Your Invitation to Join Wealth Morning’s Inner Circle… |

Lifetime Wealth Investor

[BREAKING NEWS] The coronavirus is pushing down stock values. Could they rebound? This might be your biggest opportunity since 2009…

👉SPECIAL LIMITED-TIME OFFER FOR NEW SUBSCRIBERS:

I have read the Terms and Conditions

Sign up today and you’ll get FREE access to Lifetime Wealth Investor for 30 days.

You’ll also receive our exclusive bonus guide, How to Build a Global Stock Portfolio, Step by Step — Profit from the Hidden Trends Shaping Our Economy, where we’ll show you how to build a winning investment portfolio over time that could make work optional.

Our research and analysis have really delivered for investors who previously subscribed to our old product, Small-Cap Speculator, which is why they’ve given us an enthusiastic thumbs-up.

Here’s what our readers have to say:

⭐⭐⭐⭐⭐ ‘I like the honest information about the pros & cons of each stock / company…People need to subscribe as it’s most likely the only way they are going to get in early on the small hidden gems.’ — Errol K

⭐⭐⭐⭐⭐ ’You give your reader great, up-to-date information and get right to the point with all the topics you write about. I am pleased with the shares I have purchased, at your recommendation, but more than that, with some of your advice, I have learnt how to be a wiser and more discerning buyer and also how to do a little of my own research. Thanks to you and your reports, I’m having fun.’ — Rod G

⭐⭐⭐⭐⭐ ‘…I look forward to your emails every day and especially to your next Small-Cap Speculator tips.… I would definitely recommend small caps investing and subscribing to Small-Cap Speculator as long as you can afford to lose as well as win. I check my portfolio throughout the day and it has become almost an obsession! I have become very interested in the stock market and the effects on it by outside agencies through the SCS subscription. I would never have known about any of these stocks, nor have had the confidence to invest in them even if I did, had I not been a subscriber. Keep the tips coming.’ — Kim W

Fantastic feedback!

Right now, we’re kicking things up a notch with our latest product, Lifetime Wealth Investor.

We believe that it’s time to go bigger and better…

…Beyond the Seven Seas to explore vibrant international markets…

We’re incredibly excited at the potential here— to give you timely insight into emerging trends and industries.

We want to explore stories ignored by the mainstream media. Stories that you won’t find in any regular newspaper. Stories that, quite literally, might change your life…

I have read the Terms and Conditions

Dear Friend,

Here’s what you’re going to get when you join our Inner Circle with Lifetime Wealth Investor.

Detailed recommendations from Day 1:

- Weekly Strategy Updates — Delves deep into the best businesses and sectors poised for growth in developed markets across the globe. Buy, hold or sell — and why. We’ll help you build your Lifetime Wealth portfolio step by step. Online and delivered fresh to your inbox every Wednesday.

- Stock alerts — Something happening with one of our positions? Opportunity to top up or maybe time to get out? We’ll shoot that to your inbox as soon as we’ve spotted it. So you’re always in the know on the positions in your portfolio.

- Portfolio online — Our recommended portfolio at any point is sitting on your encrypted, members only site. Log in and keep track of that at any time. Compare it against your own account.

- How to Buy Global Stocks — Regularly updated and with step-by-step instruction in plain English on how to build a golden portfolio from wherever you’re based. Direct access to our preferred global brokers.

- Customer Service — Got questions? While we can’t give any personal financial advice, we’re always here to provide support. If you’ve any questions — John Ling, our Customer Service Lead, is here to help. Email [email protected] or phone +64 20 415 88515 (Mon-Fri 9am-5pm).

I have read the Terms and Conditions

How did it all begin?

My name is Simon Angelo.

