It’s coming.

We’ve dodged the bullet this year. But we may want to start preparing for a crisis sometime between 2019 and 2021!

Even one of the world’s most successful hedge fund managers, Ray Dalio, is getting ready.

In a Business Insider interview, Dalio said that although the US economy is running at full steam, rising interest rates will put a damper on activity, eventually triggering the inevitable downturn.

On Wednesday afternoon, the US Federal Reserve rose interest rates again.

From the Australian Financial Review:

‘The US Federal Reserve has officially ended America’s crisis era monetary policy, hiking interest rates for a third month with more to follow, as signs of a brightening economy overshadow growing concerns about the China trade war.’

Yet as Chris Cole from Artemis Capital points out, taking cash out of the system could cause a liquidity crisis.

And he believes it could hit us when we’re most vulnerable…starting in 2019–2021!

It’s like 1997 again

Yes, US interest rates are now higher.

In their FOMC statement, the Fed pointed to the strengthening labour market, economic activity and consumer spending as all signs that the US economy can handle higher interest rates.

But higher rates weren’t the surprise. The talk of Wall Street was the Fed’s change of language. As reported by the AFR:

‘Pointedly the Fed scrapped its previous description of monetary policy as being “accommodative” — implying the key rate is now at a level that its economists regard as “neutral”.’

The Fed has flagged another rate rise in December. There could be three more to follow in 2019.

By 2020, pundits are thinking US rates could be as high as 3.4%, close to what we saw in January 2008.

And this might only be the first leg. [openx slug=inpost]

The second phase to stop an overheated US economy is to end QE (quantitative easing) and suck money out of the system.

Right now, we’re looking at a US economy drowning in cash. A lot of that has gone into assets (stocks, property, and so on).

‘There are only two times in the history of this century where we had debt crises in which interest rates hit zero,’ Dalio explains.

‘In both of those times, the Central Bank had to print money and go to a different type of monetary policy, which we call quantitative easing, and to buy financial assets. And that drives up, in both of those cases, the value of those financial assets and produces a recovery, but it drives interest rates down to zero or near zero, where they are around the world. And that buying, in this case $US15 trillion of financial assets, has pushed up financial assets and driven the interest rates down to zero, so it’s caused asset prices to rise.’

So what happens when this money dries up?

As Chris Cole alluded to, a liquidity crisis is one possibility. Businesses and individuals will demand cash, but like musical chairs there’s not enough seats for everyone.

This wouldn’t be too much of a problem. But the US has had years of cheap money. In that time, businesses and individuals have racked up a lot of debt.

So this time when the music stops, businesses will most likely go bankrupt and stocks could go down…a whole lot.

A similar situation played out in Asia in 1997.

Countries like Thailand, Indonesia and South Korea were taking on debt to grow their economies. But as soon as the Thai Baht rapidly declined, the whole region launched into crisis mode.

Devaluation of the Baht set off a chain reaction. Investors pulled out cash. Banks stopped lending money.

The mounting lack of liquidity saw stocks and imports decline. The only thing saving the region was emergency funding from the IMF (International Monetary Fund).

Yet I doubt the Fed will soon need to do the same for the US.

What does this mean for stocks?

What you’ve read above is worst case scenario.

The US may have a liquidity crisis. But that would only fly if the Fed was rapidly taking money out of the system.

And right now, that’s just not the case.

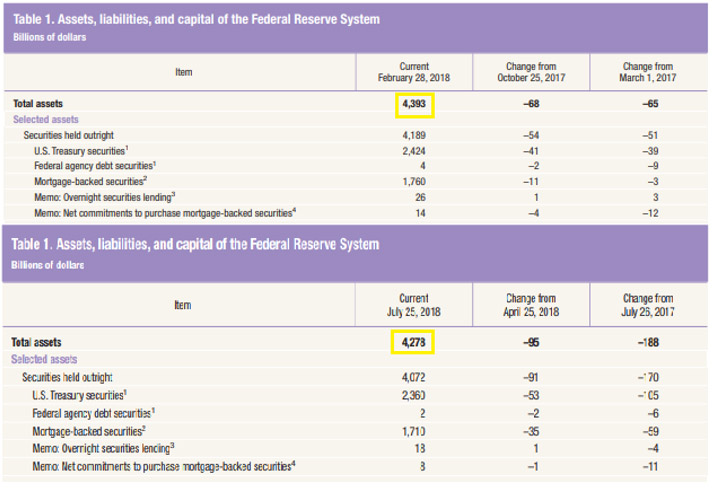

Take a look at the Fed’s balance sheet, particularly their assets from February to July this year.

|

Source: Quarterly Report on Federal Reserve Balance Sheet |

While the amount of assets is declining, the Fed is selling (sucking out) billions worth of US bonds and mortgage backed securities into markets worth trillions.

Their activity makes a dint, however a very small one.

But as interest rates rise and the Fed sell more bonds, we could reasonably expect stocks (generally) to fall.

Bond yields are like a floor for risky assets. Why would you buy a stock anticipated to rise 3% if you can earn 4% in a government bond?

So as yields rise, stocks become less attractive (at their current prices).

What ends up happening is a market-wide decline until the potential returns (based on prices) exceed bond yields by some threshold.

Of course, you could sure up cash, put on a tin foil hat and hide in your garage.

Or you could consider buying businesses earning huge returns using very little debt.

Your friend,

Harje Ronngard

Harje Ronngard is one of the editors at Money Morning New Zealand. With an academic background in finance and investments, Harje knows how difficult investing is. He has worked with a range of assets classes, from futures to equities. But he’s found his niche in equity valuation. There are two questions Harje likes to ask of any investment. What is it worth? And how much does it cost? These two questions alone open up a world of investment opportunities which Harje shares with Money Morning New Zealand readers.