Blink and you might just miss it.

Cryptocurrencies like Bitcoin, Ripple, Litecoin, and Ethereum have rocketed up in value this past month.

I believe this is all due to the coronavirus outbreak.

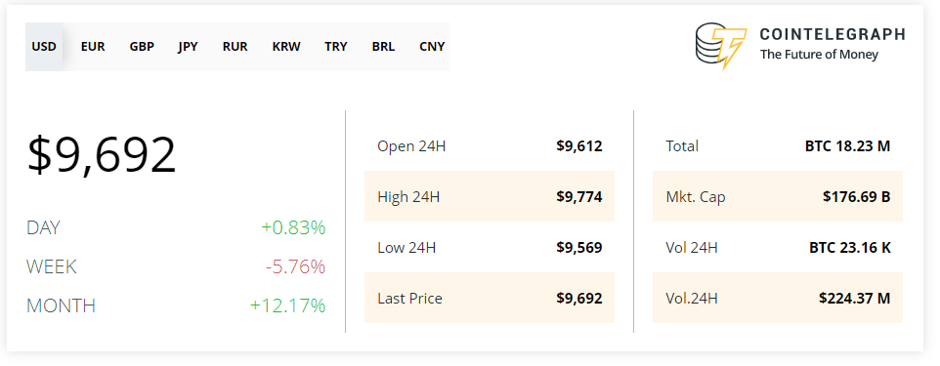

Bitcoin price as of 22 February 2020. Source: Cointelegraph

Bitcoin, in particular, has performed well this past month.

This is happening as we see scary headlines unfold — travel bans, trade slowdown, economic uncertainty.

Will the coronavirus continue to push up the value of Bitcoin?

China is one of the world’s largest trade exporters. As this outbreak spreads, most countries have stopped importing food, parts, and material from China.

This supply-chain issue has had a domino effect on everyone.

For example, let’s imagine the impact on your average steel-manufacturing business. They will have to stop importing steel. They’re seeing less demand for buildings made with steel. They may have no choice but start laying off workers to cut costs.

When you multiply this scenario many times over, you will start to understand how damaging this outbreak has been on the global economy.

As banks and stock markets coming under pressure, people tend to move their investments into safe havens. Digital assets like Bitcoin seem like a credible alternative.

This has caused the cryptocurrency to surge as the coronavirus outbreak spreads.

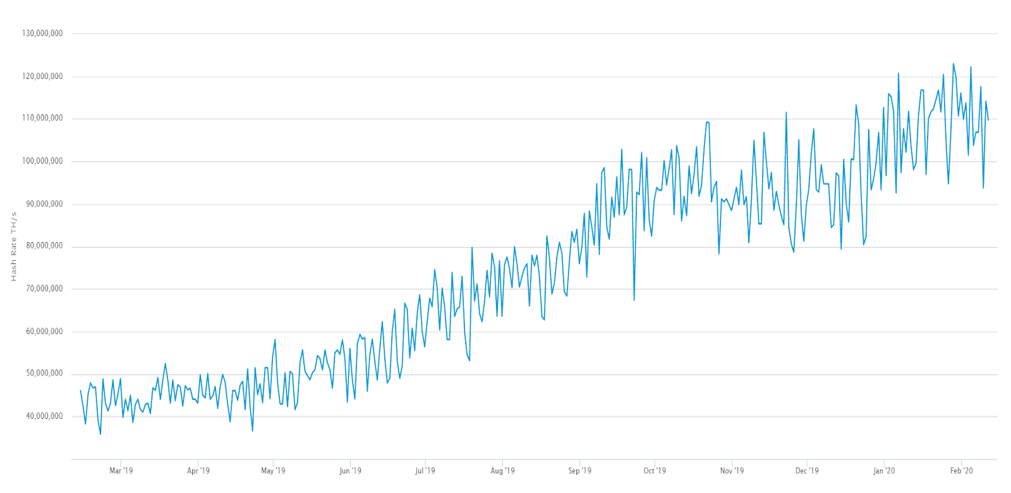

How is the Bitcoin network carrying on?

The blockchain is an important part of the Bitcoin network. You need computers to act as miners on the blockchain to confirm transactions.

At the moment, China has around 65% to 70% of the world’s Bitcoin mining pools. This represents two-thirds of global supply.

With such concentrated numbers, you might assume that the coronvirus would negatively affect the Bitcoin network.

After all, many Chinese cities are currently in quarantine lockdown. This leaves many factories vacant and unable to operate. So, as a consequence, this limits the supply of computers needed for Bitcoin mining.

Bad news?

Well, maybe not.

So far, against the odds, the Chinese network seems to be remarkably resilient. It doesn’t seem to be severely affected by the coronavirus.

Source: Cointelegraph

Why is Bitcoin holding its own despite the challenging conditions?

There are two reasons for this:

- In May 2020, the block reward for Bitcoin is expected to halve. This will boost demand. Effectively, this means that the reward for mining a block will be half of what it used to be over the past 4 years.

- The Chinese lockdown could spark an opportunity for miners based internationally. There will be less competition. So international miners could be rewarded more than usual for their activities.

It appears that the Bitcoin network will remain stable despite the coronavirus outbreak.

What if scientists discover a cure for the coronavirus?

Let’s think about this positively. Sooner or later, a vaccine will be developed and distributed. Quarantine measures will be lifted. This feared outbreak will come to an end.

What happens then?

Well, the answer is pretty simple.

We’ll see factories in China and around the world go back to normal. It’ll be business as usual. And we’ll see new computers being manufactured and rolled off the assembly line, designed specifically to mine Bitcoin.

Yes, calm and order will be restored.

As the block-reward halving comes into force, the blockchain network could, in theory, perform better than ever. This might just attract even more investors to jump on board. There will be more demand; less supply.

Should you use this as a chance to jump into Bitcoin?

Be warned, there’s a high level of risk involved. Once the coronavirus outbreak comes to an end, the current surge for cryptocurrency may falter as well.

Cryptocurrency may no longer be seen as a safe haven. Investors will ease off and return to investing in the regular stock market.

It’s still pretty much a case of wait-and-see. The next few months will be crucial for the future of Bitcoin and cryptocurrency.

Regards,

Alistair Bilkey

Contributor, WealthMorning.com

Alistair is the Chief Technology Officer at Wealth Morning. An experienced developer, his responsibilities include the website, ecommerce and our WealthMail system. He is an investor and trader in his own right with a strong interest in high-growth technology businesses and cryptocurrency. He previously worked in web development and digital strategy with a leading local bank. Alistair is a shareholder of Wealth Morning.