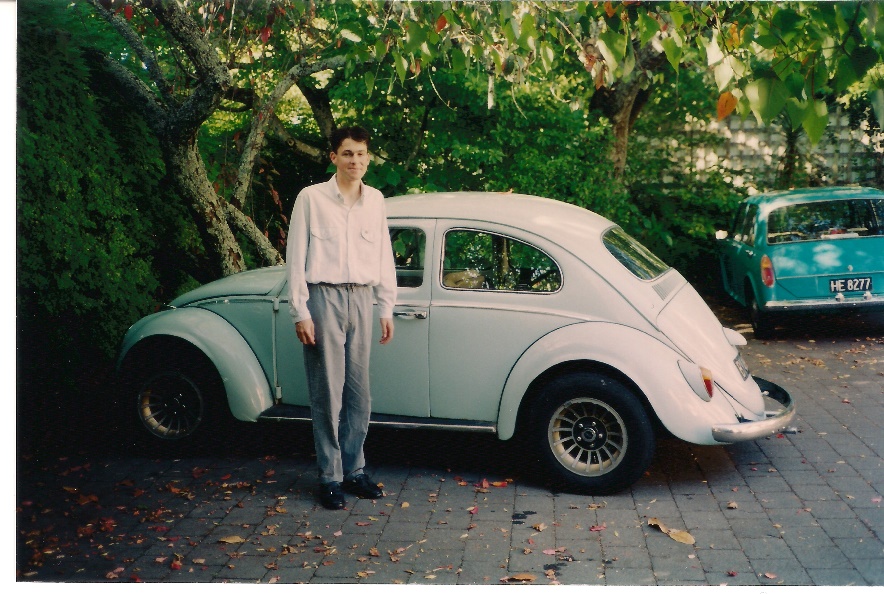

I was a spotty faced 17-year-old when I bought my first stock. I didn’t know what I was doing.

But it was great getting my first dividend payment in the mail. And banking some profits. Which I promptly put into my first car — a 1967 VW Beetle with bad brakes.

Despite the brakes, I kept the car intact for several years. Turned out, it was a good investment too.

Over the next 25 years, I studied the financial markets, built a successful business and spent a few years working with hedge funds in Europe.

I’ve since developed a significant and profitable personal portfolio.

And I’ve also become a recognised market analyst in my area, serving tens of thousands of Money Morning — and now Wealth Morning — subscribers.

Investment Beetle Profits — aged 17. Source: Simon Angelo

Now it’s time to share the full extent of my research — and my strategy with you. And not only my work — but the insights of our dedicated team.

So this is your invitation to join our inner circle and learn how build a global stock portfolio that could help you, well, make work optional.

Get This Bonus Guide Online When You Order Today:

I want to give you my guide on how to build a global stock portfolio!

This isn’t normally available to regular investors.

It’s how I built my portfolio. And how I run portfolios for wealthy wholesale investors through a separate wealth management business.

We will show you the mechanics step-by-step.

- How to setup your own personal trading workstation.

- How to access wholesale global brokerage.

- How to enter orders and maximize your buys.

- Certain ‘tricks of the trade’ that many investors aren’t aware of.

It’s available in most countries. For most currencies. And most local banks are supported.

Our bonus guide will take you through all of it, step-by-step, in plain English.

Trading floor at our brokers. Source: Wikipedia

Simply by setting up the right system and taking the right steps, you could be ready to start making profits in the global markets.

But most people won’t take these steps. They won’t get the financial tools and know-how that could lead to one day making their day job optional rather than a necessity.

Which is just as well — or there’d be a lot more competition out there for great value stocks.

But since you’re reading this far, I’m guessing you’re someone who wants to fly higher. And step by step, with the right recommendations — you’ll be surprised how quickly you can get going.

I have read the Terms and Conditions

Go big or go home

A few years back, I visited a big investor in Covent Garden, London. They were early investors in Spotify. You walk up the steps, surrounded by cutting-edge eateries. There’s a big white Scandi office. Gleaming chrome coffee machine. And a sign:

‘Go Big or Go Home’

‘It’s the first thing founders see,’ the partner tells me.‘ We want to be involved in big, fast-growing global opportunities.’

And it doesn’t matter whether you’re dealing with $100 million or $10,000 in the markets: You want to be involved in the best businesses and — ultimately — the new and hidden trends that are shaping the global economy.

Big profits from global trends

This is exactly what you’re going to get from Lifetime Wealth Investor.

