Trade worries resurfaced overnight and caused US markets to pull back a bit. The Dow fell 0.7%, while the S&P 500 declined 0.4%. That’s no big deal given the strong recent gains.

But the real damage was done in emerging markets. Capital continues to flow out of these peripheral economies and into the US. The strength of the US economy and the resultant prospect of interest rate rises are both contributing to this ongoing development.

The US economy grew at a very fast 4.2% annual pace in the second quarter. It’s the strongest rate of growth since the third quarter of 2014. That means the Fed remains on track to raise interest rates, which means upward pressure on the US dollar.

This is where emerging markets come into play.

The boss of the Bank for International Settlements recently pointed out that the level of US dollar denominated debt (outside the US) had grown to a whopping US$11.2 trillion.

A lot of this is held by emerging markets. Now consider the impact of falling emerging market currencies against the US dollar. It increases the cost of servicing US dollar debt!

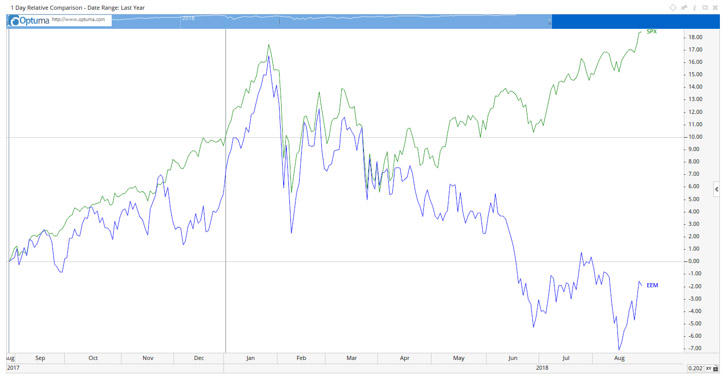

Check out the chart below. It compares the S&P 500 with an emerging markets index.

|

Source: Optuma |

That’s quite a divergence.

I’m not exactly sure what it means right now. Is it a sign that the global economy is slowing? Or does it simply reflect US economic outperformance?

We’ll soon find out…

The next ‘big’ investment opportunity

In the meantime, I’ve been looking around for the next ‘big’ investment opportunity. Which is pretty hard when most developed markets are at all-time or multi year highs.

At this stage of the bull market, there is no low hanging fruit left.

It’s not like it was just 12 months ago, when the boss of Royal Dutch Shell said that he was preparing the company for lower oil prices ‘forever’. That suggested to me the oil price had a long way to run and I recommended a handful of energy plays at the time. As a group, those picks turned out to be very profitable.

Something similar is happening in another part of the market now. I wouldn’t say it’s an obscure part of the market. But it is certainly not a sector that is on people’s investment radar.

Which is what makes it a very interesting opportunity. The biggest potential returns come from taking a position in a sector before the rest of the market wakes up to the opportunity.

That’s not to say there is a glaring opportunity right now. I’m talking about understanding the fundamentals and betting on where that will take the market (and prices) in a year or two. If you do the work and see the potential, you need to act.

For now though, let me tell you an interesting story. It’s sort of related… [openx slug=inpost]

The man behind Tesla

You’ve all heard of Tesla, right?

Well, the guy Elon Musk named it after, Nikolai Tesla, was insanely talented. He was up there with Einstein…

Tesla was born in the old Austro-Hungarian Empire. He arrived in the US in 1884 with a letter of introduction, which he presented to Thomas Edison to get a job. He improved on Edison’s direct current (DC) generation plants, and claims that Edison reneged on a deal to pay him US$50,000 for the work, so he quit to go and dig ditches.

Tesla then went on to develop alternating current (AC) power systems that are still used today.

