Income. Profit. Wealth.

The field of investing continues to spark the imagination of today’s fortune hunters.

This spirit of adventure is reminiscent of ancient explorers discovering new lands — or early prospectors scouring for gold.

So, what makes a great investor?

- Is it some unseen intelligence that only a few possess?

- Is it a secret network of guarded knowledge?

- Or is it simply a matter of luck?

These are good questions.

The following investors are recognised as being some of the most successful individuals to have ever lived.

Their journeys are not the same. However, they do not differ in their ability to consistently beat the market.

Here’s how they achieved it…

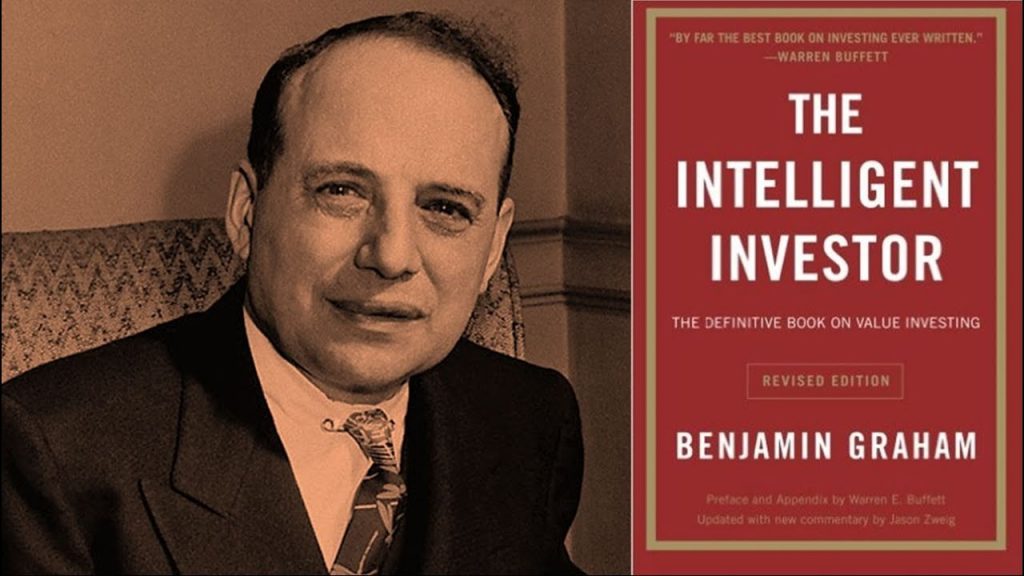

Benjamin Graham: The Father of Value Investing

Source: Quotes Database

‘Confusing speculation with investment is always a mistake.’

The late Benjamin Graham has forever solidified his name within the investor hall of fame.

His literary works — most notably Security Analysis (1934) and The Intelligent Investor (1949) — ushered in an investment discipline that is still highly regarded and relevant to this day.

This discipline is known by investors as ‘value investing’.

Note that many of his concepts are considered to be outdated, and rightfully so. It is well-known, however, that his principles will always remain relevant and timeless.

The essence of value investing proposes that any investment should be worth substantially more than the investor must pay for it. He stressed the importance of gauging the ‘intrinsic value’ of the prospective investment.

The intrinsic value of a prospective investment can be estimated using a variety of different valuation methods. Graham fathered these concepts early in his Security Analysis book.

If the intrinsic value is higher than the market value of the investment, then the investor would be inclined to buy. Similarly, if the intrinsic value is below the market price, then the investor would hold until a mean reversion occurs. A mean reversion occurs when the market price and intrinsic price converge.

Graham understood that markets move in response to the overarching investor psychology at every moment. He described the market price as ‘Mr Market’, who goes through optimistic and pessimistic periods.

He justified that a smart investor will not follow the herd mentality. They will find profit in any market no matter the conditions.

When the market is optimistic, prices are generally high, so sell high.

When the market is pessimistic, prices are generally low, so buy low.

The Covid-19 pandemic is a perfect example of this point. The relatively short-lived market crash following the start of the pandemic acted as an excellent investment opportunity for the investors who understood how fear can influence the market.

Most Famous Triumph:

- Graham averaged a ~20% annualised return from 1936 to 1956. The average market performance over that same time frame was 12.2% annually.

- His literary works and research ushered in a new philosophy and framework for a generation of investors after him.

- Well-known for mentoring the great Warren Buffet. Buffet would go on to say that The Intelligent Investor is the best book on investing ever written.

Most Famous Failure:

- Graham, much like everyone else at the time, was burned by the Great Depression of 1929. He lost 70% of his assets by 1932. Funnily enough, he still managed to outperform the Dow Index, which lost 80% over the same period.

- Graham’s losses were only made worse by his heavy use of leverage, which only served to exacerbate his problems. It is said that he would swear off leverage after being burned from nearly four years of losses.

Lessons We Can Learn:

- Focus on the intrinsic price, not only the market price.

- Do not allow creative accounting to influence the intrinsic price. Creative accounting practices are manipulations or loopholes used to portray a company’s financial health or position as better than it really is.

- It is not wise to develop a herd mentality.

Fun Fact:

- Graham rejected Warren Buffet’s application multiple times before finally giving him the job at his investment company.

Warren Buffet: The Oracle of Omaha

Source: Robb Report

‘The best investment you can make is an investment in yourself. The more you learn, the more you’ll earn.’

Warren Buffet may be the most well-known investor of all time. He is certainly one of the most successful.

