One of the biggest themes of modern business is the idea of being ‘ethical’ and having strong ‘corporate social responsibility’.

They sit along other buzzwords like ‘sustainable’, ‘tribe’, ‘space’ and the classic ‘synergy’.

Nothing is wrong with those words or concepts…but these days, business people throw them out like candy.

And I find it manipulative.

Especially the term ‘ethical’.

One of the ways companies can claim to be ‘ethical’ is by working with groups like Ethisphere. The company audits companies’ activities and gives them a rating.

In 2017, health and beauty firm L’Oréal won the honour of the world’s ‘most ethical company’.

Now they can stick the trophy in their lobby and add that tag line on their website.

But maybe whole thing is a sham…

First of all, Ethisphere is pay-to-play — companies have to shell out thousands of dollars to participate.

Pay $1,500 — we’ll say you’re ethical.

It’s possible that Ethisphere is being completely objective, but I doubt it. Imagine if they rated everyone as unethical? Nobody would pay to be labelled unethical. Ethisphere’s revenues would tank. The group would fall apart.

So it’s in their best interest to reward ‘clients’ like L’Oréal with high scores.

Doesn’t sound like an ethical business model to me…

Should companies spend money on altruistic projects in the first place?

Hear me out…

Let’s say you’re an investor in Starbucks [NASDAQ:SBUX]. You bought their stock because you want a return on investment. That return, your shareholder value, is maximised through revenue-producing activities.

Now let’s say Starbucks announces that they’re diverting company funds to a new project to pay for every employee’s college education. It’ll cost millions of dollars and won’t necessarily make the company any more money.

Are you, as a shareholder, better off or worse off?

Employees are better off, sure. And Starbucks’ public image improves. But shareholders like you aren’t any better off.

In fact, you might be worse off.

Those millions of dollars that Starbucks diverted could have helped grow the business. Better facilities, new locations, etc.

That would have likely resulted in your shares becoming more valuable.

As a listed company, Starbucks is accountable to its owners, you and the other shareholders. But if it doesn’t act in the shareholders’ best interest, is it the right thing to do?

That’s in line with the old business maxim: A business’ primary purpose is to maximise stockholder value.

But maybe that’s no longer the way we should look at business…

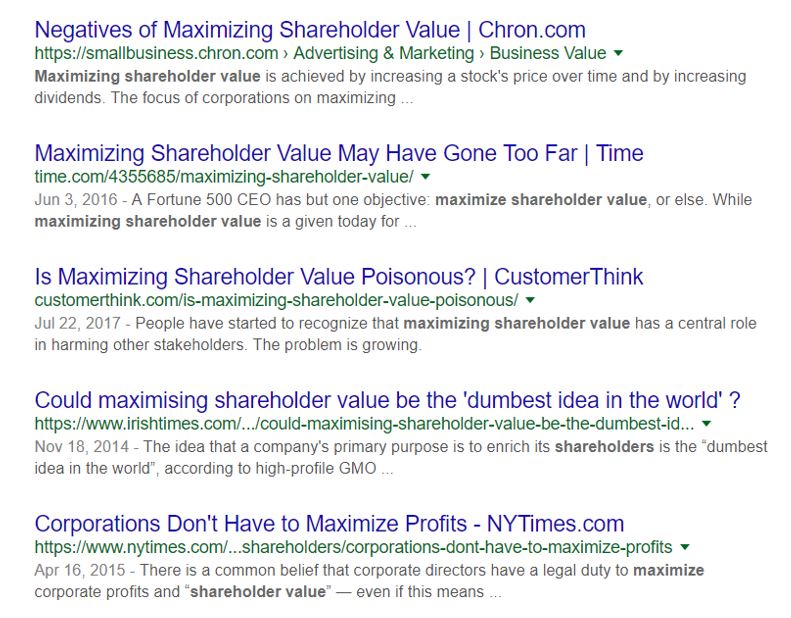

Here’s what Google shows when you look up ‘maximise shareholder value’ today:

|

Source: Google Search Results |

Well if search results are any indicator, maybe maximising shareholder value is passé…

Is that because shareholders have changed? Are returns not the priority anymore?

Jack Welch, the old CEO of GE, would say that shareholder value should never have been the goal. According to him, maximising shareholder value is:

‘...the dumbest idea in the world. Shareholder value is a result, not a strategy… your main constituencies are your employees, your customers and your products. Managers and investors should not set share price increases as their overarching goal… Short-term profits should be allied with an increase in the long-term value of a company.’

And many would now argue that ethical practices might boost the long-term value of a company.

In fact, some would say that companies that have their primary focus on ethical products hold the best long-term potential.

TOMS or Warby Parker for example. For every pair of shoes/glasses you buy, they donate a pair to someone in need.

A coffee shop near my uni would use some of their profits to build wells in Africa.

You probably know a few companies that do something similar.

It makes you feel warm and fuzzy, but is ‘corporate social responsibility’ the new ‘maximise shareholder value’? [openx slug=inpost]

Allbirds jandals

It’s the approach taken by San Francisco-based footwear company, Allbirds.

Headed by ex-All Whites captain Tim Brown and Joey Zwillinger, the company developed a line of unique jandals.

|

Source: Viva.co.nz |

They make their ‘Sugar Zeffer’ from recycled materials and bio-materials like sugarcane. Founder, Joey Zwillinger claims:

‘The reason why we are so focused on sugar is because sugar cane is the most efficient plant at sucking carbon dioxide out of the atmosphere, ultimately turning into something that’s a usable source of carbon. The sugar is harvested twice a year in Brazil and it grows incredibly quickly.

‘Take your car’s tailpipe for example, this squeezes emissions into the atmosphere and it just sits there. Sugarcane actually sucks that out of the atmosphere using photons from the sun and rainfall. It grows wonderful big sugar cane, that’s eventually crushed down. We’ve been able to take that sugar and now transform that into a bottom for a shoe — the Sugar Zeffer.’

And he adds:

‘For us it’s about getting very close to the idea that we are putting something on the planet that does something positive, versus just taking from it. It’s the overarching driver for everything we do at Allbirds — from our product development to a sustainability perspective. We track our impact on the world.’

A noble goal, but will it attract investors?

So far, it has. Academy-Award winning actor Leonardo di Caprio and Golden State Warriors basketball star Andre Iguodala have both reportedly invested in the company.

It’s also attracted CEO of Warby Parker, Neil Blumenthal, to advise the board.

But these are wealthy people with a public image to consider…not your average-Joes wanting a return on their life savings.

Maybe it’s just a PR stunt. Or maybe it’s the new investor’s paradigm.

We’ll just have to wait and see…

Best,

Taylor Kee

Editor, Money Morning New Zealand

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.