary growth have meant that older workers are staying in the workforce longer.

Workers are also having a hard time saving after living through two recessions in the last 17 years, and a decade of low economic growth.

According to a recent paper by the US Congress :

‘In 2000,12.5 percent of those over 65 were working; by 2016, that share had increased to 18.6 percent. Moreover, while the labor force as a whole is projected to grow by an average of just 0.6 percent per year between 2016 and 2026, the number of workers ages 65 to 74 is projected to grow by 4.2 percent annually and the number of workers ages 75 and above by 6.7 percent annually.’

And the thing is, the trend isn’t reversing anytime soon.

The Population Reference Bureau expects the number of Americans aged 65 and over to more than double from 46 million today to 98 million by 2060. The 65 plus population will go from 15% share of total population to 24%. That is, one in four people will be 65 plus.

In fact, as you can see in the graph below, employment growth for the 65 plus is growing fast, quicker than any other age group.

|

Source: US Bureau Labour of Statistics |

[openx slug=inpost]

Boomers Are Also Entering Retirement With More Debt…

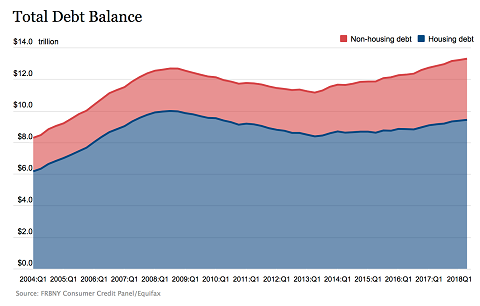

In the United States, household debt is making a comeback. As you can see below, household debt as a total is higher than in 2007. With much of the non-housing debt increasing with student loans and auto loans.

|

Source: New York Fed |

According to a recent report by the Employee Benefit Research Institute (EBRI ) in 1992, the percentage of families with debt headed by a person aged 55-plus was 53.8%. That number has increased to 68% in 2016.

Since 2007 the families headed by a person aged 75 and older saw the biggest increases in debt. The number of families with debt has gone from 31.2% to 49.8% in 2016.

Older workers are also starting to see a decrease in social security benefits due to an increase in the dependency ratio. That is, the ratio of people aged 0 to 14, and 65 and over, to the working population.

The World Economic Forum estimates the retirement savings gap — that is, the money we need to pay for pensions versus the money the government, employers and individuals actually have for retirees— will fall short by US$224 trillion in 2050. That’s right trillion, with a ‘T’.

I mean, that number only takes into account the world’s six largest pension systems: the US, UK, Japan, Netherlands, Canada and Australia.

If you add to the mix China and India, the two countries with the largest populations, the number hits US$400 trillion…

Older Americans are filing for bankruptcy at faster rates.

High costs of living, lower salaries…they are all taking a toll.

And this is happening after a nine-year long bull market. If the market came crashing down, we could see even more affected with the fallout.

Best,

Selva Freigedo