2020 has sure been an interesting year all round.

Many questions have been asked:

- Where do I invest my money during the recession that we’re facing?

- What happens when bank interest rates fall below zero?

- Once the vaccine is rolled out worldwide, will we experience hyperinflation?

Some people believe that bitcoin could be the answer to these problems.

Without a doubt, you would have heard stories in the media about bitcoin’s progress this year:

- Bitcoin fell to an all-time low in March 2020 — to a price of around US$5,000 per coin.

- As of 29 December 2020, the price is now US$27,013.

- Yes, bitcoin is at an all-time high.

The factors encouraging the rise of bitcoin

Why did we see a price surge in December 2020? What drove the value of bitcoin above US$27,000?

I believe there have been a variety of factors that were going on throughout the year to cause this:

- Bitcoin had its latest block-reward halving in May 2020.

- Excessive government borrowing for stimulus have lowered interest rates and devalued local currencies.

- Bitcoin isn’t regulated and could be protected from hyperinflation.

- Bitcoin has been called digital gold and could been seen as a safe haven during times of economic turbulence.

- PayPal has allowed all US account holders to buy and sell cryptos, including bitcoin, with a US$20,000 a week limit.

Let’s explore these individual reasons, one by one, in more detail…

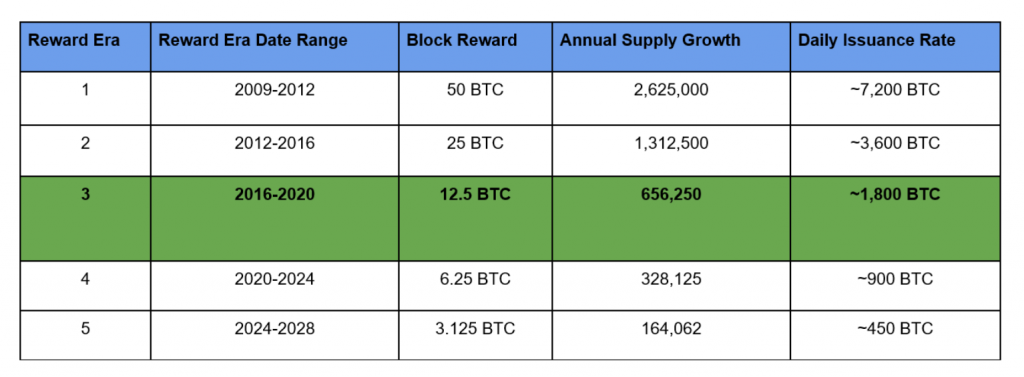

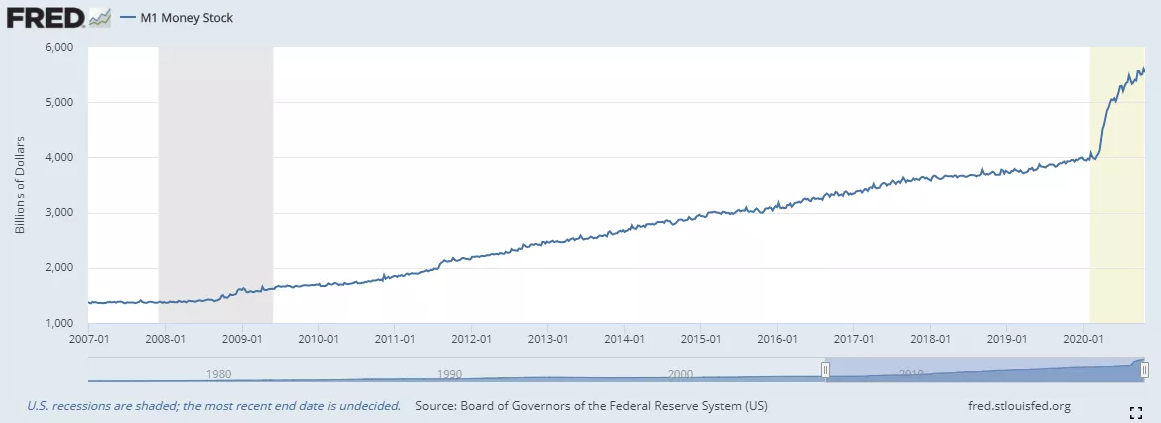

Bitcoin’s block-reward halving

Source: Medium

If you look at the two charts above, you will see that that bitcoin’s block-reward halving happened previously in 2012 and 2016.

