It’s happening again. Another surge.

Some cryptocurrencies have spiked in value this past week.

Did you watch it happen? Were you on the edge of your seat? Were you thinking, ‘Is this another crypto boom?’

It certainly got my attention.

Bitcoin was originally sitting around US$10,000 per coin — before suddenly rising and peaking at nearly US$12,000. All this happened within the space of a week.

Ripple seemed to follow a similar pattern. It jumped from US$0.21 to a high of US$0.32.

So why did this happen?

Was it unnecessary hype?

Or are we seeing another 2017 in the making?

Why have some cryptocurrencies taken a sharp turn?

The global pandemic is almost certainly a factor. In times of crisis, people usually turn to gold — or digital assets like cryptocurrency.

They are fearful of hyperinflation. So they want to hedge against it — which is why Bitcoin, Ripple, and other cryptocurrencies have seen increased popularity.

But that’s not the only reason why cryptos are booming.

Two other factors are coming into play:

- The Bitcoin halving in May 2020 may be creating a surge in demand over next 24 months.

- Visa and Mastercard have also made bold statements this past week, which suggest a mainstream adoption of crypto.

Visa and Mastercard

It’s hard to believe how much things have changed.

In the past, payment-processing titans like Visa, Mastercard, and PayPal have usually taken on an anti-cryptocurrency stance.

They have objected to crypto for these reasons:

- Volatility

- Anonymity

- Lack of financial regulation

However, recently, it appears that Visa and Mastercard have softened their position. They have been actively reaching out to cryptocurrency exchanges. Looking to do partnerships, mainly by providing crypto users with the ability to take advantage of debit-card services.

Last week, Visa made their biggest move yet — releasing a statement that hinted at further development of their crypto programme.

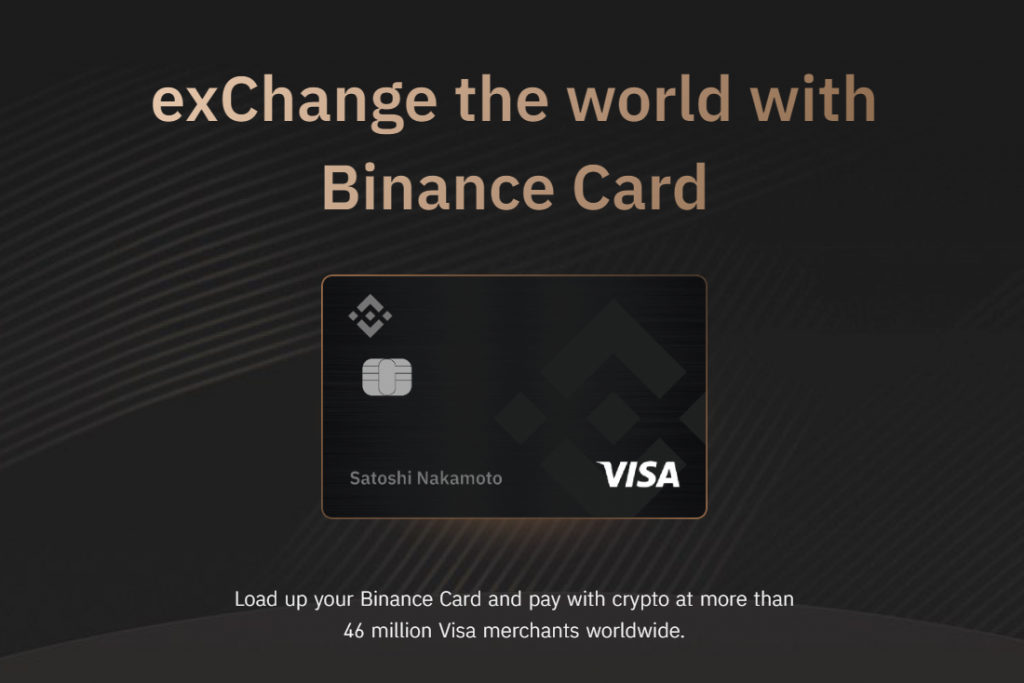

Binance — one of the largest crypto exchanges — has already partnered closely with Visa. They have introduced the Binance Card.

The Binance Card is just like a normal debit card. However, instead of being issued by the bank, it’s issued by Binance.

Here’s how it works:

- Simply top-up your card via the Binance app.

- When making a payment, Binance will automatically deduct all the expenses associated with the payment from your Binance account.

- You will no longer need to sell your crypto on Binance in order to pay for bills and goods.

Could more exciting developments like the Binance Card be on the way?

It certainly feels like it.

Visa has already filed for around 24 blockchain patents. Mastercard has gone even further — filing for 80 patents.

There appears to be a very promising future for mainstream adoption of crypto. We might even be using crypto to pay for our everyday goods and services sooner than we think.

What will mainstream crypto adoption look like?

Many big companies have already adopted Bitcoin and other cryptos as a payment option:

- Microsoft

- Subway

- Newegg

And that is only to name a few.

In addition, cryptocurrencies like Ripple can already process a transaction within seconds. It’s actually faster than what you see being done with existing Visa or Mastercard payments.

A crossover between crypto and traditional payment processing seems like the next logical step. A hybrid approach that combines accessibility and convenience.

I believe that once companies like Visa and Mastercard fully adopt crypto, mainstream acceptance will follow naturally. And we will start seeing cryptocurrency payments being used by everyone across the globe.

It’s not a matter of if. It’s only a matter of when.

Regards,

Alistair Bilkey

Contributor, Wealth Morning

PS: Looking to understand crypto and other financial trends happening around the world? Subscribe to our Wealth Talk podcast today get exclusive insights into what might be coming next.

Alistair is the Chief Technology Officer at Wealth Morning. An experienced developer, his responsibilities include the website, ecommerce and our WealthMail system. He is an investor and trader in his own right with a strong interest in high-growth technology businesses and cryptocurrency. He previously worked in web development and digital strategy with a leading local bank. Alistair is a shareholder of Wealth Morning.