- Home / Updates Latest Alerts Portfolio How to Buy Global Stocks Global Trading Masterclass Wealth Talk Customer Service My Account

-

Forget the Coronavirus Lockdown: Focus on These 2 Hidden Opportunities Instead

This lockdown comes with a strange sensation. Like lying on a deckchair on the Titanic.

There’s a sweet feeling of finally getting a break from all the rushing around. No piling onto the morning commuter ferry. No after-school activities to schedule pickups for. No slow-grind motorway queues to leave Auckland.

Here in Devonport, it’s like the whole suburb is exhaling a sigh of relief. The vibe has changed from inner-city hub to seaside holiday camp.

A camp that, as the weeks go by, we may soon realise is a pretty prison.

Out my window, there are paddleboarders in the inner harbour. When we take a walk, the roads are empty of cars but busy with families walking their children and dogs. And cyclists enjoying the empty asphalt.

But there’s also a sense of foreboding.

When will it end? Things may appear fine for white-collar workers, able to work from home and keep their pay cheque flowing. But what of the thousands of businesses closed? Those not able to work at all?

And when will the impact on travel, tourism, hospitality, and retail detonate a bomb that will ricochet across the rest of the economy?

Helicopter money

It’s pretty clear that the government is going to keep money flowing. Central banks, as the lender of last resort, will step in to create money electronically. Money will always be available.

This is what they know. It’s what worked to kickstart economies again after the GFC (Global Financial Crisis).

Back then, they argue, they did too little too late.

Not this time. Economies are being flooded with money.

The US has launched a direct stimulus package of USD $2.2 trillion. That’s nearly $7,000 for every man, woman, and child.

New Zealand currently has a $12.1 billion package. About $2,500 per person.

And Australia just launched a massive wage-subsidy programme, bringing their total stimulus package to $320 billion. Some $13,000 per person.

These packages range from 4% to over 16% of GDP.

But we’re not done yet. If you include liquidity support, bond buying, shoring up debt, and all the other measures — total rescue packages could absorb more than half of GDP. Potentially attempting to pay every adult a median salary for a year to get through.

This money will come from creation of new money within the banking system. Alongside massive government borrowing.

We will be paying this debt for generations to come.

Will it work?

This time is different from the GFC. It’s not about people not spending. It’s about them not being safe to go out and do so.

So, what is actually happening is you’re filling cars with gas, even when they have nowhere to go.

Once the road is open again, guess what will happen? Everyone will get out and drive.

The real questions for me — when analysing equities — are not around how much money is being pumped into the system. But questions such as:

- Can certain businesses survive long enough to get through?

- Will our economies — and especially our high streets — ever be the same again?

- What will the unemployment impact be? And how will this affect spending ongoing?

- How will lower job and economic numbers affect already overheated property markets?

- Which businesses are robust enough to get through and profit on the other side?

COVID-19 is the biggest risk event to hit the markets since the GFC.

Yet, the good news is that this risk event will have a finite end. We are walking a tightrope to get to the other side. Hoping the other side is stable. And the rope won’t break.

So, the big question is when will this risk event end?

Now that a lot of the panic-selling in markets seems to have dissipated, a murky view through the dust is beginning to emerge.

Experienced investors are not pricing today’s condition. They are pricing the market in 6-to-12 months’ time. And given recent index gains, it seems they’re seeing upside.

That upside comes from the risk event ending and a wall of pent-up spending and money waiting to flow.

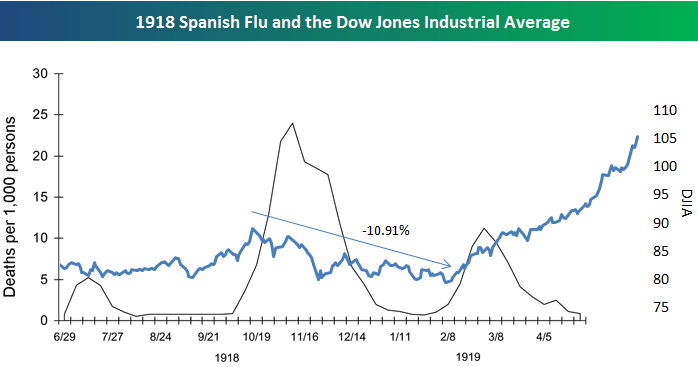

I spent much of Sunday reading and thinking about the 1918 Spanish Flu. This is the most comparable risk event we have in the form of a worldwide pandemic that killed some 50 million people.

Here’s the impact on the Dow Jones at the time:

Source: Seeking Alpha

Between the two key death waves of the Spanish Flu, there was a stock-market drawdown of about 11%. Then a rapid escalation in values.

- Markets were less responsive, since the media was far more limited. You would read about events in the newspaper the next day. They weren’t instantly online.

