The a2 Milk Company [NZX:ATM] is a Kiwi brand founded in 2000 by Dr Corran McLachlan and Howard Paterson.

They first rose to prominence when they investigated the effects of the A1 β-casein protein. Their research drew an apparent link between the protein and potential health problems.

Generally speaking, standard milk on the market contains a large proportion of both the A1 and A2 β-casein protein. The a2 Milk Company has narrowed this down by using a patented genetic test to identify cows producing the A2 protein.

In theory, this allows the company to market milk containing only the A2 protein. However, to be pedantic, it should be noted that there have been studies that show there are still traces of the A1 protein within their product, but a negligible amount.

Despite this, a2 Milk has leveraged its unique reputation to reach rock-star status. It posted a stock return of over 1,000% between January 2016 and July 2020.

Source: Google Finance

Certainly, it’s proven to be a dream run, but lately, the company appears to have hit a speed bump.

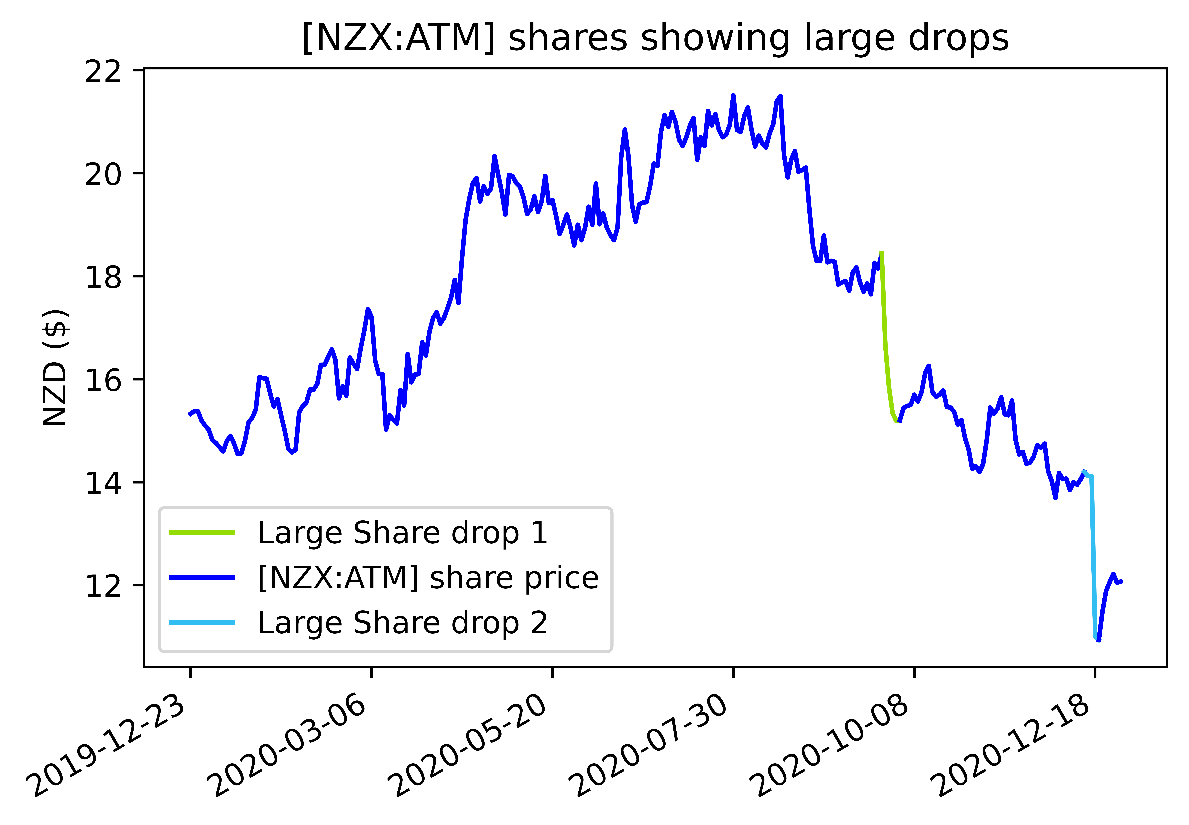

Currently, we have seen two large drops in the a2 Milk share price since August 2020, coupled with a steady downward trend. Economic and political headwinds appear to be hitting the company hard.

