- Home / Updates Latest Alerts Portfolio How to Buy Global Stocks Global Trading Masterclass Wealth Talk Customer Service My Account

Our New Stock Pick: Why It’s Time to Buy Infrastructure

In 2009, I got involved in a start-up that won a UK business award.

We were to be flown business class to London. First class train to Cardiff. And an awards dinner at the best hotel in town.

Then the UK government’s austerity measures kicked in, following the Global Financial Crisis. For a month, it seemed like all promises were off. There would be no trip at all. No awards this year.

Finally, at the last minute, they cobbled things together. The ticket from Auckland to London was economy. And the awards dinner turned out to be a tray of Sainsbury sandwiches shared beside the coffee machine in the office lunch room.

But the trip was inspiring. And we did finally end up collecting our award at the Welsh Assembly Parliament.

Accepting our business awards at the Welsh Parliament, Cardiff. Source: Author

In part, it was this trip — the trip that nearly didn’t happen — that led to me moving to Europe five years later.

We are all on a journey. In life. In business. And, of course, in investing.

A small decision — or even a slight change of course — can have life-changing consequences.

Which is why, today, I’m moving one of our Watch List candidates to our active portfolio.

But first — the reason for this.

A subtle but powerful change in risk sentiment

When the world’s most powerful asset-management firms talk, I listen. Every day, they’re managing hundreds of billions of dollars. From mum-and-dad pensions through to institutional mega pots.

Sometimes their sheer size makes it difficult for them to exploit opportunities — but they can still sway the market. How these companies will deploy cash over the next six months will help decide the fate of the market.

UBS is among the largest, running over USD $600 billion. They have over 7,000 wealth managers in the US alone.

At the higher end of money management is their Private Wealth arm. Here’s what Julie Fox, MD at the newly formed Mid-Atlantic Private Wealth Management hub of UBS, had to say. On current market conditions:

‘We think earnings are likely to recover in the second half of the year and excess liquidity will continue to support risk assets…We see further potential in global equities and think there’s some upside in segments of the market that have underperformed during the crisis.’

Other major fund managers seem to echo her sentiment. Seeing ‘multi-year recovery’, alluding to government and central bank cash flood measures. Though admitting there will be ‘wobbles along the way.’

I tend to agree with this risk sentiment. Things have not been as bad as the mid-March lockdown sell-off signalled. Even without a vaccine, we are learning to live and trade through coronavirus.

By definition, some of the biggest gains will come not from the companies that have withstood lockdowns. But rather those who have suffered, some to the very brink of their existence.

Which is why I’m moving Stobart Group [LSE:STOB] from our Watch List to our portfolio monitoring.

Stobart Group Ltd

Stobart is an infrastructure group focused on aviation, energy, and civil engineering.

It has had a string of bad luck.

First there were boardroom battles which saw CEO (and substantial shareholder) Andrew Tinkler leave the role.

Then Flybe went into administration — an airline in which Stobart had invested a key stake. This led to a £50m write-off.

Coronavirus also hit their key asset — London Southend Airport. easyJet [LSE:EZJ] announced they were closing up their base at the airport.

It could have been worse. But, recently, Ryanair seems to have stepped into the breach, making up flights lost by easyJet.

Last month, the company went to the market to raise more funds. I read the prospectus in some detail, noting that without capital funding the business could go into administration.

