CONFIDENTIAL TO MEMBERS ONLY

This is your guide on how to buy global stocks. It follows the same procedures we use in our own portfolios.

Whenever there is a material change, or a more appropriate option available, we will update this page. Please do not hesitate to send us your questions to assist in updating this section.

Let’s take it step by step.

(1)Get a Broker

Setting Up a Global Brokerage Account

By Simon Angelo

When I bought my first shares at the age of 17, you had to go see a stockbroker. He had a wood-panelled office in the centre of town. And he’d discuss the stocks you intended to buy. Then he’d submit your order. Some weeks later, you’d receive an elaborate share certificate in the mail with the company crest atop.

Boy, have things changed.

Now brokerage is electronic and online. Share certificates are fast becoming a thing of the past. The global norm seems to be holding shares through a nominee arrangement.

That means you don’t physically own the shares yourself. The brokerage holds them on your behalf as a ‘nominee’.

So, when you look at the largest holders of shares in the biggest companies, you’ll often see names like ‘HSBC Nominees’.

Doesn’t mean HSBC is owning those shares. It means it’s holding them for numerous clients as a nominee.

Is it safe?

Well, under FINRA (US Financial Regulatory Authority) rules, brokers must segregate client assets in separate accounts. This means your shares held in custody by your broker can’t be mixed in with their own business and trading accounts.

But I look for further protection.

In particular, external compensation arrangements should a broker or financial institution go into liquidation.

Source: SIPC

SIPC — the Securities Investor Protection Corporation is a federally mandated corporation that provides a further degree of protection to investors using their members.

According to their website:

‘SIPC protects against the loss of cash and securities — such as stocks and bonds — held by a customer at a financially-troubled SIPC-member brokerage firm. The limit of SIPC protection is $500,000, which includes a $250,000 limit for cash. Most customers of failed brokerage firms are protected when assets are missing from customer accounts.

‘There is no requirement that a customer reside in or be a citizen of the United States. A non-U.S. citizen with an account at a brokerage firm that is a member of SIPC is treated the same as a resident or citizen of the United States with an account at a SIPC member brokerage firm.’

You should therefore select a broker that is a SIPC member. Or, in the UK, part of the FSCS (Financial Services Compensation Scheme). You can learn more about SIPC here, and FSCS here.

Many brokers based in other jurisdictions have no external protection. In those cases, I require direct ownership of the stocks with my name/trust on the register.

Brokerage size and locations

Beyond this, I look at the broker themselves. In particular:

- Sizable operation with no debt, providing a robust business.

- Multiple headquarters around the world. If New York is down, Sydney or Hong Kong can provide me access to my account.

- High levels of staff engagement, preferably invested in the business.

- A positive financial rating and outlook from the global ratings agencies.

- A long history of successful operation, preferably with minimal regulatory breaches.

- A low-cost, online brokerage available wherever I am in the world.

One brokerage that may fit these requirements is Interactive Brokers LLC.

Interactive Brokers (IB) was founded in 1978 by Thomas Peterffy. Today, it holds total client assets in excess of $128 billion in 598,000 individual client accounts.

They cover 125 markets, 31 countries, and 24 currencies. They operate the largest electronic trading platform in the US by number of daily average trades.

The company has $7.2 billion in equity capital and is substantially owned by its employees. In 2018, of their 1,413 employees, 1,369 owned company stock.

The company also leases offices in Chicago, Washington, West Palm Beach, Montreal, Vancouver, Boston, San Francisco, Secaucus, Zug, London, Tallinn, Budapest, St Petersburg, Vaduz, Mumbai, Hong Kong, Shanghai, Sydney, and Tokyo.

More than half of the company’s customers reside outside the United States — in approximately 200 countries.

But don’t take my word for them. Do your own research. A good start is by downloading their Annual Report.

And you can check their SIPC membership here.

Compare them to other local and global brokerages.

Note: we take no commissions or payments from suggested providers. Any use of brokers or other third parties is at your own risk.

