- Home / Updates Latest Alerts Portfolio How to Buy Global Stocks Global Trading Masterclass Wealth Talk Customer Service My Account

Smart Money: Which Manufacturing and Tech Picks Are We Watching Out For?

Have you changed since the onslaught of coronavirus and its lockdowns?

I spent the long weekend downcountry in Taranaki. Fresh mountain air. A welcome absence of lines of traffic and the throngs of people that make up daily life in Auckland.

Since the lockdowns, this desire to escape the big city seems stronger than ever.

Auckland used to be quite a nice city. It now operates more like an arrivals lounge with blocked corridors and few remaining places in the sun.

Source: Lonely Planet

So we looked at some land to build a holiday home around coastal Taranaki. This meets many lifestyle goals. But when you consider how much you’d need to give up from your portfolio, the equation becomes far more difficult.

The area has plenty of Airbnb offers, many of them quite gorgeous. You could build a wonderful holiday home, but there’s competition. You’d be hard-pressed to provide the sort of growth and income I see in equities. Where you invest in businesses with a future.

Of course, people like property because it is tangible. You can go stay there. And they do not see its market gyrations listed on a daily basis. Property allows more leverage. It should always stay there. Short of tsunami or volcanic eruption.

But it lacks diversification. And creates endless work. Either maintaining the place or managing those who might pay to stay there. Any business working with people of varying degrees of integrity will carry stress.

I’d rather invest in a business able to pay enough staff to manage such processes. Airbnb, whenever they’re finally ready to IPO, is on our watch list.

As for a holiday home investment? You’d be surprised how cost effective it is to rent instead of own certain types of assets. Especially those that vacate, float, or fly…

We’re still researching a good manufacturing / technology pick

There is a trend unfolding. The US (among others) are looking to diversify — actually remove — supply-chain manufacturing from China. This could bring about a change in the global economic order. Where low-cost manufacturing can no longer be a complacent driver of return.

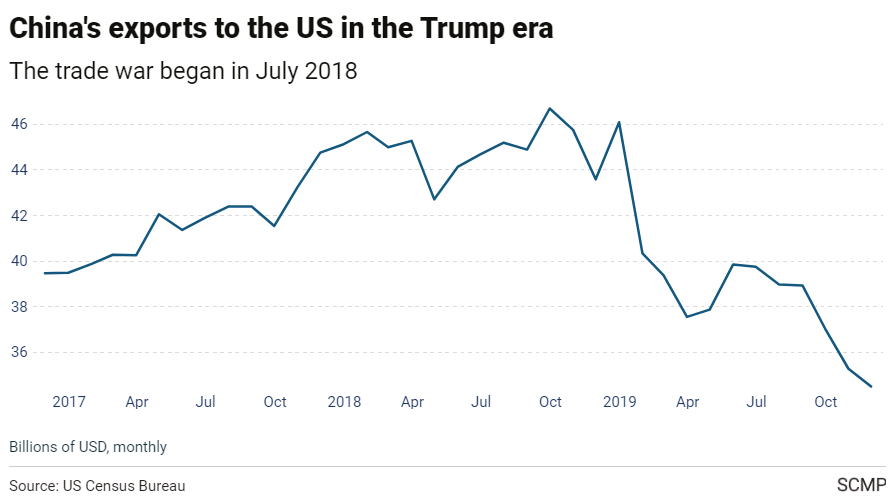

Take a look at what’s happened to Chinese manufacturing exports to the US since the trade war in 2018. Consider now how much worse relations are since the coronavirus hit. And the fact that even phase one of Trump’s deal looks ready to break.

Remember, once manufacturing moves out of China, it is hard to get it back. Tariffs of 25% or more make factories uncompetitive. They close down and lose their investment.

Now, we do not invest in China. I’m sure there’s still money to be made in some areas. But in our Lifetime Wealth approach, we must consider ownership and protection of investor capital. If the Communist Party of China can ultimately own or influence any company on a local exchange — this is not for us.

Innovative companies in the US and Europe, able to manufacture locally and drive increasing return on capital through productivity, could be an ideal investment pick.

Through my network, I came across a business — Arlo Technologies [NYSE:ARLO].

Source: Arlo.com

They make wireless security cameras that are web-enabled. Generating revenue through online subscriptions. So, if you do buy that holiday home, you could be watching it wherever you are in the world on your phone via the internet. Or making sure your dog is behaving while you’re at the mall, newly opened out of lockdown.

Arlo originally IPO’d at a hyped price of $16.

These days. it’s been struggling along around $2 to $2.50.

This is heavy erosion of value. But have investors missed something? Arlo has over 200,000 subscribers and quarterly revenue approaching $70 million. Perhaps the meat is now ready to fry?

Like many of these so called ‘turnaround opportunities’, there is much risk. You could not, hand on heart, wish to commit sufficient capital to generate massive return.

But the big disappointment for me is that Arlo really seems to lack moat. That key intrinsic part of what a business has that prevents competition.

Most of Arlo’s kit seems to be made in China. And what is to stop a Chinese pirate producing their own video cameras and selling cloud-based subscriptions online?

There might be some speculative bumps in Arlo — but right now, I’m seeing it as mutton dressed as lamb.

The real thing?

Source: John Deere

So, I started looking further afield. A US manufacturer ready to bounce on key demand drivers in agriculture. And we find John Deere [NYSE:DE] on our screener.

As they say: ‘Nothing Runs Like a Deere.’

Now, John Deere does have potential. Even if China fails to buy US agricultural produce, this business has a diversified export base for its machinery in a hungry world.

