Plexure [NZX:PX1] [ASX:PX1] went on an interesting ride throughout 2020.

This small-cap stock was affected due to Covid-19, like most companies.

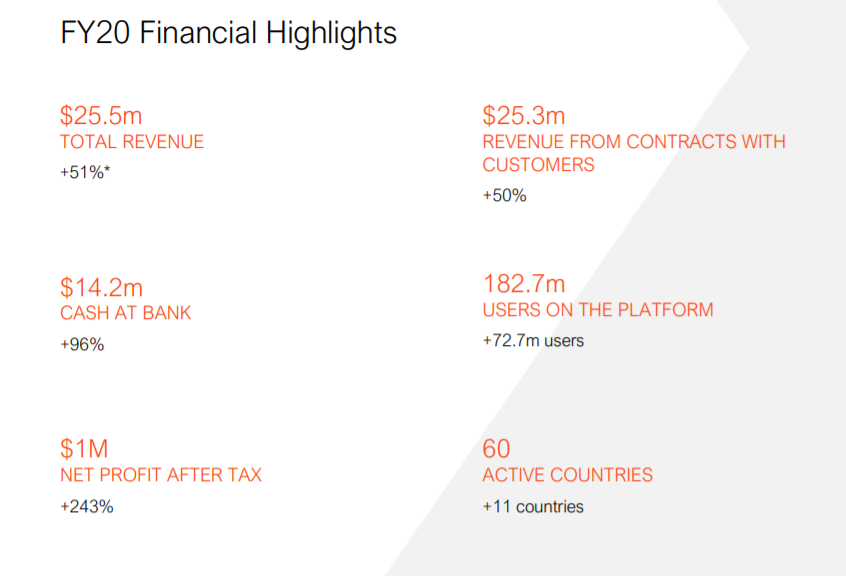

However, in their annual report, they announced that they had made a net profit. They had made more than the previous financial year, despite the pandemic hammering businesses hard.

Source: Plexure Annual Report 2020

Note: These results are to 31 March 2020.

An additional interim report showed a differing picture for the 6 months beyond to 30 September 2020:

Source: Plexure Interim Report to 30 September 2020

Even though revenue is still up on the same period last year, now we see the Company taking a heavy loss. And cash at bank declining 35%.

It is clear that the financial period beyond March 2020 has impacted the business. This may account for some investor concern on the rising stock price. And impatience for the business to achieve higher profits.

You must be eager to know what Plexure’s core business model is after that short explanation. There is always excitement when it comes to small-cap stocks, especially in small isolated countries like New Zealand.

What is Plexure’s business model?

Plexure connects brands with consumers. They do this by creating loyalty-based software applications for the businesses they have partnerships with.

For instance, Plexure integrates with apps used by…

- McDonald’s

- White Castle

- 7-Eleven

- Super Indo

The functionality and features of these apps depend on the business, but a lot of them use artificial intelligence to tailor and recommend special offers to a consumer.

Some of the offers could include buying multiple items to get a bulk discount.

Let’s take a look and dive deeper into some of the businesses that have a partnership with Plexure.

How have businesses benefited from partnerships with Plexure?

Let’s take a look at McDonald’s. It’s a name that everyone knows. It has dominated the fast-food industry for decades.

McDonald’s, in fact, owns a 9.9% stake in Plexure.

- Plexure’s app is integrated with many McDonald’s franchises around the world.

- Plexure has integrated their app into every McDonald’s franchise in Japan.

- Japan is the largest consumer of McDonald’s in the world, right behind the United States.

Plexure’s integration with McDonald’s is newsworthy and exciting.

However, a more interesting partnership might actually be one that Plexure has established with Super Indo.

Super Indo is one of the largest supermarket chains in Indonesia.

What I found fascinating about this partnership was that it happened around March to May 2020. This was right when the Covid pandemic was hammering everyone really hard.

Obviously, essential businesses like supermarkets remained open. However, it became the new norm of life for people around the world to start ordering their groceries instead of going into stores.

Plexure’s integration into the Super Indo app was a case of perfect timing. Customers could redeem attractive discounts, which encouraged them to increase their basket size of purchases by 55%.

Plexure achieved this by tailoring the app to the consumer’s needs. They personalise the experience to make customers buy more.

- For example, when you open Super Indo’s Plexure app, it pops up with a customised digital catalogue.

- This catalogue comes up with recipes on how to bake a cake or biscuits. It tells you what ingredients you need.

- On top of this, it guides you on how to choose the right food, depending on your dietary requirements. For example, vegan or gluten-free.

- In the app, they have a catalogue of pictures for a particular dietary requirement.

- From there, you can see what food items you need to get in order to make certain meals.

It’s quite clever how they are catering to everyone. This is because some vegan or gluten-free people may not know what food items are applicable for them.

Therefore, it makes sense that Plexure and Super Indo have been able to increase the shopping basket size of customers by 55%.