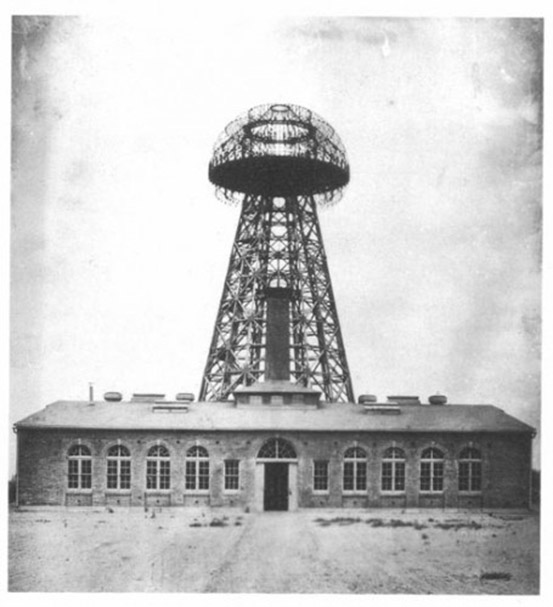

In 1902 he began exploring how to transmit electricity without power lines. He built Wardenclyffe Tower (below) with financing by J.P Morgan. But after the initial round of financing, J.P Morgan pulled his support.

|

Source: Wikipedia |

Why would he do that? The technology held so much promise.

Did it have something to do with Morgan’s large copper mine interests? Copper was (and still largely is) the metal used to transmit electricity.

That was just one of Tesla’s setbacks. His problem was that his inventions threatened the wealth of the titans of the ‘Gilded Age’.

Tesla’s biggest ‘discovery’ was ‘free energy’. Here’s what he wrote about it in 1932 (my emphasis added):

‘I have harnessed the cosmic rays and caused them to operate a motive device. Cosmic ray investigation is a subject that is very close to me. I was the first to discover these rays and I naturally feel toward them as I would toward my own flesh and blood.

‘I have advanced a theory of the cosmic rays and at every step of my investigations I have found it completely justified. The attractive features of the cosmic rays is their constancy. They shower down on us throughout the whole 24 hours, and if a plant is developed to use their power it will not require devices for storing energy as would be necessary with devices using wind, tide or sunlight.

‘All of my investigations seem to point to the conclusion that they are small particles, each carrying so small a charge that we are justified in calling them neutrons. They move with great velocity, exceeding that of light.

‘More than 25 years ago I began my efforts to harness the cosmic rays and I can now state that I have succeeded in operating a motive device by means of them. I will tell you in the most general way, the cosmic ray ionizes the air, setting free many charges, ions and electrons. These charges are captured in a condenser, which is made to discharge through the circuit of the motor. I have hopes of building my motor on a large scale, but circumstances have not been favorable to carrying out my plan.’

The crime against humanity

So Tesla began working on this revolutionary technology in the early 1900s. How do you think John D Rockefeller of Standard Oil (by then broken up into many smaller companies, of which he owned big chunks of) would have felt about that?

What about Henry Ford, who had just developed the combustible engine, which needed a solid supply of oil?

Now can you see why circumstances were not favourable to Tesla carrying out his plans?

Given the wars and misery that the pursuit of oil has caused the world since the start of the 1900s, the deliberate thwarting of Tesla is nothing short of a crime against humanity.

Free energy may be good for the world, but not good for those who ‘run’ the world.

The opportunity I’ve been researching may not be ‘free’ energy, but it’s part of the solution to our environmental problems.

Regards,

Greg Canavan

Greg Canavan is a Feature Editor at Money Morning. He likes to promote a seemingly weird investment philosophy based on the old adage that ‘ignorance is bliss’. That is, investing in the Information Age means you have all the information you need at your fingertips. But how useful is this information? Much of it is noise and serves to confuse, rather than inform, investors. And, through the process of confirmation bias, you tend to read what you already agree with. As a result, you often only think you know that you know what is going on. But, the fact is, you really don’t know. No one does. The world is far too complex to understand. When you accept this, your newfound ignorance becomes a formidable investment weapon. That’s because you’re not a slave to your emotions and biases.