- Home / Updates Latest Alerts Portfolio How to Buy Global Stocks Global Trading Masterclass Wealth Talk Customer Service My Account

Predictions for Share and Property Markets: How to Position Yourself for Opportunity

I’m excited. For the first time in a month, I can drive down to my neighbourhood restaurant and pick up a couple of gourmet pizzas for the family. Contactless, of course.

Source: TripAdvisor

I’m also supporting a local business. A business that has always been there for us. And when one of their umbrellas blew on to my car on a windy day, they covered the panel beating without fuss.

It’s this reopening of businesses and supporting of businesses around the world that is starting to refuel the stock markets.

Time to buy? Top-up? Will there be any further discounting before you do so?

One of the most fearful analyses that come through my monitoring is the view that all this is a ‘fake rally’.

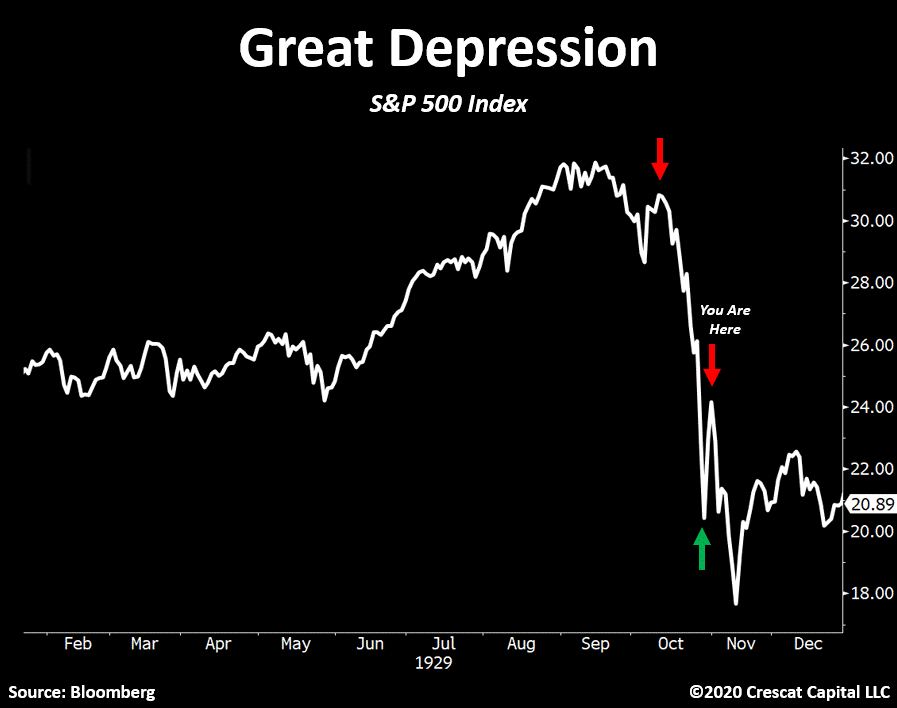

1929 Great Depression Bull Trap

So, here’s what happened during the Great Depression. In 1929, the stock market (S&P 500) initially fell 34%. Then the market surged more than 18%.

It’s similar to what we’re seeing in 2020. Around 23rd March, we saw a drop during the Corona Crash. And between 23rd March and today, the S&P has surged back.

But the dark comparison is this.

Following the ‘dead cat bounce’ in 1929, the market fell a further 26%. It then took years to recover.

Analysts see an eerie resemblance.

The coronavirus pandemic has caused two crises. A health crisis. And an economic one. The economic crisis is still playing out.

The trouble with ‘bull trap’ predictions is that they’re often produced by fear vampires looking to get eyeballs on their stories. It’s important to make a careful examination of the facts.

Emerging from lockdowns around the world, here is what we’re seeing:

- In March, US unemployment rocketed up 0.9% to 4.4%. The largest monthly increase since January 1975, amidst the oil shock. The last time unemployment peaked in the US was during the GFC, when it hit 9.9%.

- Based on increases in jobseeker allowance being sought, the New Zealand unemployment rate could now be around 6.5%. It peaked at 6.7% during the GFC.

- Lay-offs are likely to continue for some time. In a small tourism-magnified economy like New Zealand, unemployment could reach 11%.