- There is evidence that social distancing in certain US cities dramatically reduced both the spread and death rates of the virus.

- The virus had two waves. An initial spike in deaths. And then a more mild second wave. After which deaths rapidly trailed off.

- The virus became less lethal over time as it spread through the population. This is consistent with the behaviour of other viruses. People either die or develop immunity.

With COVID-19, we in the midst of the peak of a Phase One outbreak.

I’m also suspicious that fear is driving government responses beyond the risk event

In 2009, swine flu was estimated to be 10 times more deadly than it actually was. There was initial panic. Fortunately, data revealed it to be no more deadly than the seasonal flu before there was major market impact.

Much of the fear we see with COVID-19 seems to come from the impact on elderly populations. On cruise ships and in Italy — where the average age of those dying is around 80.

My friend and epidemiologist Simon Thornley notes that ‘this kind of seasonal epidemic of deaths has occurred frequently in elderly populations living in this region for some years.’

He argues that Sweden has taken a more sensible course. Providing a more limited lockdown and avoiding much of the economic self-harm we see elsewhere.

We are a risk-averse society. Those willing to see a clear view and take risks beyond this will profit.

As for market behaviour, we may be at the bottom. And prices are starting to estimate what the world will look like in September onward.

For equity investments, the value now lies in the survival of the fittest. Those able to survive the enforced harm. And get out the other side, ready to enjoy pent-up demand and printed money.

Those companies who currently have beaten-down stock prices now but could prevail in a year’s time may do just fine.

So we’re adding two new companies to our research:

Idea 1: Small-Cap REIT, Non-Retail Hedge

Warehouse REIT [LSE:WHR] is a Real Estate Investment Trust focused on UK urban warehouses.

Let me show you a sample property:

Last Mile Warehouse, Widnes. Source: Warehouse REIT

Not pretty, I know. But this REIT specialises in providing non-retail space, supporting e-commerce and business processing.

Last Mile Warehouse has excellent motorway access to Liverpool and Manchester airports and the Port of Liverpool.

It is leased to Amazon UK Services at a contracted rent of £216,000, on a newly agreed 5-year lease (as of 31 March 2019).

The valuation of the property is £2.8 million, reflecting a yield of over 7%.

Here’s why we like Warehouse REIT:

- There are currently two storefront-retail REIT recommendations in our portfolio. Warehouse REIT provides a hedge in the form of non-retail property supporting the growing trend in online shopping.

- E-commerce is growing faster than retail shopping, expanding at a rate of 18% per year (Shopify US figures). This may increase further because of the COVID-19 outbreak.

- The current share price presents opportunity to gain an ownership slice of Warehouse REIT at below the current book value of the properties (based on current a P/B of 0.8 to 0.9).

- A projected dividend of around 6.7% offers investors an attractive carrying income (provided this dividend gets maintained).

- The business was proposing a subscription offer to new shareholders at 111.5p per share to acquire new assets. However, this got called off due to the impact of the coronavirus.

Key fundamentals

Financials as at 31 March 2020

Market cap

£214.77m

P/E

10.6

P/B

0.8

LT debt to equity

75.35%

Return on equity

6.8%

Dividend yield

6.74%

Portfolio as at 30 September 2019

Portfolio value

£465m

Rent roll (contracted)

£31.3m

Tenants

629

Occupancy

93.8%

Source: Interactive Brokers TWS figures and Warehouse REIT as at 31 March 2020 and 30 September 2019

Key risks:

- Occupancy is lower than we saw in retail investments. There is risk that ongoing vacancy can reduce income and threaten dividends.

- Dividends may reduce or get cut to cope with market conditions.

- COVID-19 may also impact the production and warehousing facilities of many businesses, leading to shutdown and loss of rent.

- About 75% of the company’s equity is debt. And the LTV (loan-to-value ratio) on assets was sitting at around 40% last September. Any material decline in rent or increase in financing costs will have accelerated negative impact on this business.

- Certain tenants who are unable to conduct their activities and access their warehouses during the lockdown period may withhold rent during this time and reduce the company’s income.

- The company has yet to make a comprehensive report on the impact of COVID-19. Though we expect it to be less than on other REITs, given the focus on e-commerce and production tenants, as opposed to high street or mall.

We encourage you to explore this business further in the company’s investor relations section.

Recommendation for Lifetime Wealth Investors:

Within the income/growth allocation of your portfolio, buy WHR up to 90p.

Idea 2: Social Infrastructure REIT

Charter Hall Social Infrastructure REIT [ASX:CQE] is another Real Estate Investment Trust focused on childcare properties in Australia and New Zealand.

So we are commencing research on another REIT. Why another property-based stock?

In these volatile times, we’re looking for value. But value secured on real assets.

For example, if we buy an airline, and that airline gets into trouble, you’ll soon find there are few real assets to cover creditors. Let alone the positions of shareholders who are last in line.

