On 16th December 2019, many of you saw cryptocurrencies plummet in price.

In just three days, bitcoin lost $20 billion in market capitalisation in a period. The value per-coin fell to around US$6,500, before making a steady recovery to over US$7,000.

Many experts believe the price drop was due to the PlusToken platform (valued at $2 billion) dumping its cryptocurrency.

Pump and dumps like these can happen and are pretty common in cryptocurrencies. In order to shield portfolios from manipulative tactics, investors try to diversify and HODL their portfolios long-term so they don’t panic-sell.

A Chinese Ponzi scheme

PlusToken has hit the spotlight after a significant amount of cryptos were withdrawn into the wallets of scammers. This involved US$302 million worth of bitcoin, and US$102 million worth of Ethereum.

The price of cryptocurrencies fell, as scammers sought to withdraw up to $2 billion dollars’ in value that had been accumulated in PlusToken over the years.

How did PlusToken become so popular?

PlusToken was an investment programme with an unusually high yield. It offered a massive return on investment — around the 9% to 18% mark.

The founders of PlusToken claimed that funds invested would be put towards the development and marketing of new crypto products. For example, they hyped up the PlusToken wallet, which promised to be a lucrative game-changer in the market.

However, in a sly twist, PlusToken scammers lured victims to use their platform through a three-stage process:

- A pool of funds would be set aside to pay off initial investors with early returns.

- This helped build trust and legitimacy.

- Unsuspecting victims would be sweet-talked into investing more of their money.

Yes, lather, rinse, repeat. This was a typical Ponzi scheme.

PlusToken’s popularity was further boosted by additional sweeteners:

- A good referral programme which gave extra bonus payments to users who had referred other people into the scheme.

- PlusToken users were put into several tiers, based on how many people they had referred, along with how much they had already invested.

- PlusToken promoted itself heavily at business meetups and conferences to create awareness of the platform.

Who’s behind PlusToken?

Things started to turn sour in June 2019.

Many of PlusToken investors started experiencing delays in making withdrawals. Complaints about the platform spread rapidly on Chinese social networks.

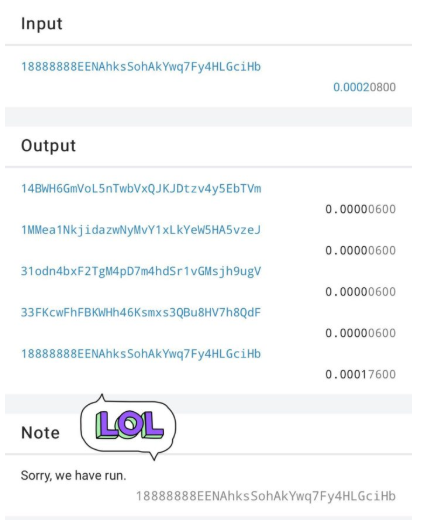

Sensing that their game was up, the scammers started moving funds immediately. They even made cheeky transaction comments, saying, ‘Sorry, we have run.’

Source: BoxMining

On 29th June 2019, law enforcement was able to chase down six of the suspects involved in PlusToken. They did this by tracking the vast amounts of crypto payments moving from wallet to wallet before being cashed out on foreign exchanges.

Believe it or not, the suspects had fled to Vanuatu. But they did not get far. They were promptly caught and extradited back to China for trial.

Source: Twitter

At the time of writing, the story is not yet over.

December has seen yet more dumping of crypto funds happen. This can only mean that more PlusToken suspects are still on the loose.

So…the plot thickens.

How will this crypto heist end?

Regards,

Alistair Bilkey

Contributor, WealthMorning.com

Alistair is the Chief Technology Officer at Wealth Morning. An experienced developer, his responsibilities include the website, ecommerce and our WealthMail system. He is an investor and trader in his own right with a strong interest in high-growth technology businesses and cryptocurrency. He previously worked in web development and digital strategy with a leading local bank. Alistair is a shareholder of Wealth Morning.