I recently read an alarming article in the National Business Review…

|

Source: National Business Review |

In the article, Sir Michael Cullen of the Tax Working Group outlined why he believed the capital gains tax is an ‘opportunity’ for New Zealand.

He said a few things that make sense, but quickly dove off the deep end…talking about the good old days of New Zealand’s command economy…how robots are overrated…and how taxing soft drinks should be a top priority.

It left me a bit confused…but also curious — could there be something to what Sir Michael said?

Despite New Zealand’s prosperity since liberalising the economy, could it be time to return to the good old days?

Should we start paying heaps more taxes to pay for politicians like Sir Michael to ‘guide’ our lives?

Save us from ourselves

I lived in Alaska for a year. It’s a unique place. Wilderness. Moose. Aurora borealis.

While there, I got to know a few hunting and fishing guides. They’d take visitors to remote locations like Kodiak Island or the Kenai River to harvest the best specimens the state has to offer.

If you are interested in hunting or fishing, it’s strongly recommended that you hire a guide.

They know the landscape. They have a well-tuned sense for threats and opportunities. They will spot a bear in the bushes way before you can.

But if you’re Alaskan, you’d probably dismiss the notion and venture out on your own.

Guides make sense for people unfamiliar with the territory.

So when interventionists like Sir Michael suggest that New Zealand returns to a command economy, it leads me to wonder — are Kiwis incapable of living responsibly on their own?

Do Kiwis need a ‘guide’ like Sir Michael to navigate the journey of life?

Are Kiwis so bad with their money that they need a politician to help them survive?

That hasn’t been my impression.

In reading the hundreds of letters that your fellow readers have sent me, I’ve found that Kiwis are generally savvy, sophisticated folks…with a good sense of finance and economics.

Not bumbling idiots with an inclination towards financial ruin, as Sir Michael might suggest.

…But maybe it’s just that Money Morning New Zealand readers are a bit brighter than everyone else.

Maybe.

A baseless argument

Back to Sir Michael’s argument — starting with the good.

He proposes that we simplify the present income tax system. Great.

He acknowledges the impact of New Zealand’s ageing population on the future economy. True. We’ve recently released a report detailing how investors could profit off this growing trend.

He thinks it’s silly to tax beer, wine and spirits at separate tax rates. Agreed.

But these ideas are minor compared to his overarching weltanschauung that New Zealanders are in need of saving…and that a strong-handed guided system is necessary to save us from ourselves.

He starts:

‘When you say capital gains tax to the general public, it reinforces their belief that we don’t tax capital income already. That’s a very bad impression to give because it makes it look like something entirely new, rather than just shifting the boundary between income and revenue. And we’re not proposing a capital gains tax. We’re proposing taxation of capital income within the income tax system.’

My interpretation:

‘Most folks don’t want this tax to happen…so let’s do it anyways and call it something different. Then maybe we’ll be able to slip it under their naïve noses.’

He continues:

‘But it would be a great shame if this opportunity were lost, both [for capital income taxation] and in the environmental taxation area. These two issues are fundamentally important to the production of a better society, one which is more dedicated to the improvement of wellbeing.’

My interpretation:

‘I know what’s best for society…and it’s that politicians like me control more of your money through heavier taxation.’

He claims:

‘The fact people with large amounts of assets are taxed at a low level is one of the main drivers behind our tax and welfare systems being weaker in redistribution than many OECD countries. The data on that is absolutely clear.

‘Has this made us a profoundly more successful economy? Well, no. Our productivity growth was the highest in the decades after World War II when we ran something close to a command economy with high rates of taxation and various other naughty things we aren’t supposed to do these days.’

My interpretation:

‘If we can just find new ways of tapping into your wallet, New Zealand could soon be a socialist utopia…like you find in Europe…and what we sampled after WWII.’

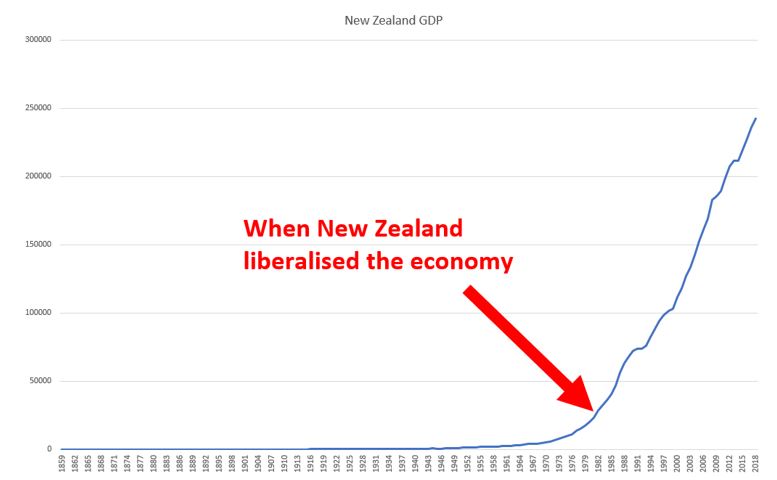

To this argument, I only offer this image:

|

Source: Taylor Kee | Stats NZ Long Term Data Series |

Actually, I can’t just leave it there. Sir Michael suggests that our post-war economy was strong because of the command economy at the time. I’d suggest that wars are generally good for any victor, regardless of the type of economy. History has shown that to be the case. [openx slug=inpost]

Here’s an article by Forbes that describes this economic phenomenon in detail.

Sir Michael continues:

‘If you try to be too nitpicky, you really are letting the perfect be the enemy of the good. That’s why this legislation must be passed before the next election. If you leave room for doubt about what it does, you will leave room for mischief.’

Seems like a strange argument — Don’t look too closely into our proposal. Just pass it as soon as possible.

I sure hope our elected representatives don’t take his advice. Please, please review and scrutinise every proposal that crosses your desk.

He continued (Emphasis mine):

‘Hopefully we can have a reasonably intelligent conversation about it and deal with the issues comprehensively. We are reaching a point where the arguments for the tax on a basis of principle are even stronger than they have been in the past. Every previous tax review has concluded that a capital income tax is a good idea.’

You’d think Sir Michael would at least be right about previous tax reviews — that’s his job, after all.

However, he’s not even remotely correct.

On considering a capital gains tax, ‘we have finally decided against such a recommendation.’

1967 — Ross Committee

‘[We are] not convinced of the need for a separate capital gains tax, does not propose its introduction…’

1982 — McCaw Task Force

‘New Zealand should not adopt a general realisation-based capital gains tax. We believe that such a tax would not necessarily make our tax system fairer and more efficient.’

2001 — McLeod Tax Review

‘While some view [a capital gains tax] as a viable option for base-broadening, most members of the TWG have significant concerns over the practical challenges arising from a comprehensive CGT and the potential distortions and other efficiency implications that may arise from a partial CGT.’

2010 — Victoria University of Wellington Tax Working Group

In fact, in the past five decades, there have been at least five tax reviews specific to a capital gains tax…and each one concluded that it is a bad idea.

So I’m not sure where Sir Michael got his facts…

I just hope he does a better job researching this proposal than he did before preparing his statements.

If his Tax Working Group runs the numbers, odds are that they’ll conclude the same thing each previous iteration has — that a capital gains tax would do no good.

We’ll have to wait and see.

Best,

Taylor Kee

Editor, Money Morning New Zealand

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.