Picture a wall. On the wall — from floor to ceiling and side to side — are tiny light bulbs. Each one is either green or red.

As financial analysts, we watch a variety of indicators that help us predict what’s coming next.

It’s like we’re constantly watching this wall of light bulbs, taking an average of the green/red mix.

Some lights have been red for years. Schiller’s P/E for example.

Others remain a confident shade of green.

But, in the past few months, we’ve seen many greens flicker to red.

Here at Money Morning New Zealand, we feel that the responsible message is caution. Be cautious with your funds. Don’t overexpose yourself…because things could get hairy in a blink of the eye.

Today, we take it up a notch — the reds are winning out…and it’s just a matter of time before the whole board is a dark shade of crimson.

Consider the warning of Scott Minerd, Chief Investment Officer of Guggenheim Partners (Emphasis mine):

‘The selloff in GE is not an isolated event. More investment grade credits to follow. The slide and collapse in investment grade debt has begun… (and later) Don’t be fooled by bond prices holding up, because trading volumes are down. There are fewer bids in the market, and the dispersion of bids is wider. It is time to jog—not walk—to the exits of credit and liquidity risk.’

Now, why is it important that this particular light has turned red?

Because Guggenheim Partners is one of the big-time players in the financial world. They hold over US$300 billion in assets. Plus, their management team is built of former chief officers for Bear Stearns, Goldman Sachs, Credit Suisse, J.P. Morgan, and Yahoo.

These guys know bubbles…because they had front-row seats to some of the worst crashes of this generation.

And now they’re sounding the retreat? That should pique your interest…

Author Ray Dalio explains the issue by labelling it a ‘Comorbid Crisis’. Essentially, that means there are two deadly trends at play right now, both operating independently…and both equally as lethal.

The first is with private-sector debt. In the past decade, businesses around the world have heaped on debt…and under the ‘easy money’ policy of low interest rates, it’s worked. But when the economy cycles back down…these businesses may not be able to service the debt.

In Alaska, I saw this play out on the streets of Anchorage. Thousands of young Americans took up jobs as roustabouts for the various oil and gas companies in Alaska.

It’s a great-paying job if you can land it. Hard on the body, but great for the wallet.

So these young guys — many of whom never held a job above minimum wage — are suddenly raking in US$100,000 or more per year.

They do what you’d expect. Party. Live it up. And, importantly, they buy stuff like houses and trucks.

When you’re bringing in six digits, why not?

Well, when the price of oil changes…and the oil companies go through rounds of layoffs, these guys can quickly find themselves unemployed, with loan payments on the horizon.

What we’re seeing now…and what Ray Dalio is describing…is the same thing. Businesses have piled on debt when times were easy, and they will soon have to pay the piper when it gets tough. [openx slug=inpost]

The second problem is similar…except on the stateside. The US government has been carbo-loading debt like a runner before a marathon. The problem is…they timed it completely wrong.

They were supposed to load up when the economy was weak, not when flying high in the sky.

They’ve essentially scarfed a few dozen doughnuts halfway through the marathon. And now it’s time to start puking.

But politicians can’t help themselves. They keep promising bigger and better stuff to their voters…all of which must be paid for somehow. They’re gobbling sticky-date pudding between chunders…

And, in the next two years, payments on interest will become the largest slice of pie for the US Budget. That’s an important turning point…

While debt is coming to a head — in both the private and public sectors — the stock market is stumbling. Here’s the Dow Jones Industrial Average in the past two weeks.

|

Source: Yahoo Finance |

It may not look like much, but that downward slope represents a nearly 2,000-point slide…something which happens only once or twice a decade.

Mounting corporate debt, mounting public debt, and signs of a scared stock market.

Red lights, each of them.

Even for Keynesians, who are big fans of public debt and intervention in general, this doesn’t look good.

In times of plenty, the state/corporations/individuals are supposed to run surplus budgets. That hasn’t happened.

And the consequence is that when times get tough — and they will eventually — the state and central bank have less room to manoeuvre. Less slack in their line.

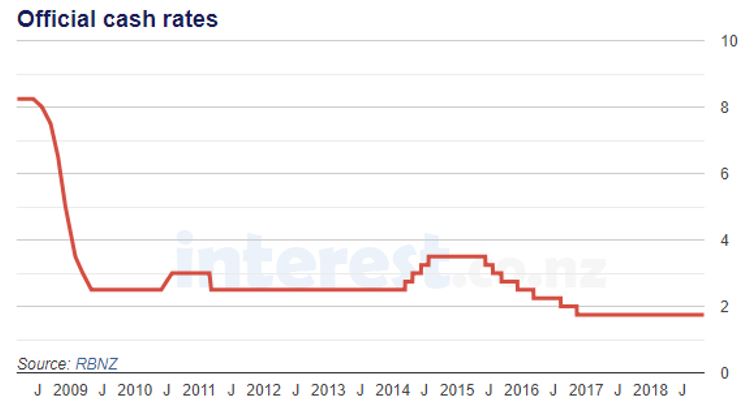

The Reserve Bank of New Zealand for example, only has 1.75% of room to budge in their official cash rate (OCR).

When 2008 hit, the RBNZ dropped the OCR by nearly 6% to stabilise the market. This time, they simply don’t have that tool in their arsenal. A chart by Interest.co.nz paints the scary picture:

|

Source: Interest.co.nz |

Another bulb glowing red….

Best,

Taylor Kee

Editor, Money Morning New Zealand

PS: Before you get overwhelmed by the bearish outlook for today’s market, please know that we at Money Morning New Zealand do believe there are pockets of opportunities…stocks that should weather any storm. But you’ll have to look outside of the mainstream…away from the big, commonly-held firms…and towards the fringe of the small-cap market. I’m finishing up a report right now that will reveal one of these promising shares (And yes, it’s on the NZX). Stay tuned…

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.