Plexure’s share purchase plan and ASX listing

From 13 to 20 November 2020, Plexure offered a share purchase plan in order to raise capital. The goal was to get publicly listed on the Australian Securities Exchange (ASX).

They were offering it at $1.20 per share — a 23% discount off the last closing price at the time, which was $1.55.

- Plexure only needed to raise $5 million.

- However, they raised in excess of $32 million.

- The Company exceeded the amount they needed in order to raise capital for further growth.

- Plexure listed on the ASX with the ticker code [ASX:PX1].

- This ticker code was also adjusted on the New Zealand stock exchange — [NZX:PLX] to [NZX:PX1].

What does the future look like after Plexure pulled back sharply on its stock price?

This chart on the NZX shows the movement of Plexure from January 2020 to February 2021:

As you can see, it showed a similar pattern to many companies here in New Zealand and around the world.

It dipped sharply in March 2020, when the Covid-19 pandemic was hammering businesses all around the world.

- Plexure has managed to recover and take off.

- It continued to climb, then dropped a bit after the share purchase plan offering.

- It then went up, and now it’s gone down even further.

- As of 1 March 2021, it is $0.87 per share on the NZX.

So, the big question is why?

Clearly, the interim loss for a supposed growth company has put some investors on alert. And since Plexure is focused on providing its app to retail businesses, there remains concern as to how well these businesses can recover following Covid.

Will the Plexure stock price recover?

Will the business and value of the stock grow further than what it was before?

McDonald’s, has in fact, still held the same percentage that they owned in Plexure. They achieved this by participating in the capital raise.

This is a good sign, not only because of the size and magnitude of McDonald’s, but it gives you the impression that they believe Plexure will continue to grow. McDonald’s wants to own a strong stake in the business that supports their discount app.

- The current forecast of revenue for Plexure in 2021 is $29.1 million.

- If this prediction is correct, then this revenue will be up 14% from the previous year.

- However, the concern is around profit.

- Even though the business grew revenue for the 6 months to 30 September by 23%, they still lost $4.4 million!

In the interim report, chairman Phil Norman stated that, given confidence in the Company’s growth prospects, they have taken a more aggressive approach to growth:

‘[We] have accelerated investment in our product portfolio and our technology capability during the first half. In particular, we have increased our use of Artificial Intelligence (Ai) and Machine Learning (ML) in the development of new products to ensure that we remain a leader of data-driven analytics to enable our customers to deliver highly relevant personalised offers to their consumers.’

Meaningfully, Norman goes on to state:

‘These investments are principally in people, thus our headcount through the half-year has grown from 139 at 1 April 2020 to 161 at 30 September 2020. Consequently, our cost base for the first half has grown by 79% and the net result for the period is an after tax loss of $4.4 million, which is in line with the Board’s expectations given our conscious decision to invest for growth…

‘The FY21 forecast net loss after tax loss is expected to be ($10.0) million, reflecting the investments the Company has chosen to make in headcount increases to support the expansion of its sales and marketing activities, its produce innovation and the required upgrading of its platform capacity to support much greater user numbers and activity levels.’

Well, this is fine, but it does create more risk for investors. The Company now has many more mouths to feed. Shareholders do not know whether these individuals will be skilful enough to meet the ambitious development plans.

Still, the revenue growth appears to be continuing, albeit slower. A concern is that while revenue now appears to only be growing around 14% or so — the cost base has increased 79%.

So we need to see some breakout contracts!

However, with Covid-19 affecting all these businesses, it’s quite remarkable that Plexure has managed to maintain revenue growth and have the confidence to push themselves to grow even further.

This is especially true when you hear stories of companies making 10% of what they did the previous year, due to the global impact of Covid.

Plexure continues to develop their software applications for the businesses they have partnerships with. On top of this, they are forming new partnerships with other companies. But we need to see more evidence that this growth can happen faster.

So, one can only speculate what the future for Plexure may hold. This is a sentiment that defines this stock. It is a small-cap tech business offering an app to other businesses in the dynamic and risky retail space, which is still recovering from Covid.

- Judging by recent drawdown on the stock price, many investors are nervous. And it is disconcerting to see the share price now lower than the equity raise.

- Investors must weigh their risk appetite, the Board’s ambitious plans, and the future speed at which Plexure can grow.

- One positive factor is that within the Covid recovery, a product offering discounts could be more attractive to cash-strapped customers.

- But with the cost base increase, we might need more of a revenue jump in order to see more security in the Company’s long-term prospects.

Regards,

Alistair Bilkey

Analyst, Wealth Morning

Important disclosures:

Alistair Bilkey owns shares in Plexure Group Ltd [NZX:PX1] via Wealth Manager Vistafolio.

Alistair is the Chief Technology Officer at Wealth Morning. An experienced developer, his responsibilities include the website, ecommerce and our WealthMail system. He is an investor and trader in his own right with a strong interest in high-growth technology businesses and cryptocurrency. He previously worked in web development and digital strategy with a leading local bank. Alistair is a shareholder of Wealth Morning.