‘We shall go on to the end, we shall fight in France, we shall fight on the seas and oceans, we shall fight with growing confidence and growing strength in the air, we shall defend out Island, whatever the cost may be, we shall fight on the beaches, we shall fight on the landing grounds, we shall fight in the fields and in the streets, we shall fight in the hills; we shall never surrender.’

Winston Churchill

It was these words that launched hundreds of ships…

OK, not all of them were ships.

There were a couple of small fishing boats that tagged along.

But Winston Churchill’s words inspired a nation.

A nation that had just suffered defeat. A nation with fathers, brothers and sons trapped overseas, with little hope of survival.

More than 800 boats left English ports shortly after Churchill’s words.

Some of them military. Some of them small fishing dinghies. All travelled to Dunkirk, France to save 338,226 soldiers within eight days.

To a far lesser extent, investors find themselves in a similar position.

They’re trapped holding losses. And without some encouraging words, the active folk will be forced to realise those losses.

Will a few words from Powell be enough to send the boats?

Using words to manipulate asset prices

Boats are not a reference to money creation.

We’ve already had plenty of that.

Boats represent investor confidence. And right now it’s higher than it has been in weeks.

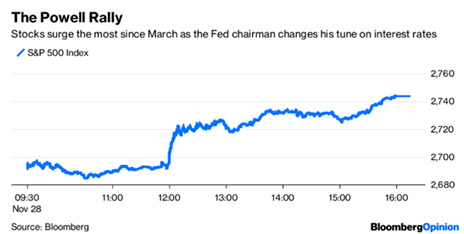

Head of the US Federal Reserve, Jerome Powell said rates were just below the neutral rate.

This is the magical rate that neither adds nor detracts from growth, while also keeping everyone employed.

Right now, the Fed is targeting a 2–2.25% Federal Funds rate.

And with a little nudge we could get to that happy place everyone’s talking about.

Why has this boosted confidence? Because it takes a far worse possibility off the table…for now.

That worse outcome is much higher interest rates. Many believed the Fed would keep pushing rates higher.

With higher rates, investors holding losses would see their portfolio’s dip further into the red.

But now we see an end in sight. Or at least people are hoping for one. [openx slug=inpost]

If Powell says the magic rate is not far off, then investors will adjust their interest rate and inflation expectations.

What they thought would be interest rates of 5% and inflation of 4% might turn out to be interest of 3% and inflation of 3% by 2019–20.

This matters because of what interest rates represent. They’re a key tool to value any asset. And depending upon whether interest is high or low, it will either create or reduce demand for assets in general.

The point is, investors aren’t bracing for continual rate hikes in the coming year.

And as a result, buying is back on the menu. In fact, investors haven’t been this giddy since the volatility shock in February earlier this year.

|

Source: Bloomberg |

What’s strange about Powell’s words is how contradictory they are.

In October, when stocks were reeling, Powell said we were a long way away from neutral. Can we go from being a long way away to nearly there in just a month?

Or is Powell just using words to manipulate asset prices?

Whatever his game, I think Christopher Joyce at the Australian Financial Review gave a pretty good summary:

‘Anyone who tells you they know what’s driving markets right now is lying or fooling themselves, which begets opportunity.’

The opportunity Joyce talks about is corporate debt. He continues:

‘Financial credit is, in fact, the only seriously cheap asset class with spreads on the major banks’ senior-ranking AA- rated bonds about 10 times wider than in 2007 even though risk-weighted leverage has halved.’

Yet this probably isn’t what you had in mind. Instead, why not look at Aussie small-caps…

Where to go hunting for bargain stocks…

In 2019, the Fed is going to have to make some tough decisions: hold, cut or hike.

My hope is that they don’t screw it up. But even if they do, it won’t be the end of the world.

Businesses will still make money. Investors will keep buying and selling stocks. Prices might just be a lot lower.

As an individual investor, this is exactly what you want. You don’t need to figure out what the market is doing or why.

Your goal should be finding a few great names and sitting on those investments for the years to come.

Even as Aussie markets fell this year, there’s been plenty of stocks that have bucked the trend. Many of them small-caps.

That’s not to say it’ll be easy finding stocks that rise, significantly, no matter the global economic environment.

But if you don’t look, then you definitely won’t find them.

Your friend,

Harje Ronngard

Harje Ronngard is one of the editors at Money Morning New Zealand. With an academic background in finance and investments, Harje knows how difficult investing is. He has worked with a range of assets classes, from futures to equities. But he’s found his niche in equity valuation. There are two questions Harje likes to ask of any investment. What is it worth? And how much does it cost? These two questions alone open up a world of investment opportunities which Harje shares with Money Morning New Zealand readers.