And the stock appears reasonably priced. Especially since return on equity is showing a very healthy 23%.

But the dividend of around 2% is slovenly. Long-term debt to equity at over 280% is unwelcome. And net margins of only 7.5% are relatively slender.

I’m tempted to make a recommendation here. But, right now, there’s just not enough margin of safety. I’d need to see this stock at a P/E under 12 before it really gets interesting — and that would mean a stock price about 30% lower. At the market crash low of around $106. So this is not a recommendation today, but another for our watch list.

It is hard to find a great business. Which is why we continue to like our REITs, especially Warehouse REIT [LSE:WHR] and Charter Hall Social Infrastructure [ASX:CQE]. These have provided dividend return, capital growth, and soothed on the capital preservation front with their property base.

We should have a firmer recommendation for you soon as we get a greater handle on market events. For now, we are adding a new area to our portfolio – ‘Watch List’ — to help keep track of certain companies that we like. But do not yet see investment opportunity for.

Once we do, we’ll alert you on ‘Buy Up To’ guidance.

Portfolio update

There’s an announcement from one of our companies this week.Sanofi [EPA:SAN] is due to update on its oncology strategy soon. A key growth area.

The company says it is rapidly building momentum with the execution of the oncology strategy, with several developments on both pipeline and marketed treatments.

Consensus estimates see continued growth for the stock price.

At first, we were a little disappointed to see the company exit its share in Regeneron Pharmaceuticals. Regeneron offered upside with coronavirus treatments. But, on balance, those are mostly treatments for symptoms — whereas a vaccine could eliminate the virus altogether. It appears to have been a little slow off the mark with vaccine developments.

The sale will give Sanofi some USD $11bn to further develop leadership in oncology.

Here’s our updated market guidance:

Ticker Name Business Risk Comments Entry Date Entry Price Exit Date Current Price Dividends Percent Gain LSE:CRST Crest Nicholson Holdings plc Medium Buy up to 280p 8-Jul-19, 17-Mar-20, 23-Mar-20 268.70 Open 264.00 11.20 2.4% ASX:WBC Westpac Banking Corporation Medium Buy up to A$18 6-Aug-19, 2-Mar-20, 16-Mar-20 22.11 Open 17.20 0.80 -18.6% LSE:NRR NewRiver REIT plc High Buy up to 70p 6-Aug-19, 16-Mar-20, 23-Mar-20 99.93 Open 63.10 10.80 -26.0% SGX:O39 Oversea-Chinese Banking Corp Medium Buy up to S$9.00 8-Aug-19 10.98 Open 8.89 0.25 -16.8% ASX:TGR Tassal Group Ltd Medium Buy up to A$4.00 21-Aug-19, 2-Mar-20, 10-Mar-20 3.89 Open 3.96 0.18 6.4% NYSE:GM General Motors Company High Buy up to $30 28-Aug-19, 9-Mar-20, 17-Mar-20 26.57 Open 27.55 0.76 6.5% BIT:IGD Immobiliare Grande Distribuzione High Buy up to €3.60 25-Sep-19, 10-Mar-2020, 17-Mar-2020 4.44 Open 3.38 0 -23.9% LSE:AV Aviva plc Medium Buy up to 270p 10-Oct-19, 9-Mar-20, 17-Mar-20 307.43 Open 260.90 0 -15.1% EPA:SAN Sanofi S.A. Medium Buy up to €90 14-Nov-19, 13-Mar-20 77.55 Open 88.82 3.15 18.6% NZX:GXH Green Cross Health Ltd High Buy up to $1.10 7-Jan-20, 28-Apr-20 1.12 Open 1.02 0 -8.9% TYO:7731 Nikon Corp High Buy up to ¥1000 16-Jan-20, 3-Feb-20 1335.00 Open 996.00 30 -23.1% ASX:KSL Kina Securities Ltd Speculation Buy up to A$1.20 17-Feb-20, 17-Mar-20, 23-Mar-20 0.91 Open 1.14 0.064 32.8% ASX:AVJ AVJennings Ltd High Buy up to A$0.45 2-Mar-20 0.41 Open 0.42 0.012 5.4% ASX:CQE Charter Hall Social Infrastructure REIT Medium Buy up to A$2.60 26-Mar-20 1.59 Open 2.45 0.04175 56.7% LSE:WHR Warehouse REIT Medium Buy up to 110p 27-Mar-20 87.60 Open 111.00 0 26.7% ASX:AGL AGL Energy Ltd Medium Buy up to A$18 21-Apr-20 16.83 Open 17.11 0 1.7% LSE:GGP Greatland Gold plc Speculation Position closed 8-Jul-19 1.60 12-Feb-20 5.79 0 261.9% ASX:TWE Treasury Wine Estates Ltd Medium Monitor at $8.50 Watch List 10.06 NYSE:DE Deere & Company Medium Monitor at $106 Watch List 452.96 Current as of 2 June 2020 at 10pm GMT.

It is good to see some more green across the portfolio! Our overall return delivery across both open and closed positions still averages over 15%. Despite coronavirus coming out of the blue.

Of course, we do like speculative kickers to boost growth. But, in a volatile world, we’re also looking for a mainstay of long-term growth and income. That should provide a meaningful alternative to the back-breaking work of small-time property investment. Or the financially indulgent idea of a holiday home.

Regards,

Simon Angelo

Editor, Lifetime Wealth InvestorPS: This week on our Wealth Talk podcast, we have former BNZ Chief Economist Tony Alexander. He’s going to provide critical insights on how stocks and property could perform as the world recovers from COVID-19.