Buffet started investing at a very young age. It was 1941, and he was 11 years old when he decided to purchase his first stock.

He bought six shares of Cities Service preferred stock — three for himself, and three for his sister.

He had amassed the equivalent of US$53,000 by the time he was 16 years old. He managed to achieve this remarkable feat by working hard through a variety of different side gigs. These included reselling used golf balls and collectors’ stamps, to buffing cars.

This achievement is highly congruent of his belief in creating multiple income sources.

After being denied from Harvard, Buffet would study at Columbia University, where he would meet Benjamin Graham for the first time.

Buffet would learn everything he could from his new mentor, and he began to administer Graham’s value-investing philosophy to his own financial strategies.

In 1965, Buffet would purchase textile maker Berkshire Hathaway [NYSE: BRK.A] and turn it into a holding company for his growing portfolio.

[NYSE: BRK.A] would produce an average annual return of 20% since its acquisition. For reference, this is almost double that of the S&P 500 Index over the same period.

Most Famous Triumph:

- Warren Buffett has amassed over US$100 billion by 2021. Berkshire Hathaway can be considered his crowning achievement. This company owns more than 60 other companies and provides Buffett with billions in earnings each year.

- Buffet has donated generously to various charities and organisations. He has pledged to donate 85% of his Berkshire Hathaway stocks to charitable foundations.

Most Famous Failure:

- Buffet purchased Dexter Shoes Company in 1993. He paid $433 million, believing that it had a competitive advantage. This advantage would soon vanish due to the introduction of new competitors. This failure would result in a $3.5 billion loss to shareholders.

- To add insult to injury, the $433 million acquisition was made with Berkshire Hathaway stocks instead of cash. It was a bad swap.

- The shares Buffett had traded away are now valued in the billions.

Lessons We Can Learn:

- Invest in yourself first. Buffet has stated that he regularly spends up to 80% of his day reading, and he believes this is attributable to much of his success.

- Only invest in securities that you fully understand. One must ensure they research their prospective investments and all the factors that may influence it.

- A great business is not at its best unless it has a sustainable competitive advantage over other firms in the same area.

- Avoid funding risky investments with money that is already tied up in solid investments.

- Expect to hold for the long-term.

Fun Fact:

In the era of smartphones, Buffett continued to use his Nokia flip phone for years. He jokes: ‘I don’t throw anything away until I’ve had it 20 or 25 years.’

Carl Icahn: The Corporate Raider

Source: CNBC

In life and business, there are two cardinal sins. The first is to act precipitously without thought, and the second is to not act at all.’

Carl Icahn is another famous investor who has racked up a multibillion-dollar net worth over his extensive career. Some would say that his investment strategies and methodologies are controversial.

Icahn has often been described as a ‘corporate raider’ or ‘activist investor’. This kind of strategy is employed by purchasing a majority stake in a company in order to put pressure on the management to make a specific set of changes to the enterprise.

Icahn would push for changes that he believes would increase share price, and effectively increase the investors’ net worth.

The ‘Icahn lift’ is a phenomenon where a stock price will rise simply because Icahn is starting to buy into it.

Although these changes are made to increase shareholder value, they do not always bode well for the success of the company.

An example of this would be when Icahn purchased a large stake in Trans World Airlines (TWA) before taking it private. This investment made Icahn $469 million, but put the company over $500 million in debt.

The other ways that Icahn created wealth for himself was forcing companies to repurchase their stock at a premium and by asset-stripping. Asset-stripping is when one sells the assets of an acquisition for a profit.

Icahn’s investment philosophy and strategy has not changed much over the last 30 years. He has since created a multibillion-dollar limited partnership called Icahn Enterprises LP.

This entity allows him additional resources in his investment prospects.

Most Famous Triumph:

- Icahn has amassed over US$16 billion.

- He has received several awards, as well as pledging to give away over half of his fortune to philanthropic causes.

Most Famous Failure:

- Icahn had a large-scale involvement in Blockbuster. At the time, worries were beginning to mount about whether its retail stores were going to be able to fend off the threat of competition from Netflix [NASDAQ:NFLX].

- Despite successfully claiming control of the Blockbuster board and attempting to revitalise the brand, Icahn obviously miscalculated. Blockbuster was eventually doomed into obsolescence, costing Icahn US$200 million.

Lessons We Can Learn:

- Most of Icahn’s wealth has been made using strategies that require a very large existing amount of capital to begin with. This may not be helpful to the average investor. However, there are still valuable insights to be learned from his style.

- Icahn believed there are two cardinal sins in life: Acting impulsively or not acting at all.

- Icahn suggests that what is currently popular is generally wrong. In other words, he subscribes to the idea that following the herd mentality is never optimal.

- Learn and adapt from your mistakes.

Fun Fact:

Before landing in Wall Street, Icahn supplemented his Princeton education fees by getting a job at a country club and joining a regular poker game.

Conclusion

As any seasoned investor will tell you, the road to riches is never straightforward.

Although you can’t simply copy someone else’s success, you can learn from the greatest and forge your own path.

So, what does your own strategy for wealth look like?

How will you make it happen?

Regards,

Samael Knaap

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

Sam is an intern analyst at Wealth Morning. He is currently completing his major in finance, while juggling his roles as President of the Massey University Investment Club and student fund manager. He won the Investment Club stock challenge, where he achieved a return of 44% over a 3-month period. Furthermore, he has received the INFINZ scholarship award for being the top 3rd year finance student in 2020. His role involves contributing research and writing financial reports for Wealth Morning’s readers.