With a property trust, it is not very likely that property values in developed markets will fall so far below valuation that they cannot support conservative loan to value ratios. Especially in a low interest rate environment — now with extensive government credit and fiscal support.

So why take outsized risk when you can still find value with some margin of safety?

Charter Hall is currently reeling from the effects on childcare centres across Australia and potential unemployment impacts from the lockdown.

At the time of writing, the share price is down more than 50% from its high. And reveals a current P/B of around 0.6.

So you’re buying the childcare land and buildings — often in prime metropolitan suburban centres of Australasian cities — for around 60% of their actual value.

Charter Hall owned childcare centre, Australia. Source: Charter Hall

Now, if you approached another owner of a similar property and offered them 60% of the registered valuation, even amidst the fears of a COVID-19 extended lockdown, they’d likely tell you to take a shower.

No doubt this is a contrarian investment. There’s been wide sell-off of Charter Hall based on fears that range from immediate rent loss, to massive property value downgrades, to disruption of the whole sector.

And you do invest with heightened risk:

- What if childcare centres close permanently?

- What if key tenant Goodstart — who rents 46.5% of the portfolio — gets into trouble?

- What if rent fall-off means the business cannot pay its financing costs?

- What if the childcare industry faces reduced demand for a long period to come due to seismic employment disruption?

At the moment, childcare centres must stay open to care for the children of essential workers. But some centres are reporting a struggle just to keep open, citing roll drops from 32 children to 2 in one case.

Goodstart Early Learning is a non-profit and Australia’s largest provider. It is owned by a syndicate of large charities. It resulted from the purchase of ABC Learning out of voluntary liquidation. Last week, they had to lay off 4,000 casual educators from their workforce of around 13,000 staff.

As Goodstart does not have to publish public reports, I was unable to ascertain their debt levels. But there is likely some long debt to service from the original purchase.

There are now calls for the government to reallocate the $8bn in subsidies it pays to parents, direct to centres to keep them alive.

Education Minister Dan Tehan has moved changes through the Federal Parliament. This ensures that childcare centres forced to close because of COVID-19 will continue to receive the childcare subsidy.

Despite the early fear and selldown, there is an important realisation emerging. Childcare centres will be urgently and strategically required on the other side when Australia goes back to work.

For a Charter Hall shareholder, the sudden drop in share price came as a shock. Investors like me and many funds invest in Charter Hall because of its defensive characteristics. The property assets. The tailwinds of growth in this sector.

COVID-19 was a sudden and unexpected tidal wave.

There remains significant risk. But this could be one to buy at value now and gain growth and income on the other side. If you’re comfortable with the risks.

The company made an announcement to the market last week, withdrawing earnings guidance. But they advised that capitalisation remains strong. Hopefully strong enough to weather this storm.

Key points of this announcement are as follows:

- The business is unable to provide earnings guidance for the 2020 financial year.

- CQE remains ‘well capitalised with debt facilities of $500 million with no debt maturities until March 2023’.

- There is available liquidity and the ability to fully fund contracted property acquisitions and future development pipeline from existing facilities.

- CQE’s distribution for the March 2020 quarter of 4.175 cents per unit previously declared will be paid on 21 April 2020.

I would read into this that further dividends ahead may be suspended until things return to normal.

Here are the current fundamentals on this stock:

Financials as at 31 March 2020

Market cap

A$564.58m

P/E

7.2

P/B

0.6

LT debt to equity

35.11%

Return on equity

9.1%

Dividend yield

9%

Portfolio as at 31 December 2019

Portfolio value

A$1.3bn

Properties

420

WALE (Weighted Average Lease Expiry)

629

Occupancy

99.8%

Source: Interactive Brokers TWS figures and Warehouse REIT as at 31 March 2020 and 31 December 2019

It’s important to note that these figures give a snapshot of past occupancy, revenue, and performance.

The impacts of COVID-19 may impact them drastically. This is what the discounted share price is attempting to factor in. But for those willing to take the virus duration and post-recovery risks — it may well have been oversold.

Key risks:

- Occupancy falls heavily and impacts revenue.

- Key tenant Goodstart is unable to cover contracted leases and terms are up for negotiation.

- Some childcare centres get closed and unable to reopen.

- The market value of closed childcare centres may be much lower than their previous valuation.

- The government does not sufficiently support the sector to keep it afloat.

- The company struggles to meet its interest payments and debt obligations.

- Dividends get cut or suspended for the next 1-4 quarters.

We encourage you to explore this business further in the company’s investor relations centre.

Recommendation for Lifetime Wealth Investors:

Within the income/growth allocation of your portfolio, buy CQE up to A$1.90.

Portfolio update

Nikon [TYO:7731] announced a dividend of 30 yen per share for shareholders on record at 31 March 2020.