I first started investing on a small exchange — the NZX. Back then, it was awash with value. Like picking up coins from the pavement.

Now, at least by the conventional measure of P/E multiples, it’s gotten expensive.

Then, in June 2016, I was sitting at a trading desk in Europe.

None of the mainstream financial analysts thought the UK would vote to leave the EU. So, all the stock prices and expectations on the LSE in London were holding up. It would just be business as usual. Right? Wrong…

My colleague at the time, Raj, thought different. He’d spent a lot of time in the UK. Listening to people. Especially older people.

‘They’re going to vote to leave,’ Raj said.

He was right. And then later that year, right again on Trump.

I also noticed something odd. Although the mainstream financial media was predicting Brexit would not happen and the polls were saying the same — something different was happening at the local betting shops.

There was more money in total being placed on a Remain vote — the UK staying in the EU. Yet, by actual number of bets, there were more for Leave. A lot more.

As the shock result for Leave unfolded, the pound immediately fell to a 31-year low, and the FTSE dropped 8%.

As a stock investor, many of my favorite British companies were on sale! And fortunately — having ignored the mainstream noise — I had some money to buy up…

Well-run, profitable mid- to large-caps — supported by solid asset bases in sectors with upside like infrastructure — delivering yields over 7%.

They turned out to be profitable buys, contributing thousands of pounds in gains during 2016 to my portfolio.

But the opportunities aren’t in Britain alone.

During the US-versus-China trade war, you could have captured gains worth thousands of dollars in a single week on the NYSE and NASDAQ.

During the Aussie mining boom, you could have multiplied your money many times over on the ASX.

By targeting the Singapore property slump with SGX REITS (Real Estate Investment Trusts), you could have notched up a 25% return in a little over 6 months while banking healthy dividend yields of 5-7%. Although past performance does not indicate the future. Please remember that it may not happen but this is just an example to demonstrate its potential.

So the point is: to invest successfully for a lifetime, you need to scour the world for value and opportunity. You need to be in the right place at the right time.

I’m guessing you don’t have the time to put in the 50+ hours a week needed to do the research required to achieve that. Well, that’s what I do — and I pull in numerous reports and analyses from other experts I know and trust.

And now I’m happy to share this with you.

The Lifetime Wealth Investor Approach

I know you’re busy. You want well-researched ideas you can put into play straight away. High conviction ideas that can lead to stellar capital growth with good income while you wait.

And as a savvy investor, you want clear recommendations with the convictions and reasons behind them explained. You want to know the upside and the downside so you can make your own assessment on whether you should get involved or not.

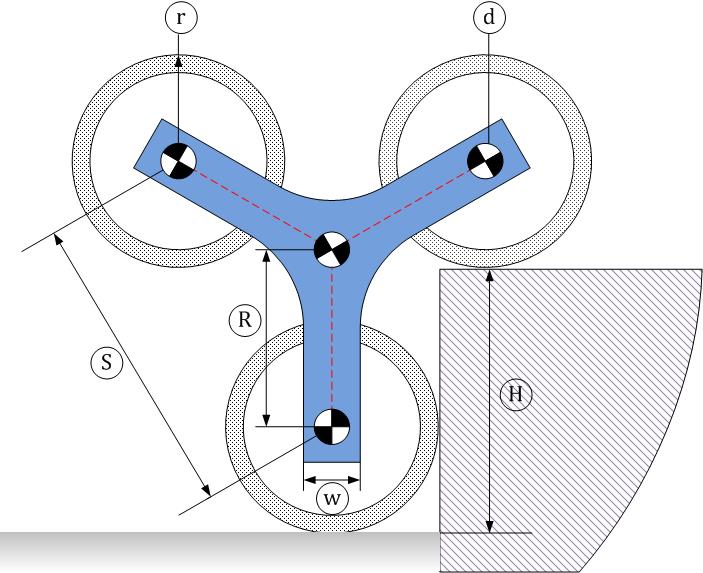

First thing, our strategy has a 3-pronged approach.

We call this building a Tri-Star Portfolio.