(2) Setup Trading Desk

Setting Up Your Trader Workstation

Source: Interactive Brokers

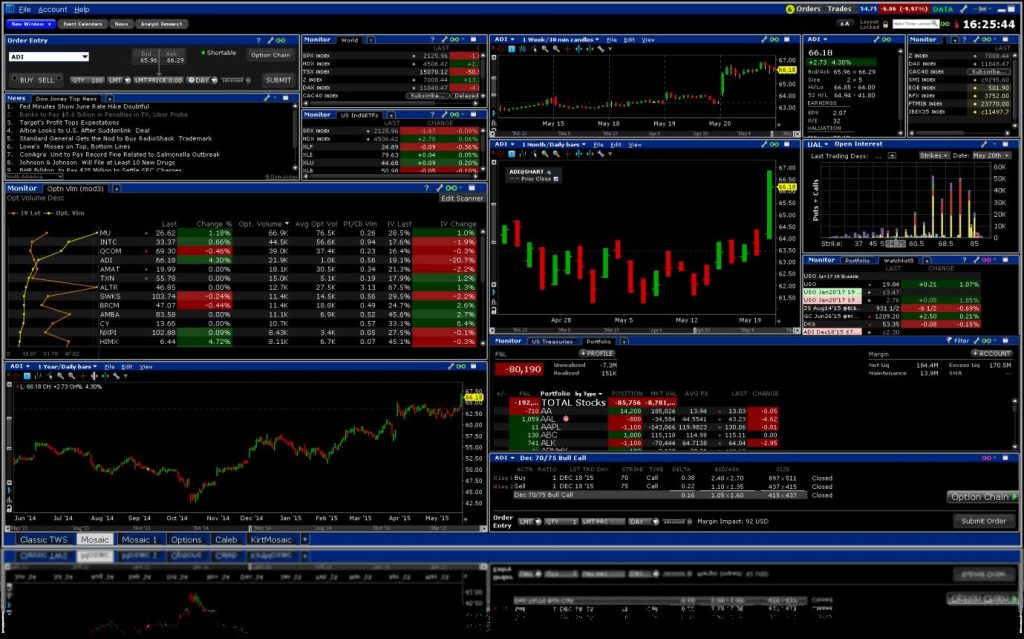

Interactive Brokers (IB) — or whichever brokerage you elect to use — will provide a ‘trading desk’ online. This is essentially a piece of software that provides you their global trading platform on your computer.

These workstations can take time to learn. I recommend running a ‘paper account’ for a while first to fully learn the system.

With a paper account, you can place orders for stocks and trade forex without using any of your own real money!

Once you’re 100% fluent and comfortable with the workstation, then you can start placing some real orders.

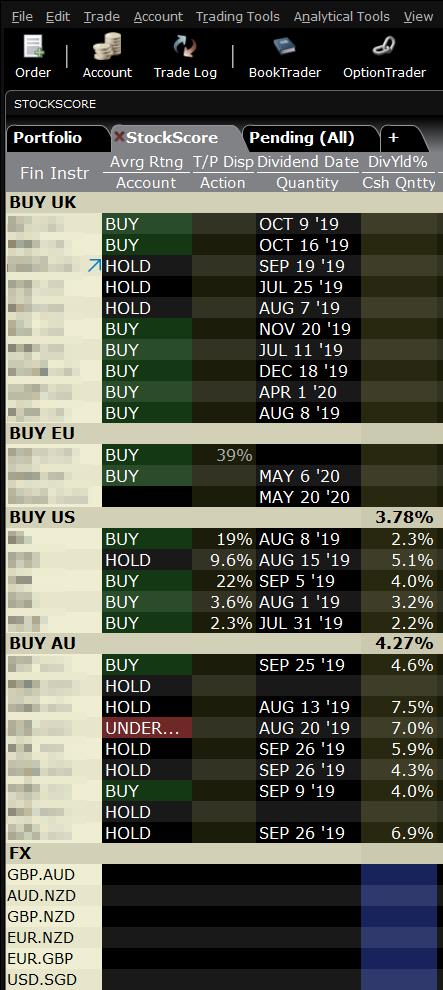

Configuring Your Trading Desk I recommend entering a watch list of stocks and currencies, separated by country. And then a separate area for forex pairs. To find a stock, you’ll simply enter the ticker and then select the exchange. For example, Rio Tinto is ‘RIO’ on the LSE and ASX — [LSE:RIO] or [ASX:RIO]. To load a currency, you’ll enter it as a pair. For example, USD.AUD or GBP.NZD. To buy GBP with NZD, you’d submit a Buy order. To sell USD for AUD, you’d submit a Sell order. Then add some statistical columns of interest. For example, if you’re an income investor, you may like to monitor dividend yields and the date the next dividend will be paid. So you’ll end up with a workstation starting something like on the right… 👉 Learning more Of course, the best way to get into things and configure a desk to suit your own needs is to practise with the ‘paper account’ option first. As for training, a good place to start is with one of the many videos. For IB Trader Workstation, we recommend this one: |