- During the GFC, New Zealand house prices fell 7-8%. Given unemployment could be 60% higher this time — we could see property price impact more in the range of 11-14%.

- More diversified economies such as the US may see a resurgence in domestic consumption as lockdowns lift. We expect a push to move more manufacturing back home. And potential further fuel for developed market resurgence as consumers and investors play catch-up.

- We also have an oil shock. Unlike the 1970s where the oil price increased some six-fold, this shock is different. The oil price has fallen through the floor. And while that pulls down large oil companies, lower transport costs may assist consumers and other businesses to recover post-lockdown.

- Large-scale monetary and fiscal stimulus from governments should continue to support asset prices as the money supply itself burgeons.

On balance, there’s recessionary impact on the horizon. No doubt. But this not a decade depression in the making. It is an emergency event — to which we’re applying relief and economic reset.

Modern digital economies may reboot faster than many expect.

How markets work

Share markets ultimately price the earnings outlook for listed businesses. But, in the short-run, they are prone to swings based on the emotions of fear and greed.

Around March 23rd, we saw panic-selling driven by fear. Stocks were oversold beyond the risk event.

Since then, markets have played catch-up.

We’re now trying to assess the earnings impact on businesses over the next 12 months.

Clearly, travel, retail, aviation, impacted property REITs and so forth are going to be missing earnings targets in lockdown months by a long shot.

Yet certain pharma, food supply or tech businesses may be unaffected or even enjoy extra growth.

We are looking at a period of rebuilding. This could accelerate as pent-up demand starts to release and economic stimulus flows into economies coming out of lockdown.

As two friends of mine — both professionals working in essential industries — put it, ‘We haven’t been able to spend any money over the past month. So we’ve been saving more than ever. We’re looking forward to things opening again!’

Recessions impact people very differently.

Stock markets are starting to wake up to the fact that this may be an opportunity. To buy low prices now on earnings-risk discount, with a view to locking in gains in 2021-22.

Again, for those willing to take the risks, we see stock market investing through such periods as one of the most efficient ways to build net worth.

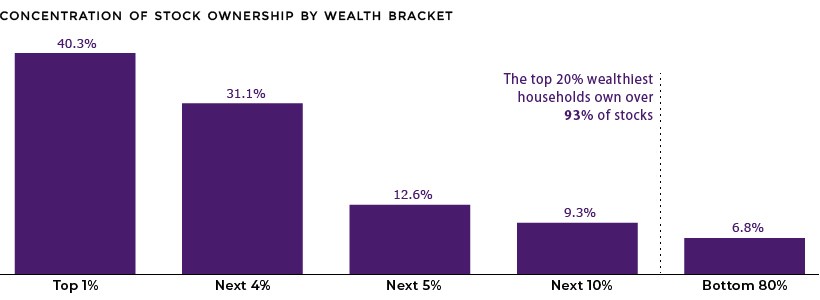

In the US, the top 20% of households own 93% of stocks:

This coronavirus epidemic is likely to exacerbate this wealth divide further. As risk-takers take the spoils of fortune, while mere survivors will own even less a stake in their economies.

The property market

We don’t usually spend a lot of time on physical property markets, since we generally prefer to capture them via property-owning stocks. Especially REITs.

Yet, it’s useful to note that illiquid markets work quite differently.

The share market prices earnings over the long-run — swinging between fear and greed — and that cycle creating value opportunities.

The property market comes down to specific situations caught up in wider market sentiment.

We’re moving into an unusual environment. Most property owners should be OK; some supported by six-month mortgage holidays.

The usual sale reasons of death, divorce, and default (with the bank) will continue. But the latter two may be higher in an unemployment-hit post-corona economy.

I bought my first home in Auckland in 2000. That was a specific and favourable market situation. The vendors were overseas. The road was a main highway. The house was old and needed work. There appeared to be a break in the usual overrun of migration numbers.

What most prospective buyers missed was that the eventual move toward a Western Ring route and tunnel across Auckland would reduce traffic on this road to no end. My offer got accepted. And a week later, someone tried to buy the contract from me for $10,000.

There may be more of these types of situations in the post-corona property market, as people need to get out. And fearful prospects miss the long-run trends.

But we should also keep in mind that yields and median income levels have failed to support Auckland property prices for a long time. And without mass migration or near-full employment, very different dynamics may be at play.