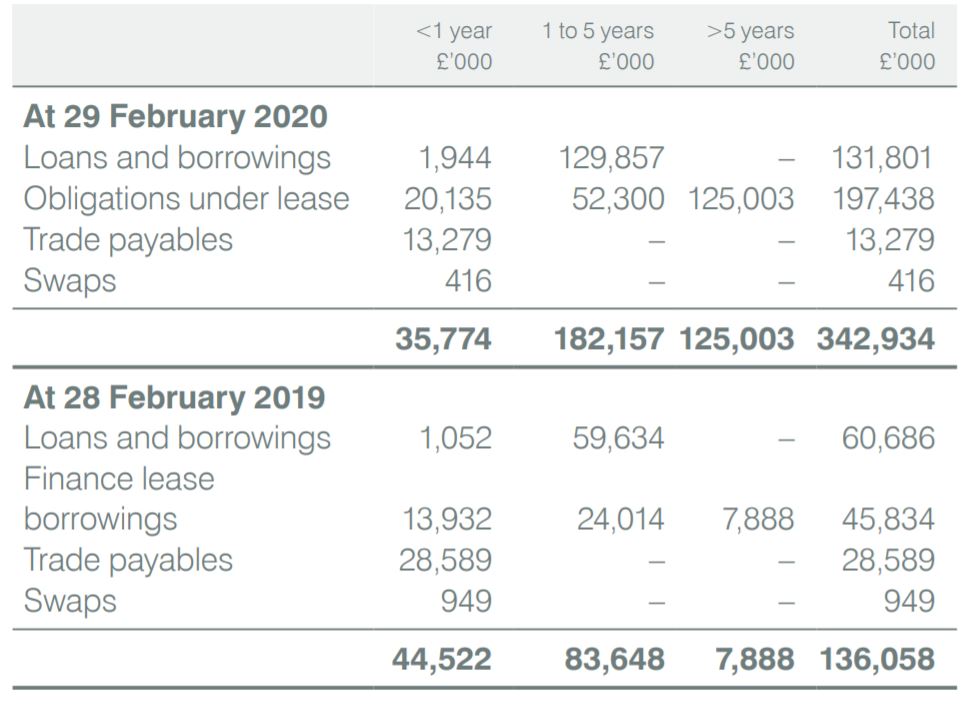

The key problem for Stobart is the increased debt load it’s carrying:

Source: Stobart Group 2020 Annual Report

In particular, about £180m due over the next five years.

But despite all this, here’s the potential we see for Stobart:

- Southend Airport remains a very valuable asset. Before coronavirus, it was ranked one of the UK’s top airports and showed steady, profitable growth.

- Before coronavirus, the company had received an offer of £200m for a 25% stake in the airport. Note — Stobart’s entire market cap currently sits at just £192m!

- Although the retail capital raise was only around 56% completed, by my estimations. the company now has another £150m to add to the coffers — assuming the institutional placement has been fully transacted.

- The company is looking to clear its rail and civil divisions. And potentially other non-core businesses, allowing for a focus on aviation. Positioning for its rebound.

- Toscafund — a large UK fund manager — has increased their stake to 28% of the business (versus a prior stake of 23%) as part of the capital raise.

- Internal directors have taken up individual allocations increasing their ownership in the business. In the case of Non-Exec Chairman David Shearer, he added £125k worth of stock, paying 40p per share. This boosted his holding by 313%.

- Stobart right now could be an opportunity to own a piece of Southend Airport at a hefty discount and benefit when travel regenerates.

Of course, a business in such an uncertain environment, carrying a heavy debt load (around 173% debt-to-equity) is limping through. There is the risk that it may not make it. But there is also the opportunity on the other side. A major UK airport alongside other infrastructure businesses ready to boom.

It was only a few years ago that Stobart traded above 200p and paid out dividends of 5%+.

But again, to remind you, this is a distressed business. Its lifeline has been the recent capital raise which they managed to get away at 40p per share.

In my view, it remains a very speculative investment which could take a year or more to bear fruit. Providing the tree itself survives.

The main risk I see is another lockdown or series of heavy travel restrictions. This could be too much for this company.

But, at today’s price of around 30p, the comeback chance is also impossible to ignore. As is the latent value in that airport.

Remember, this is a speculative pick in the form of a troubled business with turnaround potential. If you have a large portfolio base, you can afford more risk. For those starting from smaller bases, less so.

Recommendation for Lifetime Wealth Investors:Within the speculative allocation of your portfolio, buy LSE:STOB up to 30p

If Stobart is looking too risky for you — you may like to take a look at Auckland International Airport [NZX:AIA]. AIA currently trades at a similar P/B (price to book) ratio of 1.2, signalling value in coronavirus-hit assets with longer-term potential.

Though we are not commencing coverage on AIA here. The current price — while somewhat attractive — may not offer sufficient growth for this strategy. Especially since dividends are looking suspended for some time.

Currency analysis

On another note, the change in the risk sentiment presents some opportunity to buy currencies at soft prices. In particular the new six-week lockdown in Melbourne has hammered AUD.

GBP has also softened as a growing uncertain Brexit on top of coronavirus weighs on the risk premium.

Recommendation for Lifetime Wealth Investors:

Buy AUD.NZD at or around 1.06

Buy AUD.USD at or around 0.69Buy GBP.NZD at or below 1.92

Buy GBP.USD at or below 1.25Portfolio update

Anglo Asian Mining [LSE:AAZ] has seen welcome boost. The company previously announced that their production target of 100,000 ounces is now in sight. Though the scale of increase and timing of production is dependent on exploration results.

Crest Nicholson [LSE:CRST] saw some more insider purchases. Group Finance Director Duncan Cooper took advantage of the downturn to buy 5,000 shares at around 211p last week — it appears through his wife.

He previously bought 5,000 shares at around 197p on 3rd July.

Peter Truscott (CEO) bought 90,000 at around 201p on 2nd July.

As always, we like to see insiders ‘eating their own cooking’.

NewRiver REIT [LSE:NRR] also made some pleasing post-lockdown announcements:

‘Across our retail portfolio, 81% of occupiers by gross income are now open. This figure will increase as lockdown restrictions are eased further across the UK, and as occupiers progress their phased store reopening plans.

‘Of the total quarterly rent due on 24 June 2020, 71% has either been collected or had alternative payment terms agreed with occupiers.’