We continue to see insider purchasers (typically directors) using the downturn to buy their company shares at value.

In particular, Tassal Group [ASX:TGR], Aviva [LSE:AV.], Charter Hall [ASX:CQE], and for AVJennings [ASX:AVJ] — a substantial portion of 231,431 shares by Director Cheong Sae Peng.

General Motors [NYSE:GM] has also entered the ventilator business. They expect to produce ventilators at a rate of 10,000 per month, starting in mid-April. The ramp-up has been surprisingly rapid. As yet the return on this capital investment is unknown.

Here is our current portfolio with ‘Buy Up To’ prices updated:

Ticker Name Business Risk Comments Entry Date Entry Price Exit Date Current Price Dividends Percent Gain LSE:CRST Crest Nicholson Holdings plc Medium Buy up to 180p 8-Jul-19, 17-Mar-20, 23-Mar-20 268.70 Open 175.50 11.20 -30.5% ASX:WBC Westpac Banking Corporation Medium Buy up to A$17 6-Aug-19, 2-Mar-20, 16-Mar-20 22.11 Open 16.50 0.80 -21.8% LSE:NRR NewRiver REIT plc High Buy up to 70p 6-Aug-19, 16-Mar-20, 23-Mar-20 99.93 Open 59.70 10.80 -29.4% SGX:O39 Oversea-Chinese Banking Corp Medium Buy up to S$8.80 8-Aug-19 10.98 Open 8.64 0.25 -19.0% ASX:TGR Tassal Group Ltd Medium Buy up to A$3.70 21-Aug-19, 2-Mar-20, 10-Mar-20 3.89 Open 3.50 0.18 -5.4% NYSE:GM General Motors Company Medium Buy up to $22 28-Aug-19, 9-Mar-20, 17-Mar-20 26.57 Open 20.78 0.76 -18.9% BIT:IGD Immobiliare Grande Distribuzione High Buy up to €4.00 25-Sep-19, 10-Mar-2020, 17-Mar-2020 4.44 Open 3.75 0 -15.6% LSE:AV Aviva plc Medium Buy up to 280p 10-Oct-19, 9-Mar-20, 17-Mar-20 307.43 Open 268.50 0 -12.7% EPA:SAN Sanofi S.A. Medium Buy up to €80 14-Nov-19, 13-Mar-20 77.55 Open 79.94 0 3.1% NZX:GXH Green Cross Health Ltd High Buy up to $1.20 7-Jan-20 1.19 Open 1.14 0 -4.2% TYO:7731 Nikon Corp High Buy up to ¥1000 16-Jan-20, 3-Feb-20 1335.00 Open 950.00 0 -26.6% ASX:KSL Kina Securities Ltd Speculation Buy up to A$1.00 17-Feb-20, 17-Mar-20, 23-Mar-20 0.91 Open 0.92 0.064 8.5% ASX:AVJ AVJennings Ltd Medium Buy up to A$0.50 2-Mar-20 0.50 Open 0.46 0.012 -5.6% ASX:CQE Charter Hall Social Infrastructure REIT High Buy up to A$1.90 26-Mar-20 1.59 Open 1.86 0 17.0% LSE:WHR Warehouse REIT Medium Buy up to 90p 27-Mar-20 87.60 Open 91.60 0 4.6% LSE:GGP Greatland Gold plc Speculation Position closed 8-Jul-19 1.60 12-Feb-20 5.79 0 261.9% Current as of 31 March 2020 at 9pm GMT.

I guess if you’ve forgotten something I’ve said from the beginning — you should now be keenly aware of it now.

When investing in shares, you’re buying into businesses.

We try to find the best, strongest businesses we can.

But all businesses carry risks. During a pandemic, for many businesses, these risks become critical.

For now, we are riding the storm. Considering the risks. And positioning to profit.

Next week, we will have 2 new strategic recommendations — dependent on further research and market conditions over the next few days.

Are we at peak fear? Or is, as Roosevelt said, ‘the only thing we have to fear is fear itself’?

That quote could end up ringing very true across the markets for diversified investors.

This is not nuclear war. An end is in sight. The world will go back to normal. And the economy will recover.

Where will you be when that happens?

Regards,

Simon Angelo

Editor, Lifetime Wealth Investor

Important disclosures

Simon Angelo owns shares in Charter Hall Social Infrastructure REIT [ASX:CQE] and Warehouse REIT [LSE:WHR].

PS: In case you missed the announcement last week…

Due to the increased demand on our servers, research time and customer support — we’re increasing the price for new customers only, effective April 1st.

This will not affect you. We are rewarding our loyal subscribers by keeping your current subscription price locked in. And, as a Lifetime Wealth member, you will also receive a discount on our Vistafolio sharebroking service, if you want to access that.