In that case, stock markets could offer more upside as lockdown releases fuel earnings.

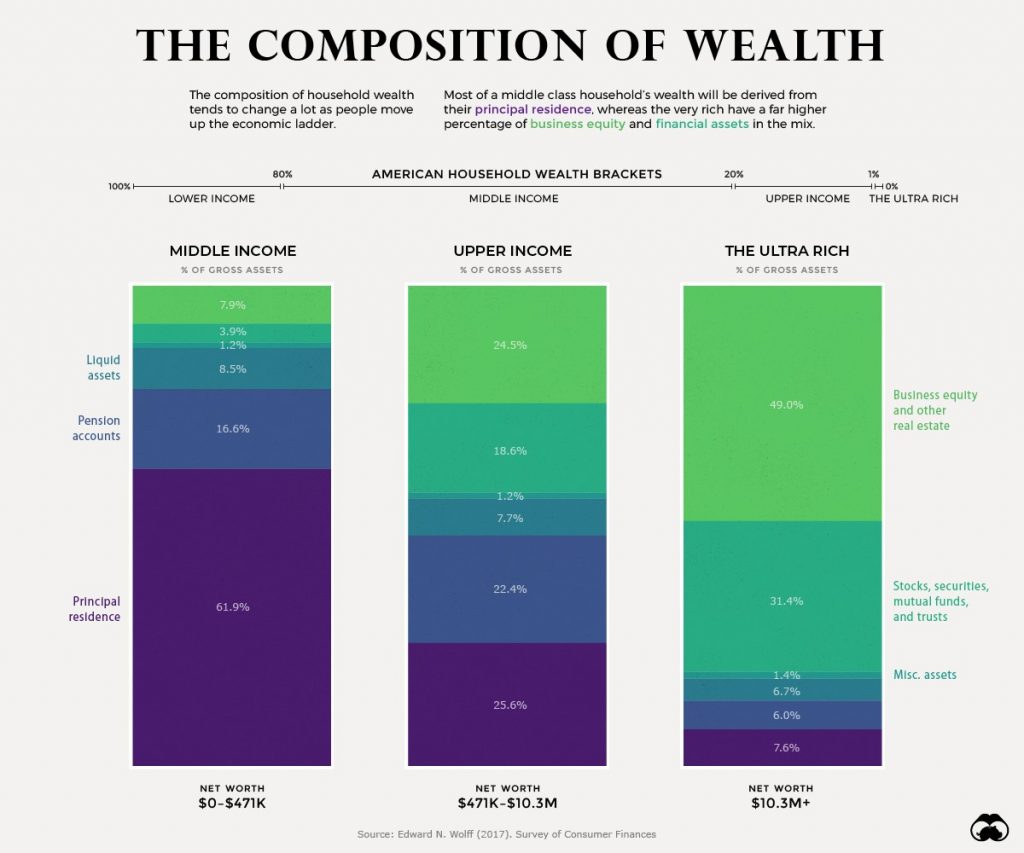

This useful graphic from Visual Capitalist shows how individuals with various levels of net worth tend to allocate their wealth.

Here are some updates on our current portfolio:

Portfolio update

Westpac Bank [ASX:WBC] has announced likely impairment from coronavirus conditions of about A$1.6 billion. On top of other write-offs and provisions, this takes the total impairment charge for 1H20 to $2.2 billion.

Add in the previous AUSTAC costs and provisions, and we’re looking at reductions of around $3.6 billion off the first-half-year financials.

The market reacted with a gentle nudge upward in Westpac’s share price yesterday. This happened when the bank mentioned that it had a solid cash buffer to withstand this. And that its regulated common equity tier 1 (CET1) ratio will be at 10.8 per cent. ‘Right where the Australian Prudential Regulation Authority expects banks to be.’

As the bank also recently raised $2.8 billion in share placement capital, the CEO Peter King reiterated that capital provisions ought to be sufficient to ride out the crisis:

‘Having materially strengthened capital over the last decade, building significant buffers, we are well positioned to absorb this increase and respond to future developments in the environment.’

Westpac will announce earnings and a decision on the dividend on May 4.