Thus far, the share price has not seen meaningful uplift on this news. I guess the market wants to see more rent collected and a path for dividends to safely return.

Warehouse REIT [LSE:WHR] announced a successful capital raise. Share commitments generated £153m for new acquisitions.

Neil Kirton, Chairman of Warehouse REIT, commented:

‘The result of this equity raise, ahead of our original £100 million March target, is a strong endorsement of our strategy. We are extremely grateful to both the new UK and global investors and existing shareholders who share our vision for the REIT, support which was clearly reflected in the upsized Firm Placing. Demand for warehouse space in strong locations across the UK shows little sign of slowing down, and our focus now is to execute on our near-term pipeline of accretive acquisitions with firepower well in excess of £200 million, leveraging management’s deep sector expertise.’

Kina Securities [ASX:KSL] divested their Esiloans portfolio to Nationwide Microbank. The transaction appears in line with their strategic partnership.

Here’s our latest portfolio and guidance:

Ticker Name Business Risk Comments Entry Date Entry Price Exit Date Current Price Dividends Percent Gain LSE:CRST Crest Nicholson Holdings plc Medium Buy up to 220p 8-Jul-19, 17-Mar-20, 23-Mar-20 268.70 Open 211.80 11.20 -17.0% ASX:WBC Westpac Banking Corporation Medium Buy up to A$19 6-Aug-19, 2-Mar-20, 16-Mar-20 22.11 Open 17.83 0.80 -15.7% LSE:NRR NewRiver REIT plc High Buy up to 70p 6-Aug-19, 16-Mar-20, 23-Mar-20 99.93 Open 61.50 10.80 -27.6% SGX:O39 Oversea-Chinese Banking Corp Medium Buy up to S$10.00 8-Aug-19 10.98 Open 9.16 0.25 -14.3% ASX:TGR Tassal Group Ltd Medium Buy up to A$3.80 21-Aug-19, 2-Mar-20, 10-Mar-20 3.89 Open 3.62 0.18 -2.3% NYSE:GM General Motors Company High Buy up to $27 28-Aug-19, 9-Mar-20, 17-Mar-20 26.57 Open 25.64 0.76 -0.7% BIT:IGD Immobiliare Grande Distribuzione High Buy up to €3.70 25-Sep-19, 10-Mar-2020, 17-Mar-2020 4.44 Open 3.53 0 -20.6% LSE:AV Aviva plc Medium Buy up to 300p 10-Oct-19, 9-Mar-20, 17-Mar-20 307.43 Open 289.30 0 -5.9% NZX:GXH Green Cross Health Ltd High Buy up to $1.10 7-Jan-20, 28-Apr-20 1.12 Open 1.03 0 -8.0% TYO:7731 Nikon Corp High Buy up to ¥1000 16-Jan-20, 3-Feb-20 1335.00 Open 907.00 30 -29.8% ASX:KSL Kina Securities Ltd Speculation Buy up to A$1.10 17-Feb-20, 17-Mar-20, 23-Mar-20 0.91 Open 1.03 0.064 20.7% ASX:AVJ AVJennings Ltd High Buy up to A$0.55 2-Mar-20,28-Apr-20 0.41 Open 0.52 0.012 29.8% ASX:CQE Charter Hall Social Infrastructure REIT Medium Buy up to A$2.60 26-Mar-20 1.59 Open 2.26 0.0765 46.9% LSE:WHR Warehouse REIT Medium Buy up to 115p 27-Mar-20 87.60 Open 109.50 1.6 26.8% ASX:AGL AGL Energy Ltd Medium Buy up to A$19 21-Apr-20 16.83 Open 17.30 0 2.8% LSE:AAZ Anglo Asian Mining plc Speculation Buy up to 150p 18-Jun-20 125.70 Open 150.00 4.5 22.9% LSE:STOB Stobart Group Ltd Speculation Buy up to 30p 14-Jul-20 28.35 Open 28.60 0 0.9% LSE:GGP Greatland Gold plc Speculation Position closed 8-Jul-19 1.60 12-Feb-20 5.79 0 261.9% EPA:SAN Sanofi S.A. Medium Position Closed 14-Nov-19, 13-Mar-20 77.55 22-Jun-20 94.55 3.15 26.0% ASX:TWE Treasury Wine Estates Ltd Medium Monitor at $10 Watch List 11.40 NYSE:DE Deere & Company Medium Monitor at $130 Watch List 169.56 Current as of 14 July 2020 at 10pm GMT.

Well, last time there was a major financial crisis, my business-class ticket was promptly downgraded to economy.

It’s that sort of time again.

We are flying economy through a thunderstorm.

But the destination is looking pretty sunny. It’s time to order a drink, select some films, and enjoy an upward ride.

Regards,

Simon Angelo

Editor, Lifetime Wealth InvestorImportant disclosures

Simon Angelo owns shares in Stobart Group [LSE:STOB] and Auckland International Airport [NZX:AIA].