Is a2 Milk still worth investing in? Are the company’s best years already behind it? Or is there still value and growth to be found here?

Let’s find out.

Why makes a2 Milk different

How does the company stand out from its competitors?

The science behind their milk formula explains it all.

The protein in bovine milk is 80% casein. 30% of this is a specific type called β-casein, which forms A1 and A2 forms in milk. You can guess where a2 Milk got its name — its milk contains only the A2 β-casein protein.

There have been epidemiological studies that suggest a link between the A1 β-casein and chronic diseases, increased gastrointestinal inflammation, and decreased cognitive processing speed.

Studies also show, with moderate certainty, there is adverse digestive health effects due to the A1 β-casein as compared to the A2 β-casein.

It should be noted that this area of research is still being investigated. Conclusions drawn now may change in the future. Regardless, a2 Milk’s formula is promoted to be more beneficial for health than standard milk formulas.

Market competitors

Is a2 Milk’s formula unique in the current market? Who else sells A2-type milk?

The company sells largely in Australia, New Zealand, China, and North America.

- Australia is their most well-established market, with few competitors there.

- Currently, in New Zealand, one competitor is Fresha Valley. This is a small company based in Northland, producing A2 β-casein focused milk. But others are emerging, such as Jersey Girl Organics.

- Meanwhile, in China in 2019, Junlebao Dairy Co., Ltd. launched an A2 β-casein milk powder. For the first time, a2 Milk is facing a domestic competitor in China.

It is possible that Chinese consumers could favour the domestic Junlebao product over the New Zealand import. This could pose a risk to profit margins in the Chinese market.

However, the memory of the Sanlu milk scandal in 2008 still holds sway over the public imagination. Back then, over 300,000 children reportedly suffered kidney complications as a result of Chinese milk tainted with melamine.

Because of this lingering fear, the majority of Chinese consumers may still be attracted to New Zealand’s clean, green image. This is a key moat advantage that a2 Milk can continue to cultivate, if they play their cards right.

The current climate in the share market

The a2 Milk Company has seen a steady decrease and two sharp drops in share price over the last three months.

- On 25 September, they experienced their first large drop in share price. This happened after their announcement that Victoria, Australia being in a stage 4 Covid lockdown had affected reseller sales.

- On 18 December, they experienced their second large share drop. This happened when they made another announcement that lower sales were anticipated for 2021.

- It’s important to note that significant sales in Australia come from Chinese international students and tourists. This has been adversely affected by the ongoing Covid situation.

- Moreover, growing tensions between China and Australia could also explain the steady decreasing trend as investors start seeing a2 Milk as a riskier investment.

These large share drops are likely due to lower investor confidence in the company.

Before a2 Milk’s first announcement, they had a P/E of 26.99. But, as of now, the P/E sits around 23.53. The lower P/E supports our view that this could be due to lower confidence.

