How do you get home from work?

Car? Bus? Ferry? Bicycle?

The truth is, there are more viable transportation options available to the average Joe today than at any time in history.

I have just realised that, from my office in Auckland, I can take no less than nine different types of transportation to get to my home.

Nine!

So, naturally enough, I’m curious…how do they stack up?

I have picked seven of the most realistic ways and measured them against each other. I’ve used the distance between my office in the PwC Tower in Auckland to SEA LIFE Kelly Tarlton’s to the east. That’s 5.5km along Quay Street and Tamaki Drive.

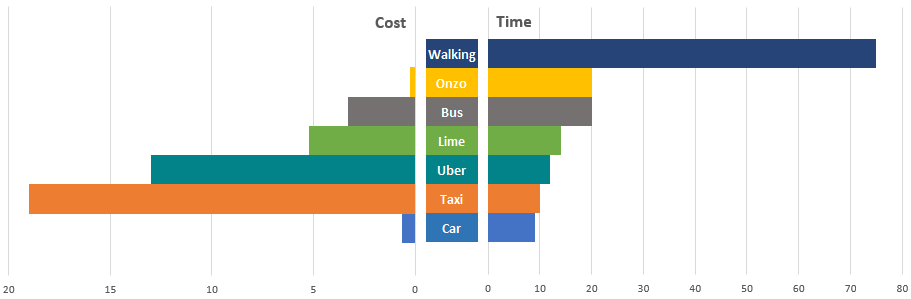

Here’s how they compare in terms of cost and time:

|

Source: Taylor Kee |

The seven options are walking, Onzo bicycle, Lime scooter, Uber, taxi, bus or via my own car.

First — walking is free, but it costs over an hour of your time.

If you value your time as anything more than $1 per hour, you’d be better off taking an Onzo bike…which only costs 25 cents per 15 minutes.

Or if you happen to have a HOP card and it’s a sweltering day, you could opt for a public bus with air con for $3.30.

Then the next tier down is where I was surprised.

Lime scooters are a pretty good option. Just a tad more expensive than the bus, but faster. It’s a solid middle-of-the-road option…and if you don’t have a HOP card, it’s actually both cheaper and faster than the bus.

Then, for a marginally better arrival time, you could take an Uber. But you’ll pay over double the price.

Worth it for the air con, music and comfort? Possibly. And if anyone’s with you, the odds quickly flip to Uber’s favour. Three passengers in an Uber is about the same cost as three on the bus, but an Uber is significantly faster and more convenient.

The most expensive option is the taxi.

From the PwC Tower, it’s a tad quicker than an Uber, but only because there’s always a line of taxis just outside the lobby. If you work somewhere without taxis out front, it could be quicker to call an Uber instead.

And at almost $19 for the 5.5km trip, it’s hard for me to rationalise taking a taxi over anything else. I could ride a Lime scooter there and back for less than a one-way taxi ride.

And, lastly, I included the cost of taking my car. With the current price of diesel, it’d cost about 64 cents to drive to Kelly Tarlton’s from the PwC Tower.

Now, you might see the car option and wonder why it’s so cheap. I reckon most folks already have a car. Since they’re ‘sunk costs’, I didn’t include insurance or purchase price — just the price of diesel for a 2018 Ford Ranger.

So it’s not really fair, but for most folks, it’s their number one option…so I threw it in anyways. [openx slug=inpost]

Removing my car from the equation, we can make a couple general conclusions:

- The longer it takes, the less it costs.

- The greater the cost, the smaller the marginal time improvement.

And interestingly:

- The greater the cost, the worse the impact on the environment.

For the most part, we already knew all of this to be true.

There’s a link between time and money. To save time, you normally have to spend money.

What ‘sharing economies’ like Lime, Onzo and Uber have done is offer you more options in the middle. They give people greater flexibility in terms of time and money to find the optimal way to get from A to B.

And for that, I applaud them.

However, in the investing world, folks aren’t quite sure what to do with these kinds of companies. Uber and its American competition, Lyft, are both racing to IPO next year…and financial commentators are in a tizzy.

Some value Uber at $120 billion; Lyft a lot less at $15 billion. Both are wild valuations given that neither company holds many discernible tangible assets at all. It’s software, mostly.

Lime and Onzo are a bit different, though. They have assets — their bikes and scooters — but not much in terms of staff. They reward people for recharging and placing their products around the city for them.

To run their businesses, each of these companies tap into the capital of the public.

Uber and Lyft do it with people’s cars.

Lime and Onzo do it with people’s labour.

Just like how AirBnB and Couchsurfing do it with people’s homes.

Or eBay and Trade Me with people’s stuff.

It’s a new world. One where everything you own can be turned into a productive asset…and the innovator who figures it out can claim a middleman’s fee.

A game-changing model…and it’s revealing the future of the markets.

The savvy investor embraces it and should seek to find the next personal asset to be commercialised.

My prediction? Your data.

But we’ll save that for another issue.

Best,

Taylor Kee

Editor, Money Morning New Zealand

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.