- Home / Updates

Latest Alerts

Portfolio

How to Buy Global Stocks Global Trading Masterclass Wealth Talk

39% on Top Pick in 2.5 Months — Macro Strategy Reveals Strength

I heard a British MP tell Economist Radio that Brexit has been a bit like preparing to give birth. After a while, you just want the baby out. Then you can start enjoying life again. Sleeping in. Going for long walks. Having a drink.

Ha! Anyone who has had a young child knows that the birth is only a small part of the responsibility. Brexit will come out, one way or another. It is adjusting to the new dynamics of the household that changes you forever.

And this is what Britain — and four of our stock picks — are facing. A new trajectory.

The market has come around faster than we expected. The pound is up — as are our curated UK picks. We hoped for a longer buying run. Now that’s getting harder.

But the Brexit pregnancy term ran too long. The baby got too big. And investors had enough time to see the child that would come out of it. He wouldn’t be so bad. He might even be stronger, fitter and leaner without an EU parent.

If you got in at the start of the recommendations and have enjoyed the run-up — well done!

If not, you’re probably wondering — what next?

Well, Brexit is not done yet. There will be volatility and potentially an emergency birth. The store may still have a few more sale opportunities. So we watch and wait.

Meanwhile, if you’re confused as to what’s happening and what will happen with the whole situation, the latest update may be summarized as follows:

Source: Twitter @Conservatives

Apparently some MPs were furious that there wasn’t enough time to look at the 100 page bill.

Well, it does look like Brexit could get done – but not by October 31. Unless in the unlikely event the EU refuses to grant a ‘technical’ time extension. January 31 is now mooted.

But the frustrations and delays are at boiling point. And this increases the chance that a general election may be called.

Should the UK manage to leave the EU in the next few weeks or months — the pound and our stock picks could accelerate. We expect a period of investment and growth in the UK as pent-up demand (and relief) gets released.

Any call for an election is going to shudder the markets. And we’ll be back into volatility. Great if you can hold your nerve and buy the long-term opportunity. Rocky if you’re holding a large portfolio of recently invested positions.

A ‘Brexit Britain’ next year could be a child waiting to be reared. Expect tantrums. Difficulty. Sleepless nights. We don’t yet know how it will turn out. But over the next year or two, with so much pent-up demand and few other places for yield, we could be in for a bumper season on the London Stock Exchange.

This could be further fuelled by potential cuts to taxes, stamp duty on homes and much-needed deregulation.

Perhaps once the positions get high; it will be time to take a little profit off the table. For now, we’re still very much in build mode.

Portfolio update

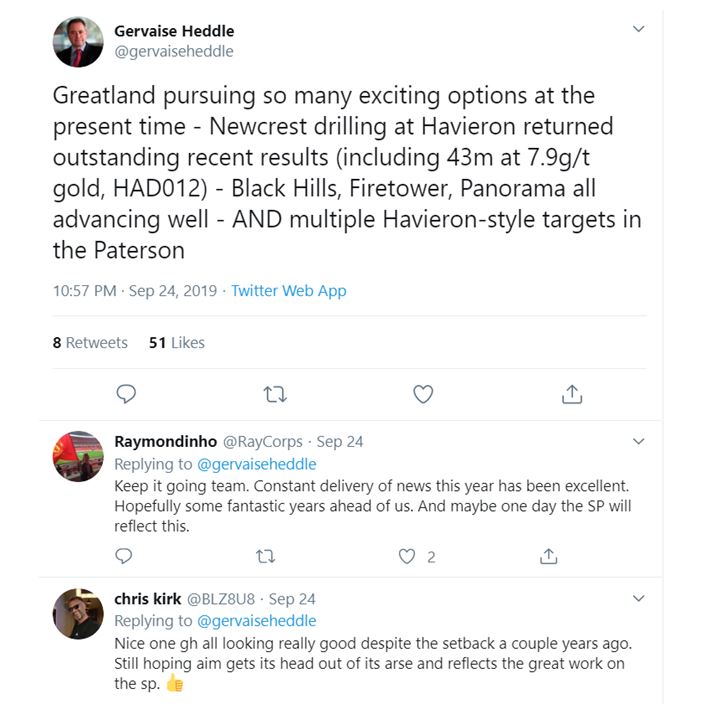

Greatland Gold [LSE:GGP] continues to show speculative promise. At the company’s 100% owned Panorama project, located in the Pilbara region of Western Australia, the company has advised that results of soil sampling confirm presence of gold anomalism.

Gervaise Heddle, chief executive officer, commented: ‘We are very encouraged by the results from our soil sampling campaign at Panorama which highlight several areas of gold anomalism along the mineralised trend. These geochemical results, combined with images from the recent detailed aeromagnetic survey, enhance our understanding of the project and build upon the work we conducted earlier this year which identified gold in rock chips and coarse gold over six kilometres of strike.’

Back in September, he tweeted confidently on the company’s full range of prospects:

Source: Twitter @gervaiseheddle

And you can see there were a few comments stating that the ‘sp’ (share price) ought to reflect this.

Note: Greatland remains a highly speculative investment until drilling reveals a larger gold find. Of course, if and when it does, the share will no longer be available at around 1.8p.

OCBC Bank [SGX:O39] continues to see downward drift due to the malaise impacting China from US trade pressure. Again, as with Brexit, this creates a macro opportunity to buy at value with the possibility of uplift as events resolve.