Mathematical forecast and analysis

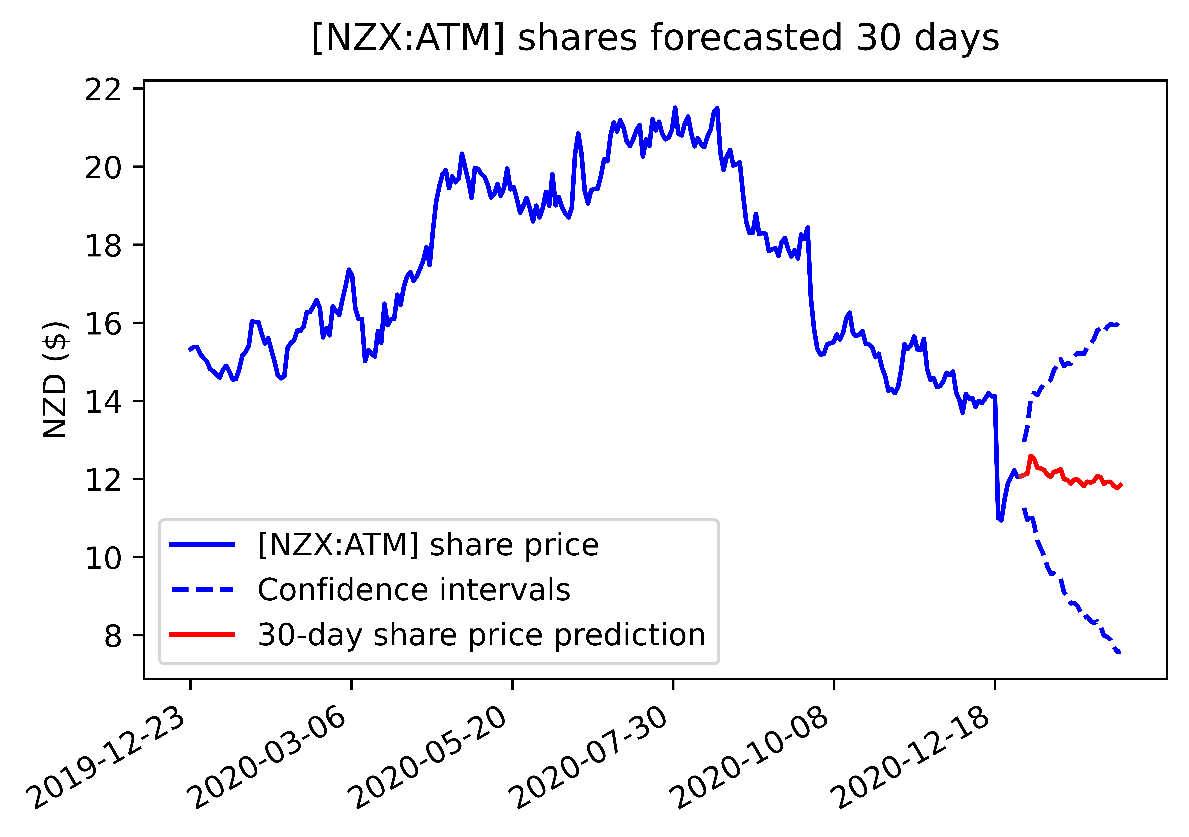

We have forecasted the share price for 30 days by using previous share data over the past year.

In New Zealand, the company lacks significant competitors in the market that sell milk without the A1 β-casein protein. This allows them to stand out as innovative.

On the other hand, the Chinese company Junlebao Dairy Co., Ltd. is something to keep an eye on. This emerging company could pose significant competition for a2 Milk in China.

Due to Covid affecting the sales of the company in Australia, we saw investor confidence drop. This is seen in the lower P/E ratio and large dips in share price following negative announcements by the company.

Is a2 Milk still worth investing in?

As a short-term investment, it feels speculative, at least while Covid is still around. This is supported by our 30-day forecast, which shows the share price not likely to increase significantly in the near future.

On the other hand, there is good potential in a2 Milk as a long-term investment. They hold an innovative stance in the market, with their milk being promoted as having health benefits over standard milk. As the threat of Covid subsides, the negative impact on the company’s key markets could subside.

In any case, we should observe how tensions between Australia and China develop. This may have longer-lasting effects on the company’s performance.

Regards,

John Bailie

Analyst, Wealth Morning

(Disclaimer: this material is provided for example purposes only. It should not be construed as investment advice. The opinions expressed are the personal views and experience of the author, and no recommendation is made.)