Peculiar rates

Our first prediction was that the Fed will never normalise interest rates. It claims to have begun the normalisation process more than three years ago, in June 2015, taking tiny steps toward higher rates — increasing them by 25 basis points each quarter.

But consumer price inflation is walking faster…and now — 10 years after its emergency rate cuts — the Fed’s key lending rate is only 2%, nearly 100 basis points below the rate of inflation.

In other words, the Fed is still lending money at a very abnormal rate.

The Fed will never normalise its rates because it has created an economy that depends on peculiar ones. Normal rates, discovered by cooperating parties in a free market, would now sink both the economy and the stock market.

Most likely, stocks will fall and the economy will go into a vicious recession long before the Fed gets anywhere close to normal.

Then, it will repeat the mistake of dropping rates again in a panic. We have high confidence that that is what will happen — especially with the self-described ‘king of debt,’ Donald J. Trump, egging it on.

It’s our second prediction that we’re beginning to wonder about. We predicted that the president would back off from his trade war. But after his latest tweets, we’re not so sure.

Local update

Let us get to that in a moment. First, a local update:

Europe has been suffering from a heat wave — a canicule, as they call it here in France. Lawns dry up. Retirees drop dead. The young and old stay indoors during the heat of the day.

Few people have air conditioning. It is rarely needed. And even today, with temperatures in the 90s, it isn’t as uncomfortable as you might think. Humidity is low.

The old houses — with their thick, stone walls — never heat up completely. Windows are thrown open at night to cool the houses down. In the morning, outside shutters, windows, indoor shutters, and curtains are closed to keep the heat out.

And in the evening, we enjoy a long, slow dinner outside…as the light and heat fade away.

Oh…and we have a new project!

Big doors — 14 feet high — are meant to block the passageway to the inner farmyard. Alas, they have been falling down ever since we got here 23 years ago.

Now, it’s time to do something about them. But what? How?

Stay tuned.

|

Bill’s newest project: A set of old doors at his home in the French countryside |

Buck stops

Meanwhile, we leave the real world of real things, real problems, and real solutions…and return to the make-believe world of Donald J. Trump.

Not that we have anything against America’s chief executive… But he sits at the desk where the buck stops and bravely takes responsibility for all that happens during his watch. And he seems like the perfect person for the job.

Thrown up by malicious fate…carefully chosen by the mischievous gods…and groomed for catastrophe, like Custer for the Battle of the Little Bighorn…or Edward John Smith for the Titanic…

…Mr. Trump is a phenomenon; generations will sing his praises or curse his name, depending on how it turns out.

How it will turn out is, of course, beyond our ken. We can only try to understand what is going on and guess about how it ought to turn out.

And our guess is that China’s People’s Daily is right… The US will make a fool of itself.

Mr. Trump has nothing to be ashamed of. At least, insofar as macroeconomics is concerned; Barack Obama didn’t know anything about it, either. It’s not a job requirement.

And few politicians have the time or motivation to think very deeply about it. Instead, they bring on advisors who inevitably come with their own bad ideas and hidden agendas.

Readers remind us that Donald Trump is a rich guy — a seasoned businessman who was trained at Wharton, the prestigious business school of the University of Pennsylvania.

But this only makes us suspicious of Wharton; what do they teach there?

Do they mention that, as a general rule, as trade expands, people grow richer? More trade means more transactions, more competition, more choices, more learning, and more specialisation.

That’s how an economy moves ahead. It’s also why some groups are rich and others are poor. A poor economy is one in which everyone has about the same knowledge.

It’s a bit like the life we see up in the mountains of Argentina. All the locals know the same things – how to plant corn, how to cure hides, how to protect the sheep from the pumas, and how to build mud roofs.

In a rich society, people know very different things. One knows how to program a computer…another knows how to fix the toilet…and still another knows how to bake bread.

The rich guy is not the jack-of-all-trades, but the one who figures out one métier better than others. Then, this dispersed, specialised knowledge is brought together through trade.

Usually, the larger the free-trade area, the richer the people in it. As the trade zone shrinks, so does its wealth.

Fight to the end

But along comes the Wharton graduate, Donald J. Trump, building walls with razor wire on top…between the US and China, Europe, Iran, Mexico, and Canada.

The press reports that some Canadians have begun boycotting US products.

According to People’s Daily, China vows it will ‘never surrender to blackmail.’ Instead, it will ‘fight to the end.’ China also stepped up its purchases of Iranian oil…in defiance of Trump’s new sanctions.

Europe passed a law making it illegal to comply with Trump’s sanctions against Iran.

And that’s just today’s news!

As the walls go up, Mr. Trump thinks he is ‘winning’ because China’s stock market is down.

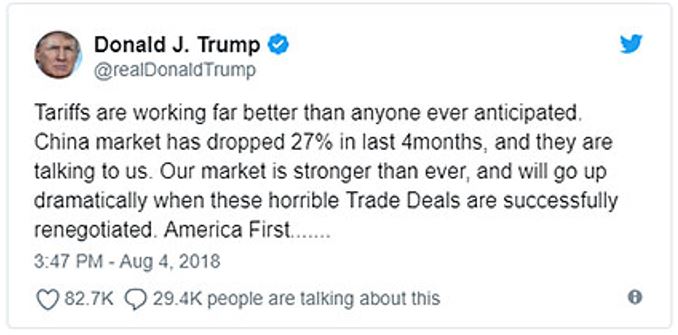

POTUS tweeted:

|

Source: Twitter |

So if you have faith in Mr. Trump, getting rich is a piece of cake. Just buy stocks. The market will go up ‘dramatically’, he says, as he puts the world economy in order.

If you lack faith, on the other hand, you may want to sell short. Walls surely increase the risk of a crash on Wall Street and a global depression.

Which brings us back to our second prediction: Since the Deep State depends on the survival of the present, EZ-money financial regime, and since the system heavily depends on China to provide low-priced goods (keeping inflation at bay in the US) and to recycle its Main Street earnings into Wall Street assets (mostly US Treasuries), we forecast that The Donald would never follow through on his trade threats…especially with China.

The Deep State itself would be the biggest loser.

We assumed that someone would explain the risk…and he would back down.

But as of last weekend, it still appeared that he had slept through his key Wharton classes and wasn’t taking calls from Deep State insiders.

Instead, he may be serious about disrupting the world economy and stifling world trade. If foreigners want to do business in the US, he says, they can damned well pay a tax…or make stuff in the USA.

Presidents say dumb things all the time. Most mumble and hedge…on this hand, this…on that hand, that…

One of Mr. Trump’s charms is that he says what he thinks and does what he wants, no matter how ignorant, mendacious, or moronic.

The walls go up…and the ground beneath them trembles.

| Regards, |

| Bill Bonner |

Since founding Agora Inc. in 1979, Bill Bonner has found success and garnered camaraderie in numerous communities and industries. A man of many talents, his entrepreneurial savvy, unique writings, philanthropic undertakings, and preservationist activities have all been recognized and awarded by some of America’s most respected authorities. Along with Addison Wiggin, his friend and colleague, Bill has written two New York Times best-selling books, Financial Reckoning Day and Empire of Debt. Both works have been critically acclaimed internationally. With political journalist Lila Rajiva, he wrote his third New York Times best-selling book, Mobs, Messiahs and Markets, which offers concrete advice on how to avoid the public spectacle of modern finance.