Source: Stair-climbing-robot.blogspot.com

Like a Tri-Star Wheel — which can climb stairs — the strategy is nimble enough to cope with any market condition.

We delve into…

- Unexplored stock opportunities in high-conviction boom sectors. We’re talking about resources, medicine, energy, infrastructure, and high-impact property trends.

- High-income producing shares that could provide you income for life. This is based on booming sector profits, strong margins and free cashflow. That alone is better than many mainstream financial goals.

- Capital preservation. We’ll give you deep fundamental analysis and business knowledge. We’ll seek out investments with sound management, strong profitability, good dividend yield and value underpinned by solid assets.

Lifetime Wealth Investor combines the slow steady burn of our high-yield income strategy with mega-profit picks from our growth convictions. Plus, downside management with our discerning approach to business valuation.

Together, the Tri-Star Technique means the real homework and heavy lifting is done. We believe it could offer subscribers big gains, reliable dividends and confident investing.

The reality is the mainstream financial media and pundits so often get it wrong. Like they did with Brexit. And Trump…

Nobody cared about your need for a reliable and growing stream of income and wealth. Until now…

Lifetime Wealth Investor provides the alerts you need to generate meaningful wealth and lasting passive income from the most profitable sector conviction businesses on the global markets.

It shows you how to find sectors offering both growth and income. The research helps bring to light some of the greatest hidden-sector growth opportunities.

And we hope it could offer your family financial security for years to come.

Most of all, build it big enough and you could potentially make work optional one day. Live the dream of spending more time relaxing by the beach, enjoying good food and wine and doing some travel — without always worrying where the next dollar is coming from.

Start securing your income supply. Step by step. We’ll show you how. Start generating the wealth to enjoy life’s great opportunities…

I have read the Terms and Conditions

The Hidden Cove

Source: North Shore Council

There’s a stunning bay near my home. It’s largely unknown. Locals fought for access. Now we have a little path to enjoy this special part of the world.

In the same spirit, Lifetime Wealth Investor works to ensure subscribers have access to the best ‘income-with-growth’ opportunities.

A path to achieve lasting financial independence in an uncertain world.

Now, as with any investing, there are risks:

- Stock prices can rise, as well as fall. While our recommendations are carefully researched and explained in our updates — unexpected events and market conditions mean your return is not guaranteed and your capital is at risk. We will outline key risks associated with each recommendation.

- While dividends have proven a reliable source of income in the past, they are subject to the dividend policy and profitability of each company. While we monitor dividend cover, your income from dividends can rise as well as fall.

- When investing in the global markets, there is also forex risk. While our research analyses and explains the optimal time to buy needed currencies (as part of our strategy), the value of your money in a foreign currency can fluctuate in your local money.

Please consider your own personal circumstances before you invest in any of our recommendations and never invest more than you can afford to lose. Remember that you must be prepared to take some risks if you want to achieve return.

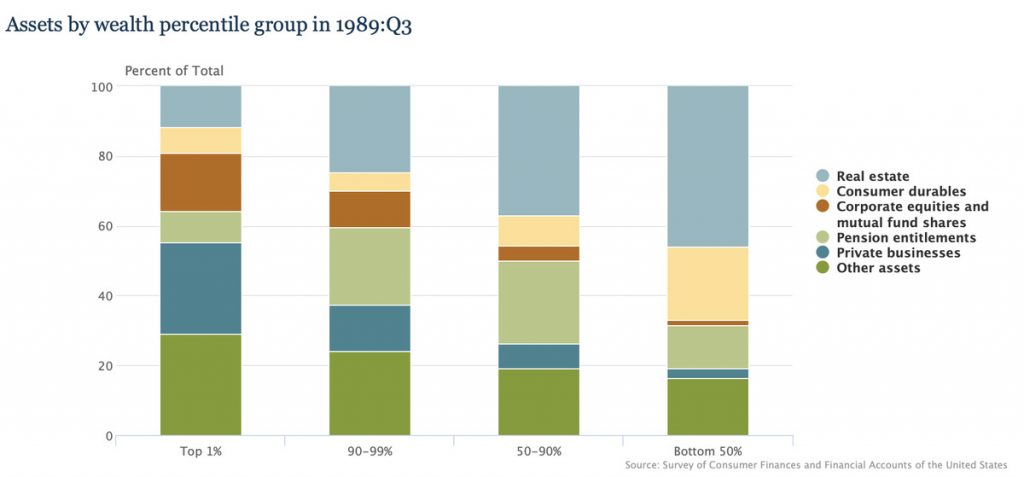

Which is what America’s top 1% has done over the past 30 years.

