New Zealanders have a debt problem.

In the past seven years, household debt has skyrocketed…Kiwis are spending more money that they don’t have. It’s a signal to economists that the foundations are shaky.

It’s also not hard to see why borrowing is going through the roof — property prices.

Houses cost more. People have to borrow more to buy them. Wages are growing more slowly than house prices. The result? Ballooning debt.

That’s not all bad, right?

People need homes, after all…and with today’s low interest rates — why not?

But the problem with debt, especially mortgage debt, is that it only pays off if everything goes well for the next 30 years. It’s the homebuyers betting on the market. That their return on investment outweighs the cost of the debt.

Sometimes, however, there are hiccups. There are market crashes. Interest rates increase. There are unexpected medical events.

When this happens, a house can quickly turn from an affordable, long-term investment into a savings-draining ball and chain.

The key is to borrow within your means.

In other words, give yourself a cushion…so if something unexpected does happen, you have the financial capacity to stay afloat.

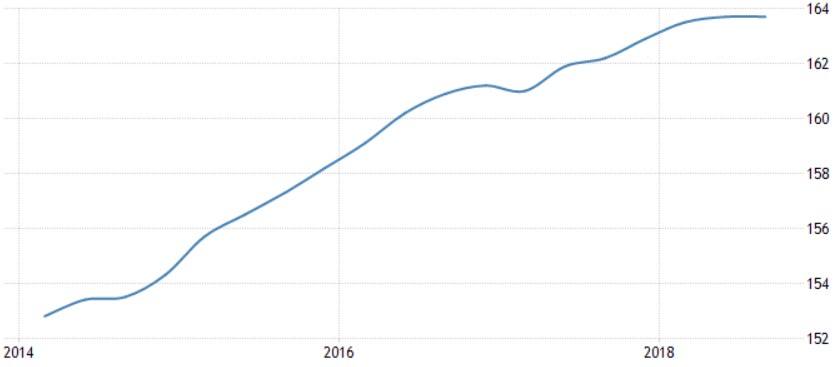

According to RBNZ data, Kiwis are doing a terrible job of that. Between 2014 and 2019, household debt as a percentage of income has jumped from 153% to 164%.

|

Source: TradingEconomics.com | RBNZ Data |

For reference, the Eurozone has an average debt-to-income of 94%.

What does this mean?

Kiwis owe a lot and make a lot less. It locks them up in a long-term pattern of servicing that debt…and reduces their ability to react to market events.

In other words, debt makes you vulnerable to crashes.

You have less room to cut back on your spending because you’ve got to service that debt no matter how the market performs.

For some, they considered that when they decided to take on debt…and built in a cushion. They borrowed less than they could afford. So if things get rocky, they still have some room to breathe.

It’s a lot like driving a car.

Personally, I’m a speed demon. I love the sound of a big engine revving…the pistons pumping…the tyres screeching. When I see open road ahead, I hit the pedal to the metal.

And so far, it’s worked out okay…but only because I’ve been lucky that a tourist or a sheep hasn’t jumped out in front of me. That oncoming cars stayed in their lane. That there hasn’t been an oil slick or a rock in the road as I peel around a corner.

But let’s say a lamb does wander into the road one day…and I come screaming down towards it. Because I’m moving so quickly, I won’t have time to stop. If I try to swerve away, I could fly off the road into a tree. Most likely, I’d have to plough straight into the poor animal…and have the front end of my car crumpled in.

Someone else going an appropriate speed would simply come to a stop…and easily drive around.

By driving more slowly, they’ve given themselves a much greater capacity to react when something unexpected pops up.

It’s the same thing with borrowing.

When you borrow like a madman and load up as much debt as the bank will give you…you’re giving yourself less room to manoeuvre down the road.

While someone who only borrows comfortably within their income has plenty of flexibility if something pops up.

Today, Kiwis have very little breathing room.

And if the market’s vulnerabilities come to a head (Which we’re overdue for by most economic theories), then it could get a bit tricky.

The simplest result is bankruptcy.

If people can’t pay off their debt, they go bankrupt.

If a company can’t pay off its debt, it goes bankrupt.

If a government can’t pay off its debt, it goes bankrupt.

Right?

Well, as you know, governments can simply borrow more to stay afloat. My home country of the United States is a prime example.

Companies can be bailed out. I remember Lockheed Martin, GM, Chrysler, and others deemed ‘too big to fail’.

Borrowing more and being bailed out are unsustainable solutions, but they can keep you on life support for a while.

But here’s the thing — while the government has easy access to emergency cashflow…and big corporate has the state at its back…individuals like you and I are mostly on our own to survive downturns.

We’re left to our own devices to work out a solution…and with heaps of debt hovering over us, we don’t have many options.

It’s a scenario that the IMF warns could have explosive consequences if it plays out. Here’s what the IMF stated in a recent overview of New Zealand’s economy:

‘Household debt remains high under the baseline outlook and would amplify the impact of large downside shocks, notwithstanding recent improvements in its risk structure after macroprudential policy intervention. Such shocks could also trigger a disruptive housing market correction.’

Amplified shocks triggering market-wide corrections. It’s not a pretty picture.

But it is a very real threat to you and your wealth right now.

Perhaps you’re vulnerable and you have debt up to your eyeballs. Consider stress-testing your financial future…see how you’d fare if things go south. If your stability cracks under the stress, it might be a good time to consider focusing your efforts on paying off some of your debt burden.

Best,

Taylor Kee

Editor, Money Morning New Zealand

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.