- Home / Updates

Latest Alerts

Portfolio Global Trading Masterclass Wealth Talk

Forget the Trade War: Here’s What You Can Buy

August 7, 2019

The escalation of the trade war with China by Donald Trump was sudden and unexpected. Stocks have experienced a sell-off. After six months on a rising trend, we’re on shaky ground again.

Certain large asset managers are already shorting producers of industrial commodities. A sign that a rapid production slowdown in China is fast becoming a reality.

Unfortunately, the New Zealand and Australian export economies are stuck hazardously in the middle.

In an environment such as this, you need some patience to ride the storm, the ability to profit from corrections, and the opportunity to earn some income along the way. So a parry tactic might be needed.

Parry? It means to ward off an impending blow.

I’ve been involved in the sport of fencing on and off over the past few years. Partly because it’s in my background. An ancestor on my father’s side was instrumental in formulating the sport. It’s more popular in Europe. And an Olympic event.

Fencing parry: Jérémy Cadot (on left) parries an attack from Andrea Baldini during

the final of the Challenge international de Paris. Source: WikipediaAnyway, when I fenced in Europe, one memorable and effective fencer was a gentleman well into his 60s. He’d allow you to spend most of the round trying to attack him, while he’d parry most of your lunges. Then, as your energy waned, he’d come in for his hits and systematically get them in one after another.

Today, I’m looking at a couple of stocks that could add this sort of defensive strategy to our portfolio.

Charlie Munger — Warren Buffet’s offsider — once quipped that the secret to a long and happy marriage is to look for someone with low expectations. The 95-year-old billionaire’s second marriage endured 54 years until Nancy Munger’s death in 2010.

Well, you could say the market has had low expectations lately of these stocks:

Idea 1: Large-cap, income with possible growth

Some time ago, I came across a gentleman with a sizeable term deposit in Westpac Bank [ASX:WBC]. It paid around 3.4% per annum.

Westpac common stock currently pays an annual dividend of 6.52%. Analyst valuations suggest the share could be worth nearly 8% more than the price at time of writing. A wider Australian recovery at some point could help further. And some commentators say we’re now seeing the floor of the Sydney and Melbourne housing markets.

Of course, this potential return carries a greater risk as an equity holder than a depositor. Unlike a term deposit, the share price can fluctuate, and the value of your capital may rise or fall. Yet, for income and growth over a longer period, I know where I’d rather be.

Quantitatively, Westpac is reasonably priced in an otherwise rather high market. Take a look at the fundamentals:

Market cap:

$100.58bn (AUD)

P/E:

13.7

P/B:

1.53

LT debt to equity:

327%

Return on equity:

12.7%

Net margin:

33.4%

5Y Revenue growth:

-0.3%

Dividend yield:

6.52%

Source: Aspect Huntley and Interactive Brokers TWS figures as at 10:30pm 4 August 2019 GMTDebt-to-equity is high, and one concern is Westpac’s exposure to the domestic lending market. But we’ll get to that in a moment. What we do like is the impressive return on capital — which provides room to manoeuvre.

The next step is macro research.

Westpac is precariously exposed to a fast-slowing Australian economy. Plus, increased regulatory scrutiny and potential interference on the back of a damning Royal Commission report. And to compound pressures on the business, APRA (the Australian Prudential Regulation Authority) is requiring the major banks to lift their total capital requirements by 3 percentage points of risk weighted assets (RWA).

For Westpac, with RWA of around $420 billion, this represents about $13 billion of additional capital requirement.

This should make the bank safer through a downturn. However, it could also lower returns a little over time.

Still, there are signs of life pointing to a potential Australian recovery. And the new tax cuts coming on-stream from the ScoMo government could provide some stimulus.

Possibly, the fear impacts on the Westpac share price have been overreached.

Westpac is strong in loan markets.

An analyst friend of mine in Sydney recently looked in detail at both Westpac and Commonwealth Bank of Australia [ASX:CBA].

He saw qualitative potential in CBA and quantitative potential in WBC. He’s been right on CBA. We bought at around $66 and have seen a rise toward $82 in less than a year, while enjoying reasonable dividend income.

But his predictions for Westpac have yet to deliver. And we don’t see any reason why Westpac should be lagging.

The analyst friend of mine in Sydney is working for a large asset manager. He’s a talented migrant wanting to get ahead. And at the time, he was also moonlighting for me as an ASX equities analyst.

‘All my friends are working all hours we have to pay our mortgages,’ he told me. ‘Don’t worry, Simon. The bank always gets paid.’

As with any stock, there are risks.

The pressures on Westpac mean the dividend could get cut. The share price could fall.

Yet, inside a recovery, fiscal stimulus and ongoing demand (although recently subdued) in the Australian housing market, Westpac could also strike out with a rise.

As Australia’s oldest bank and one of the country’s key lenders, there remains in our view long-term upside potential beyond the negative short-term issues.

Recommendation for Lifetime Wealth Investors:Within the income allocation of your portfolio, buy ASX:WBC up to $28.

Idea 2: Mid-cap, income and speculation

New River REIT [LSE:NRR] is a beaten-down REIT (Real Estate Investment Trust) on the London Stock Exchange with a market cap of just under £500m.

At the time of writing, it pays a 13.3% dividend yield (paid quarterly). And at current price-to-book ratio, you’re buying the assets in the business at an approximately 40% discount.

Forum Retail Park, Wallsend, England. Source: NewRiver

So, what does NewRiver own?