AGL Energy [ASX:AGL] appears to be continuing with daily share buy-backs, returning value to shareholders. For now, the business continues to show strong return on capital employed. Though continued earnings upside is at the risk of falling demand from lockdowns.

General Motors [NYSE:GM] is feeling the pain of a coronavirus lockout on auto sales. It announced suspending of the quarterly dividend and share buy-backs to preserve cash.

The share price has got hammered. But the business is doing what we like to see through such storms — seeking to protect its balance sheet to capitalise on better times.

GM Chief Financial Officer Dhivya Suryadevara says:

‘Fortifying our cash position and strengthening our balance sheet will position the company to create value for all our stakeholders through this cycle.’

Here is our updated market guidance:

Ticker Name Business Risk Comments Entry Date Entry Price Exit Date Current Price Dividends Percent Gain LSE:CRST Crest Nicholson Holdings plc Medium Buy up to 270p 8-Jul-19, 17-Mar-20, 23-Mar-20 268.70 Open 261.20 11.20 1.4% ASX:WBC Westpac Banking Corporation Medium Buy up to A$16 6-Aug-19, 2-Mar-20, 16-Mar-20 22.11 Open 14.92 0.80 -28.9% LSE:NRR NewRiver REIT plc High Buy up to 70p 6-Aug-19, 16-Mar-20, 23-Mar-20 99.93 Open 62.40 10.80 -26.7% SGX:O39 Oversea-Chinese Banking Corp Medium Buy up to S$9.00 8-Aug-19 10.98 Open 8.84 0.25 -17.2% ASX:TGR Tassal Group Ltd Medium Buy up to A$4.00 21-Aug-19, 2-Mar-20, 10-Mar-20 3.89 Open 3.72 0.18 0.3% NYSE:GM General Motors Company Medium Buy up to $23 28-Aug-19, 9-Mar-20, 17-Mar-20 26.57 Open 22.18 0.76 -13.7% BIT:IGD Immobiliare Grande Distribuzione High Buy up to €4.00 25-Sep-19, 10-Mar-2020, 17-Mar-2020 4.44 Open 3.57 0 -19.7% LSE:AV Aviva plc Medium Buy up to 260p 10-Oct-19, 9-Mar-20, 17-Mar-20 307.43 Open 249.50 0 -18.8% EPA:SAN Sanofi S.A. Medium Buy up to €90 14-Nov-19, 13-Mar-20 77.55 Open 92.19 0 18.9% NZX:GXH Green Cross Health Ltd High Buy up to $1.10 7-Jan-20, 28-Apr-20 1.12 Open 1.05 0 -6.3% TYO:7731 Nikon Corp High Buy up to ¥1000 16-Jan-20, 3-Feb-20 1335.00 Open 979.00 30 -24.4% ASX:KSL Kina Securities Ltd Speculation Buy up to A$0.90 17-Feb-20, 17-Mar-20, 23-Mar-20 0.91 Open 0.83 0.064 -1.4% ASX:AVJ AVJennings Ltd Medium Buy up to A$0.38 2-Mar-20 0.50 Open 0.32 0.012 -33.6% ASX:CQE Charter Hall Social Infrastructure REIT Medium Buy up to A$2.40 26-Mar-20 1.59 Open 2.29 0.04175 46.7% LSE:WHR Warehouse REIT Medium Buy up to 100p 27-Mar-20 87.60 Open 97.80 0 11.6% ASX:AGL AGL Energy Ltd Medium Buy up to A$18 21-Apr-20 16.83 Open 17.09 0 1.5% LSE:GGP Greatland Gold plc Speculation Position closed 8-Jul-19 1.60 12-Feb-20 5.79 0 261.9% Current as of 28 April 2020 at 10pm GMT.

As you’re seeing, we’re still in an environment of heightened risk. We’re investing for 2021, 2022, and beyond — when pent-up demand and stimulus could see economies on heat again.

When you’re looking that far ahead, things become even less certain. That’s why we’re also favouring those who can protect their balance sheets.

Right now, small gains are big wins. The ability to go out, pick up a good pizza, and enjoy it with a glass of wine has never felt better. Absence makes the heart grow fonder.

A starved market can get hungry again real fast.

We’ll have more recommendations for these most unusual times along soon.

Regards,

Simon Angelo

Editor, Lifetime Wealth Investor