US stocks rose again overnight. The S&P 500 is just 0.3% away from the all time closing high of 2,872.87 points, reached on Friday, 26 January this year.

Will the bull market continue? Will this turn out to be the longest (and most improbable) bull market in history? Who knows…so let’s get the popcorn out.

Tesla is going private

Speaking of improbable, did you hear that electric car manufacturer, Tesla is in a trading halt, following an announcement that it would take itself private? As The Financial Review reports:

‘Chief Executive Elon Musk saidhe is considering taking Teslaprivate in what would be the largest deal of its type, moving the electric car maker out of the glare of Wall Street as it goes through a period of rapid growth under tight financial constraints.

‘“Am considering taking Tesla private at $US420. Funding secured,” Musk said on Twitter. At $US420 per share, a deal would be worth $US72 billion ($97 billion) overall. Musk did not disclose the source of the funding.’

There are a whole bunch of short sellers who would be hurting right now. Tesla stock surged 11% on the news. It closed with a price of US$379.57 per share. With a buy out price of $420, there’s another 10% of pain in this trade for the short sellers.

For years now, Tesla has been a favourite short selling candidate, especially with value managers. To ‘sell short’, by the way, is to bet on a share price declining. Depending when they got into the trade, it could have been profitable.

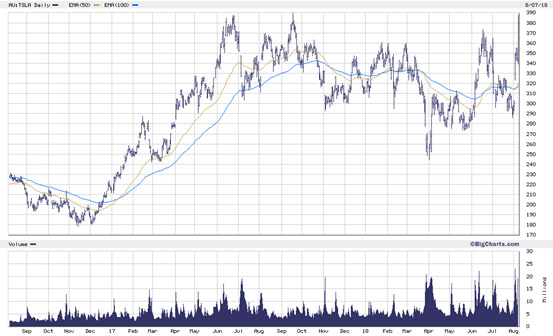

The chart below shows the Tesla share price over the past two years. It peaked around US$380 per share in 2017, and hit a low of US$250 in April this year. That’s a decline of 34%.

But in reality, almost no one will have generated this return from betting against the company. In fact, I think most will have lost considerable sums. That’s especially the case when you consider that you have to pay a fee to borrow shares in order to sell them.

|

Source: Bigcharts.com |

I said it was improbable because betting against Tesla was so obvious. The company loses money, has huge capital expenditure requirements, and carries a big debt load. How can it have an equity value of nearly US$60 billion?

Exactly.

But in the market, what is obvious rarely works out as an investment idea. If ‘everyone’ knows something, it is usually in the price, however hard that price might be to justify based on your ‘beliefs’.

And so the improbable has happened with Tesla (at least in the eyes of the shorts). Musk wants to take it private at an all-time high share price. Their only hope is that this is a dodgy ploy by Musk to inflict pain on them.

The issue is that Musk said ‘funding is secured’. If it’s not, he’s in real trouble.

Funnily enough, Musk delivered the news via Twitter. The stock then had to go into a trading halt while the company put out an official statement. Is that even legal?

Regardless, I’m sure Musk won’t receive a ban or shadow ban for his dubious behaviour. Not like the editorial director of antiwar.com, Scott Horton, former State Department employee Peter Van Buren, and the executive director of the Ron Paul Institute, Dan McAdams, who were all banned from Twitter overnight.

The deep state purge of free speech continues… [openx slug=inpost]

Interest rates on hold…again

Meanwhile, in the backwaters of Australia, the RBA kept interest rates on hold again at their monthly meeting yesterday. That’s a record 22 months in a row of no changes. And there has been no monetary tightening since November 2010, the last time our terms of trade started to surge higher and provide a boost to national income.

This continued easy money stance should provide ongoing support for the stock market. But with China feeling the pinch from the trade war (which hurts commodities) and the property market continuing its slow and mild correction (which will restrict bank profit growth) the upside is limited too, in my humble opinion.

Taking my humble opinion out of it — which is always a good thing to do — and looking at things objectively, it’s hard to be bearish on Aussie stocks right now.

The chart of the ASX 200, below, is trending higher and looks healthy…

|

Source: Bigcharts.com |

It’s also trading at decade highs. This is bullish. The ‘obvious’ thing to think about Australia is that the housing downturn will drag us into recession and send stocks into a bear market.

But as you know, what is obvious rarely plays out in the world of the stock market.

Until next week,

Greg Canavan,

Greg Canavan is a Feature Editor at Money Morning. He likes to promote a seemingly weird investment philosophy based on the old adage that ‘ignorance is bliss’. That is, investing in the Information Age means you have all the information you need at your fingertips. But how useful is this information? Much of it is noise and serves to confuse, rather than inform, investors. And, through the process of confirmation bias, you tend to read what you already agree with. As a result, you often only think you know that you know what is going on. But, the fact is, you really don’t know. No one does. The world is far too complex to understand. When you accept this, your newfound ignorance becomes a formidable investment weapon. That’s because you’re not a slave to your emotions and biases.