According to VOX.com, the top 1% of households in the US have increased their net worth by 650% since 1989. The bottom 50% grew their wealth by only 170% during the same period.

Federal Reserve figures indicate in 1989 the levels of risk those households took on:

Source: Federal Reserve/Vox.com

The top 1% had most of their wealth in businesses and shares. The bottom 50% mostly real estate — and tellingly, almost no shares.

Show me the money!

Here’s what you’re going to get when you join the Inner Circle with Lifetime Wealth Investor. Detailed recommendations from Day 1:

- Weekly Strategy Updates — Delves deep into the best businesses and sectors poised for growth in developed markets across the globe. Buy, hold or sell — and why. We’ll help you build your Lifetime Wealth portfolio step by step. Online and delivered fresh to your inbox every Wednesday.

- Stock alerts — Something happening with one of our positions? Opportunity to top up or maybe time to get out? We’ll shoot that to your inbox as soon as we’ve spotted it. So you’re always in the know on the positions in your portfolio.

- Portfolio online — Our recommended portfolio at any point is sitting on your encrypted, members only site. Log in and keep track of that at any time. Compare it against your own account.

- How to Buy Global Stocks — Regularly updated and with step-by-step instruction in plain English on how to build a golden portfolio from wherever you’re based. Direct access to our preferred global brokers.

- Customer Service — Got questions? While we can’t give any personal financial advice, we’re always here to provide support. If you’ve any questions — John Ling, our Customer Service Lead, is here to help. Email [email protected] or phone +64 20 415 88515 (Mon-Fri 9am-5pm)

I have read the Terms and Conditions

This service is confidential, for members only: You will be required, as per the terms of membership, to agree to keep all recommendations to yourself. This confidentiality is important. It not only maintains the exclusivity of the Lifetime Wealth Investor service, it ensures all members have the best possible chance to buy any investments Simon recommends at the prices he states. By ordering today you are agreeing to respect this confidentiality.

This service is provided by email only: To sign up today, we need a VALID email address from you. We cannot process your order otherwise! This is so we can send you Lifetime Wealth Investor, as well as give you a login to the members area of our website.

All advice is general advice and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if you’re in doubt about the suitability of an investment.

From time to time, we may suggest a financial product provider that is optional for your use. In the event that we derive any referral fee and/or commission, such relationship is always stated clearly and upfront. Any use of third party providers is entirely at your own risk.

Calculating Your Future Returns: The value of any investment and the income derived from it can go down, as well as up. Never invest more than you can afford to lose, and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in this report are forecasts and may not be a reliable indicator of future results. Any potential gains in this letter do not include taxes, brokerage commissions, or associated fees. Investments in foreign companies involve risk and may not be suitable for all investors. Specifically, changes in the rates of exchange between currencies may cause a divergence between your nominal gain and your currency-converted gain, making it possible to lose money once your total return is adjusted for currency.

Customer Service: For any queries on Lifetime Wealth Investor, please contact [email protected]. Or phone +64 20 415 88515 (Mon-Fri 9am-5pm).

I have read the Terms and Conditions

Here you can view our Disclosure Statement — Financial Services Guide.

Lifetime Wealth Investor is published by Wealth Morning

All content is © 2020 Wealth Morning. All Rights Reserved

Wealth Morning is registered on the New Zealand Companies Office and Financial Service Providers Register: FSP596789. NZBN: 9429046548122.

Registered Office: Level 26, 188 Quay Street, Auckland, NZ, 1010.

Lifetime Wealth Investor

+64 20 415 88515