Within two years after those events, the value of bitcoin increased by 7,976% and 2,902% respectively.

- In May 2020, bitcoin has halved again for the third time.

- The current reward for every block mined is now 6.25 bitcoin.

- This means that it is now twice as hard to mine and generate new coins to be put in circulation.

This scenario may encourage a further price increase for bitcoin.

As we say, past performance is not an indicator of future performance. However, it is fascinating to see what happens when there is less supply available for bitcoin.

Bitcoin has become more mainstream in 2020

Many businesses are continuing to adopt cryptocurrency every single day. Now we seem to see cryptos being offered everywhere as a payment option — on websites and retail stores.

One big shift happened on November 13. PayPal officially launched the ability for US users to buy and sell cryptocurrency, with a US$20,000 a week limit.

Source: Twitter

- PayPal is one of the most widely used platforms when it comes to transferring money, along with paying for goods and services across the world.

- As of 2020, there are currently 346 million active PayPal users around the world.

- 179 million of them reside the USA.

Not all active USA PayPal users will be buying, selling, and trading goods with cryptocurrency regularly. But even if small percentage of Americans use crypto —such as 1% — that still represents a huge proportion of people using crypto in their daily lives.

This will, without a doubt, have an influence on the value of cryptocurrency.

But PayPal implementing this is only the beginning. You never know. Soon enough, PayPal may be introducing it for account holders residing in Europe, then maybe the rest of the world.

Why bitcoin is considered a safe haven from hyperinflation

As many of you will be well aware of, the government has been borrowing money excessively for Covid stimulus.

Will this lead to inflation?

The risk is certainly there.

When there is an increase in the money supply, money becomes less valuable. Therefore, the price of goods and services becomes more expensive.

On average, inflation increases every year by roughly 2%.

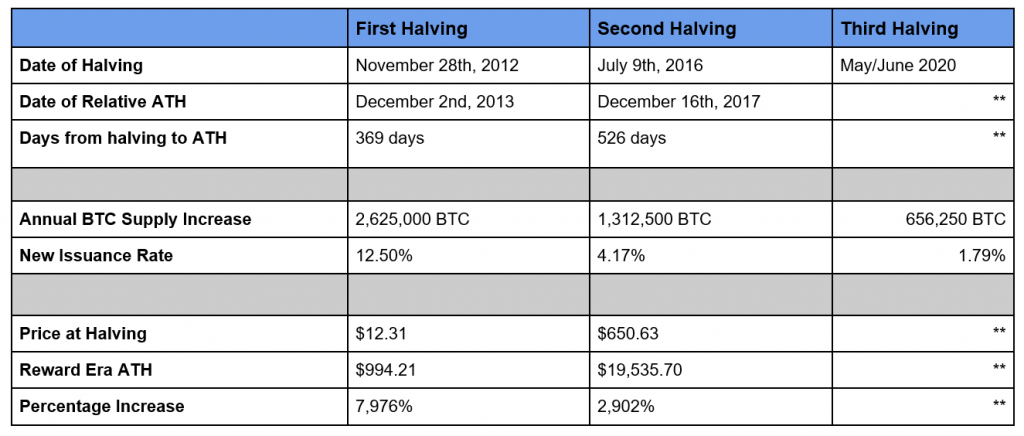

- If you look at this chart above, you can see how much the US government has been spending every year since 2007.