Source: Interactive Brokers |

Source: Interactive Brokers

(3) Place an Order

Placing Your First Order

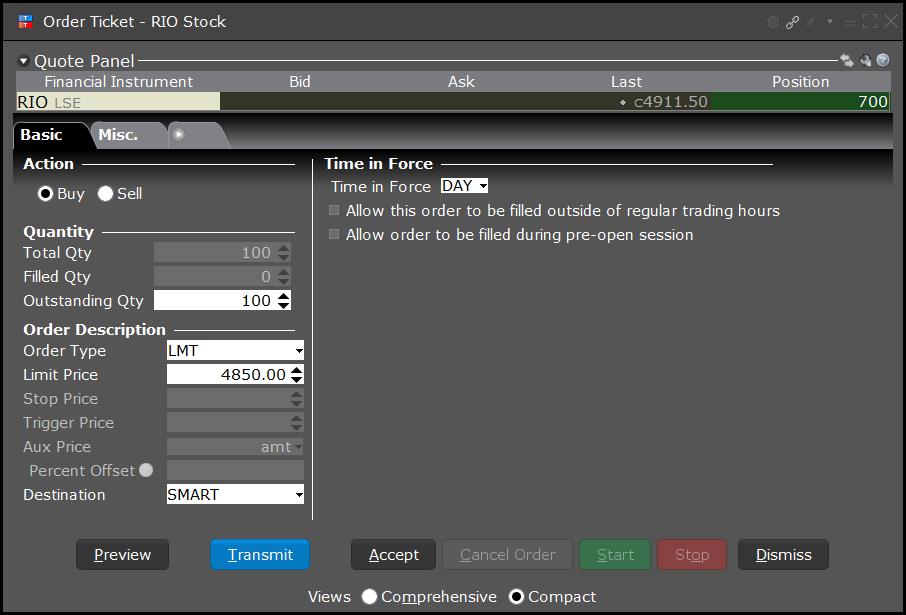

The main type of order we recommend in our strategy is a Limit Order (LMT).

With a Limit Order, you enter the price at which you wish to purchase an instrument.

For example, the current (market price) of Rio Tinto [LSE:RIO] might be 4900 GBX.

Assuming there is some evidence that throughout the trading day it could soften, you might enter a Limit Order of 4850 GBX.

Source: Interactive Brokers

A good strategy is to review the pattern over the past several days and month. Get a feel for the trading pattern from opening price. And keep your eye on any news tickers and upcoming events.

For example, if the stock has just gone ex-dividend, we may expect it to fall a bit — since you won’t get the next dividend when buying at this time.

If a bonus dividend or buyback has just been announced, it could lift.

Then you should review the market depth. This shows you the number of buyers (Bid) and sellers (Ask) in the market. Look out for any large bids or recently filled orders.

For example, in the stats below we can see a buyer traded £30m at 4911.50.

Source: hl.co.uk

When setting your Limit Orders, you need to process all this information and enter the most strategic limit you think suitable.

The more you trade, the more your judgment will refine and grow.

Of course, Limit Orders will sometimes mean you miss out on a trade that day altogether. But when buying stocks, it’s important to remember — you make money when you buy.

Forex

If you’re buying stocks in a foreign currency, you need to consider the impact of foreign exchange. Ideally, you want to be entering markets with currency upside against your account currency.

For example, if GBP is soft against your currency, it may be a good time to buy GBP and stocks on the LSE (London Stock Exchange).

With a cash brokerage account, you will first need to purchase the forex in order to place orders for stocks in that currency.

Again, use a lower limit order, observe the spread between Bid (buyers) and Ask (sellers) and study the expectations for the currency pair.

Risks

Remember, with any online trading there are user and market risks.

- Software risk: trading platform is temporarily unavailable during updates or maintenance

- Risk of error: entering incorrect orders or amounts

- Risk of loss: stock or currency movements go against you

- Risk of limit orders not being filled

(4) FAQ

Frequently Asked Questions

We’re building a page of the most commonly asked questions.

Please submit any queries you may have to [email protected]