Trump’s last signal was that trade talks are on target for a November deal. Read into this what you will. He is a mercurial deal marker who will keep his adversaries on their toes until American benefit is assured.

Not only do we see Singapore as a potential hedge against China falling off the log; we see it as a bet each way. Should China conclude a decent deal with the US that allows continued growth, stocks like OCBC bank may rise.

Should it fail to do so, there’s enough alternative activity in Southeast Asia waiting to take up the slack.

Of course, there are risks with OCBC. Its business is exposed to China due to recent investments there. So, either way, this will be a long-term pick.

And perhaps not a bad one to wait out, with the company recently opting to increase dividends in lieu of further growth investment.

At today’s price, the stock is on track to provide a dividend yield of around 4.5% per annum while the share price offers value.

The company also has a generous dividend reinvestment scheme if you want. This is accessible under ‘Corporate Action Notifications’ around dividend time if you’re using Interactive Brokers.

Tassal Group [ASX:TGR] has been our slowest pick off the mark. At the time of recommendation, it was going through a rights issue to fund investment into its prawn farms and other operations. Then the US v. China trade war became more aggressive. Investors got nervous on the export potential for salmon and seafood under such conditions.

Those nerves are still raw for Australasian food exporters. But the long-term story comes down to a global hunt for protein — particularly healthy options like salmon.

The company seems bullish. Internal directors have been topping up positions. And they have just announced that ‘all major council and Queensland state government approvals for its stage three expansion of its prawn farm near Proserpine have been received.’

It is a good start for the investment by a company that has seen an excellent run of earnings growth over the past 5 years.

CEO Mark Ryan stated: ‘With all major stage three approvals received, we can now commence investing $30 million to build 80 hectares of additional pond and new hatchery infrastructure for production next financial year that will create 50 new jobs and support our target of generating $25 million in EBITDA (earnings before interest, tax, depreciation and amortisation) from prawns in financial year 2021.’

Of course, a business like Tassal carries seasonal risk. But with increasing demand and growing ability to fill that demand, there does seem to be a current opportunity here.

Within a similar industry, we’ve recently watched New Zealand seafood business Sanford [NZX:SAN] enjoy a good run in its share price. And now like too many stocks on the small NZX, it is looking less opportunely priced.

Tassal is larger and materially cheaper at its current stock price.

General Motors [NYSE:GM] has seen some of the relief we expected with an emerging deal to end the UAW (United Auto Workers) strike. At the time of writing, we are waiting for the union’s vote on the proposed deal on October 25.

The plot thickens a little as well. Currently, there is a federal investigation into corruption within the UAW, targeting its highest-ranking officials, including past president Dennis Williams, and current president Gary Jones.

Neither have been charged with a crime, though federal officials raided both their homes in August.

Again, this is like the early days of the Brexit situation. If you can handle the upheaval and the risk, it’s a good time to buy. Long-term prospects for the company are promising as discussed back in our September recommendation.

We see it as more prudent exposure to electric car opportunities (amongst others) at a forward P/E of approx. 5.5 and dividend yield of approx 4.2% — as opposed to the likes of Tesla [NASDAQ:TSLA] at a forward P/E of 63 sans dividend.

Providing the strike is settled, the GM share price could lift. Savvy investors at this point in time will consider the likelihood of a positive union vote on October 25th and either buy or wait.

Here’s how our portfolio is currently tracking — with ‘Buy Up To’ guidelines modified for the current market opportunity:

Ticker Name Business Risk Comments Entry Date Entry Price Exit Date Current Price Dividends Percent Gain LSE:CRST Crest Nicholson Holdings plc Medium Buy up to 420p 8-Jul-19 351.60 Open 433.20 11.20 26.4% LSE:GGP Greatland Gold plc Speculation Buy up to 1.90p 8-Jul-19 1.60 Open 1.83 0 14.4% ASX:WBC Westpac Banking Corporation Medium Buy up to A$30 6-Aug-19 27.62 Open 28.98 0 4.9% LSE:NRR NetRiver REIT plc Medium Buy up to 210p 6-Aug-19 156.58 Open 213.50 5.40 39.8% SGX:O39 Oversea-Chinese Banking Corp Medium Buy up to S$10.80 8-Aug-19 10.98 Open 10.71 0.25 -0.2% ASX:TGR Tassal Group Ltd Medium Buy up to A$4.15 21-Aug-19 4.40 Open 4.12 0.09 -4.3% NYSE:GM General Motors Company Medium Buy up to $37 28-Aug-19 36.03 Open 36.31 0 0.8% BIT:IGD Immobiliare Grande Distribuzione Medium Buy up to €5.80 25-Sep-19 5.52 Open 5.75 0 4.2% LSE:AV Aviva plc Medium Buy up to 420p 10-Oct-19 378.00 Open 418.60 0 10.7% Current as of 22 October 2019 at 9pm GMT.

I’m also pleased to announce — due to popular demand — we now have another investor training event available! Unfortunately, we’re currently only able to host these events in Auckland — but have moved the day to Friday to hopefully accommodate more investors.

I’ll be covering new developments in the strategy, launching another exciting stock pick and providing further training on a professional trading desk.

You can sign up to this event here.

Meanwhile, I’ll keep hunting for our next value opportunity.

Regards,

Simon Angelo

Editor, Lifetime Wealth Investor