- The amount has been steadily creeping upward since the last recession in 2008/2009.

- Due to the global pandemic in 2020, there has been a steep increase in government stimulus — rising sharply from US$4 trillion to just under US$6 trillion.

The fact that government spending has increased by about 30% could be an early warning sign of hyperinflation in the foreseeable future.

Hyperinflation is when the price of goods and services increase rapidly to keep up with the pace of an increased money supply.

Often, during times of hyperinflation, many people buy stockpiles of goods. They fear that prices will grow much more expensive. So they want to save having to pay for them later.

This may lead to shortages of products. This could mean your daily essentials like food and household items.

As people hoard, daily supplies become scarce. The economy starts to fall apart. People lose their life savings. Traditional currency becomes worthless.

So, how is bitcoin protected from all this?

For starters, bitcoin is not regulated. It hasn’t got any central authority. There is no government control.

- The way that the protocol is built, you can’t just increase the supply of bitcoin.

- There has been a cap set on bitcoin for its total circulating supply to not exceed 21 million.

- This means bitcoin can never increase its maximum circulating supply.

Also, as I have mentioned above, bitcoin’s block rewards halve once every four years. This is so that bitcoin can keep up with the rate of inflation. The bitcoin supply is set to decrease, not increase. Therefore it won’t lose its value, and it will still be a very valuable asset.

What the future looks like

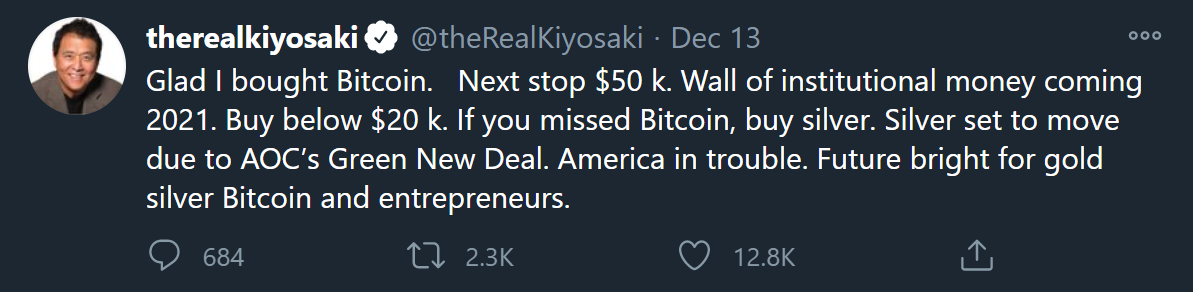

Bitcoin has already surpassed US$20,000 per coin. Some commentators have suggested that this cryptocurrency could climb even more, potentially hitting a value of $50,000.

Source: Twitter

Is this possible? Or is it just pure speculation?

For now, it’s still a case of wait and see.

I think there is a bit of a herd mentality when it comes to people protecting their wealth during times of economic turbulence. Despite the risk and volatility of bitcoin, some people appear to be willing to treat it as digital gold; a digital safe haven.

Where we go from here is anyone’s guess.

Regards,

Alistair Bilkey

Analyst, Wealth Morning

(Disclaimer: this material is provided for example purposes only. It should not be construed as investment advice. The opinions expressed are the personal views and experience of the author, and no recommendation is made.)

Important disclosures:

Alistair Bilkey owns Bitcoin (BTC).

PS: As part of our Vistafolio Wealth Management Service, we can invest in a cryptocurrency trust on request. This allocation strategy is part of a balanced portfolio which we professionally manage for Eligible and Wholesale clients. Click here to find out more.

Alistair is the Chief Technology Officer at Wealth Morning. An experienced developer, his responsibilities include the website, ecommerce and our WealthMail system. He is an investor and trader in his own right with a strong interest in high-growth technology businesses and cryptocurrency. He previously worked in web development and digital strategy with a leading local bank. Alistair is a shareholder of Wealth Morning.