Everyone loves the idea of cash. It’s highly liquid and easy to convert. And that’s what bitcoin is — it’s essentially cash but on a digital spectrum.

Bitcoin is used to make payment transactions over the internet. Its purpose is revolutionary, which is why it has taken the world by storm.

Even if you don’t have a big interest in the cryptocurrency space, you’ve almost certainly heard about the excitement surrounding bitcoin.

Bitcoin has gone through phases where it has reached extreme highs in its price:

- In 2013, a single bitcoin was US$994.21

- In 2017, it hit US$19,535.70

That’s a massive surge of almost 2000%. Incredible.

So…what is the reason behind this? Could it happen again?

Many things have happened in the bitcoin space. Not only has many businesses adopted bitcoin as a payment option, but every 4 years, something significant happens — bitcoin halves the block reward given to miners.

Bitcoin block rewards

Bitcoin mining happens when a person uses their computing power to confirm blocks of transactions taking place between Person A and Person B.

Every time a person initiates a bitcoin transaction, a block gets created.

This block contains information, like the bitcoin addresses of the sender and receiver, as well as how much is being transmitted.

Each block gets verified by thousands of computers, which are known as miners. Every miner gets rewarded in bitcoin for each part of the block they mine.

The block reward is drawn from what is left in the pool. This is known as the circulating supply. As of 18 December 2019, there are 2,892,613 bitcoins left to mine.

Currently, as of 2019, a block reward is 12.5 bitcoins. This means that for every block mined, 12.5 bitcoins will be distributed to all of the miners who have contributed.

However, as of May 2020, the block reward will drop to 6.25 bitcoins. Effectively, block-mining is getting harder and more exclusive.

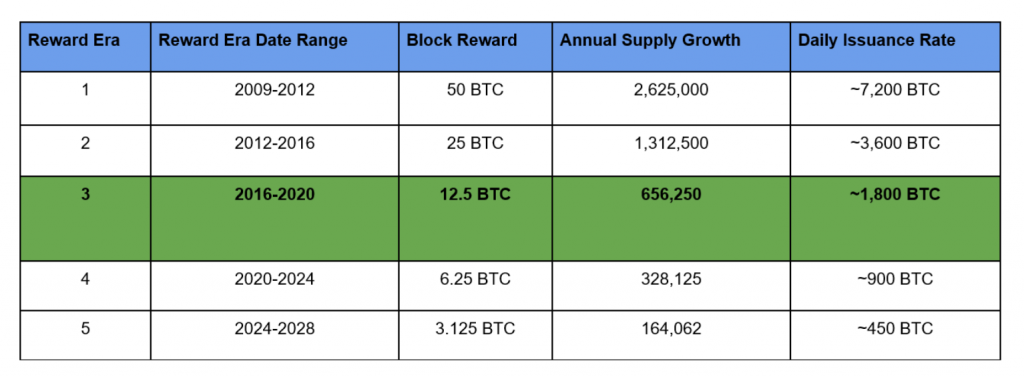

This happens because, every 4 years, the block reward halves. The image below shows past, present and future halvings:

Source: Medium

Bitcoin’s next block-reward halving in May 2020

So…why does the block reward get halved every 4 years?

This has been put in place so that bitcoin can keep up with the rate of inflation.

If there are too many bitcoins being generated too quickly, then there will be too many in circulation. As a result, each bitcoin will hold very little value.

What will happen when halving continues?

The next step

There are several theories on this, based on bitcoin’s history.

In the early years, directly after the block reward halves, the price of bitcoin usually increased by a small amount. However, over the past 12-24 months, the price dramatically increased.

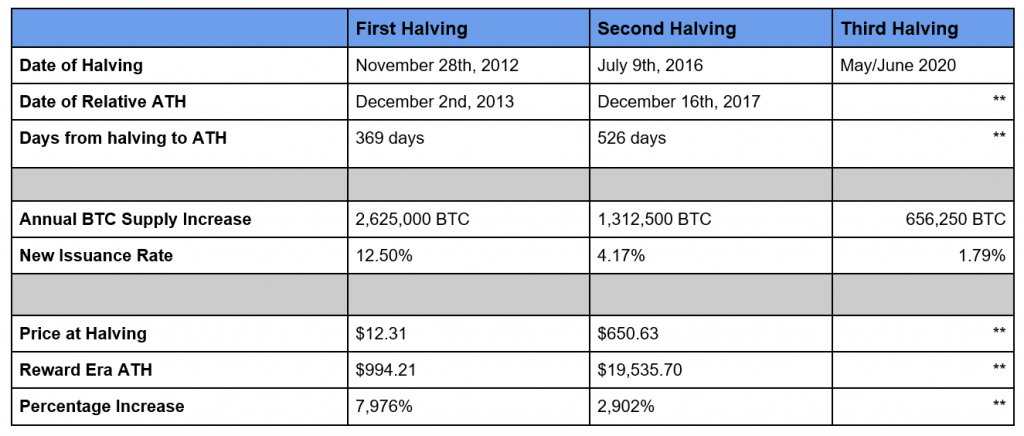

In 28th November 2012, when bitcoin first halved, within 13 months, the price went from US$12.31 to US$994.21. That’s a 7,976% increase in value.

In July 9th 2016, during its second halving, within 17 months, bitcoin went from a value of US$650.63 to US$19,535.70. That’s a 2,902% increase in value.

Source: Medium

Some analysts say the price increases have happened due to various factors — the Cyprus bailout, new businesses adopting bitcoin, as well as the general bullish sentiment on crypto.

Nonetheless, most analysts would agree that because of the block-reward halving, there will be even a shortage of supply of bitcoin. This is bound to increase the price at some point.

What is the future for bitcoin in 2020?

Bitcoin could have great potential once the block reward is halved after May 2020.

There will be less bitcoins in circulation, which will create more of a demand. This will be fuelled by businesses continuously adopting bitcoin as a payment option.

If its past trajectory is anything to go by, the price of bitcoin may well go up. The only question is by how much?

When May 2020 comes around, you can be sure that many people will eyeing bitcoin with feverish anticipation, seriously considering whether it’s a good investment.

Of course, past performance is no indicator of future performance. But right now, the stars do seem to be aligning for bitcoin, despite the heightened level of risk involved.

Regards,

Alistair Bilkey

Contributor, WealthMorning.com

Alistair is the Chief Technology Officer at Wealth Morning. An experienced developer, his responsibilities include the website, ecommerce and our WealthMail system. He is an investor and trader in his own right with a strong interest in high-growth technology businesses and cryptocurrency. He previously worked in web development and digital strategy with a leading local bank. Alistair is a shareholder of Wealth Morning.