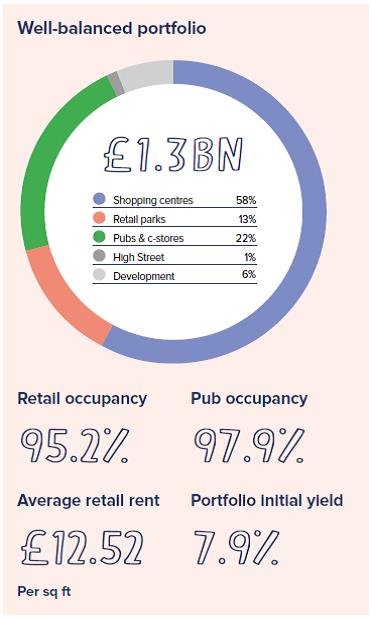

It has 33 community shopping centres, 23 retail parks and over 650 community pubs. The best summary of their assets by share of portfolio value is provided in the most recent annual report (25 June 2019):

Source: NewRiver Annual Report 25 June 2019

The pleasing factor is the high occupancy.

Because retail in Brexit Britain is worrying.

A local friend worked there for years in the commercial property sector. He’s just been back, catching up with old mates.

He played a lot of golf. Because his letting agent friends had nothing else to do. He told me about empty malls and nobody leasing due to the uncertainty around Britain leaving the EU in October.

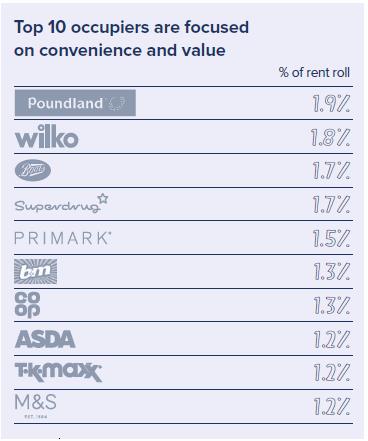

So for NewRiver to be maintaining occupancy above 95% is a good sign. And one of the reasons for this is the focus on convenience-led retail. Again, from the annual report, here are the top tenants:

Source: NewRiver Annual Report 25 June 2019

In addition, some of the areas of high vacancy have options. The company has identified the potential to deliver up to 2,400 residential units across the portfolio over the next 5-10 years, resulting in up to £140 million of development profit.

One concern is the company’s ability to continue to pay dividends in a challenging retail sector. Leases are under pressure. CVAs (Company Voluntary Arrangements) are becoming quite common, where struggling businesses agree with landlords to pay rent arrears back over a set period.

And the valuation of retail portfolios has fallen.

Yet, NewRiver has recycled some lower-yielding assets and reported on 25 July that it has re-established a fully covered dividend.

So why is NewRiver so cheap?

There are clear signs the company has been oversold.

Previously, it had been targeted by short sellers as a domestically focused business sure to struggle through Brexit.

Meanwhile, star UK fund manager Neil Woodford has fallen on hard times. Facing demand for redemptions, he has had to cut his stake in NewRiver from 11.84% to less than 5%.

This sort of sell-off in a smaller FTSE stock is sure to stamp on the price.

Yet, it’s heartening to note that not all investors are against New River. Berenberg’s analyst Kai Klose in July stated:

‘We think that the defensive profile of NewRiver REIT’s £1.2 billion retail portfolio, with low vacancy rates of three per cent, affordable rents of £12.36/sq ft and a fairly broadly diversified tenant structure, remains attractive.’

What are the risks?

Cut-priced assets. Amazing dividends paid quarterly. Seems too good to be true!

Be careful. NewRiver is carrying some debt at around 63% of equity.

This seems sustainable for now. Yet, if there’s a major retail crash through Brexit, mass bankruptcies and widespread vacancies that impact on NewRiver’s convenience focus — the business might be at risk of liquidation.

In that case, losses could be severe.

Yet this is unlikely. Brexit may not be as bad as presumed. People still need to get to the store for the essentials of life that aren’t so easily bought online.

And an economic recession could encourage patronage at the company’s more than 650 community pubs.

The more likely risk is that pressure on rents in the economy means the dividend must be cut for a period. Although the business has signalled a focus on sustaining the dividend through challenging conditions.

So if you can cope with the risks of a further retail crunch and see the upside after Brexit — NewRiver could be well-placed not only to pay you a great income but also rise in value quickly.

To get a closer handle on the business, I would encourage you to have a read of their annual report, which is available here.

Recommendation for Lifetime Wealth Investors:Within the income and speculative allocation of your portfolio, buy LSE:NRR up to 165p.

Portfolio update

In line with the trade war market shock, we’re reducing our ‘Buy Up To’ prices. Here is the current model portfolio:

Ticker Name Business Risk Comments Entry Date Entry Price Exit Date Current Price Dividends Percent Gain LSE:CRST Crest Nicholson Holdings plc Medium Buy up to 360p 8-Jul-19 351.60 Open 349.20 0 -0.7% LSE:GGP Greatland Gold plc Speculation Buy up to 1.90p 8-Jul-19 1.60 Open 1.84 0 15.0% ASX:WBC Westpac Banking Corporation Medium Buy up to $28 6-Aug-19 27.62 Open 27.73 0 0.4% LSE:NRR NetRiver REIT plc Medium Buy up to 165p 6-Aug-19 156.58 Open 156.80 0 0.1% Current as of 6 August 2019 at 9:45pm GMT.

Next week, I’m looking at some opportunities in Asia.

China may be suffering, but Singapore could be poised for growth. If these pan out, I’ll be sure to fill you in. But either way, there’ll be some more recommendations and thoughtful market commentary as we continue to navigate toward a profitable, long-term portfolio.

Regards,

Simon Angelo

Editor, Lifetime Wealth InvestorPS: A couple of subscribers requested further info in regards to tax and franking on ASX shares. You can download our free report by clicking here.

Important disclosures

Simon Angelo owns shares in Westpac Banking Corporation [ASX:WBC] and NewRiver REIT Plc [LSE:NRR].