Did you hear about the family in Papakura currently paying $520 per week to live in a swamp?

Not a house surrounded by swamp; rather a house slowly sinking into the swamp water. That’s right. These folks pay $520 per week to live in a house that’s flooded in a stagnant, rubbish-littered pond.

As you’d expect, the house is full of condensation, the family is getting sick, and they say the landlord hasn’t lifted a finger.

Maybe it’s an isolated event…or maybe this housing market has gotten so out of hand that $2,000 a month doesn’t even get you a dry floor beneath your feet.

I’d bet on the latter.

Is that the new normal? Are there so few houses in New Zealand that you can no longer expect a decent place to live? Especially if you’re forking out $500+ a week?

Maybe walls will be the next to go. Get yourself a nice mid-century gazebo for just $450 a week! Deal!

A potential fix for our housing crisis

One solution that’s been suggested is the co-op model.

If you’re not familiar, a co-op — or housing co-operative — is a type of living arrangement where residents own shares in a corporation, which owns the building.

Shareholders are entitled to a unit in the building…and have voting power in how the corporation is run.

Instead of a mortgage, you’d take out a ‘share loan’, and you’d be responsible for paying a share of the building’s loan.

In essence, you’d be taking the landlord out of the equation. Rather, you’d be a resident through the corporation…at an at-cost basis.

It makes ownership a bit easier.

And it’s worked.

In expensive cities like Zurich or New York, co-ops have helped create openings in an otherwise unaffordable market.

And what’s more, it makes a lot of sense in New Zealand’s already heavily co-operative market.

Craig Presland of apex body Cooperative Business NZ says:

‘NZ is one of the most co-operative economies of the world, with our co-ops, mutuals and societies generating around one-fifth of GDP, serving more than 1.4 million kiwis and employing over 50,000.

‘Unfortunately, we have virtually no co-operatives currently operating within the housing sector. This is in stark contrast to elsewhere in the world where housing co-ops are experiencing significant growth.’

Democratic. Self-governed. Affordable.

To me, it sounds like a fantastic idea…

But Presland is wrong about one thing — this type of model is operating in New Zealand. It’s called the Papakainga Model.

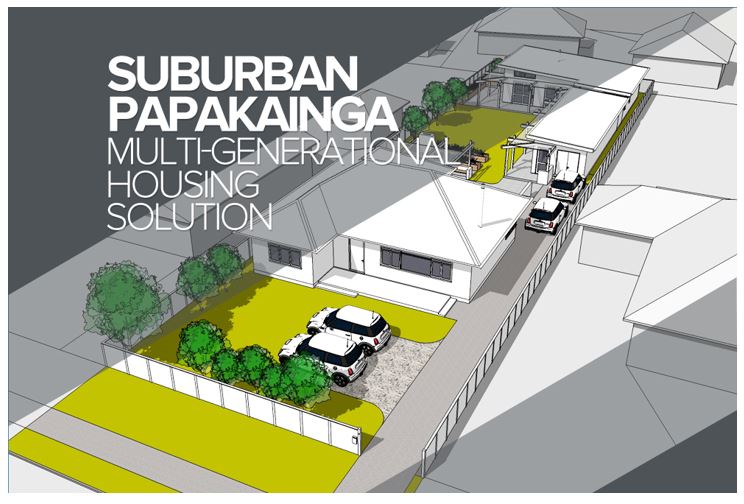

The Papakainga Model was designed specifically for a multi-generational whanau (family) accommodation.

It involves converting yard space into smaller single-storey dwellings. [openx slug=inpost]

Here’s a mock-up from the Auckland Design Manual:

|

Source: Auckland Design Manual |

It makes a lot of sense. But it might be too small-scale for New Zealand’s needs.

It targets families. Today’s housing crisis affects thousands at the city-level. That’s why the co-op model might be a good step up from the Papakainga Model.

It applies the same ownership and space-saving concepts in a multi-storey building environment.

The state

To you, this may sound like semi-socialist rhetoric…

Communal living. Distributed costs. Paying your share. I get it — it gives me the heebie-jeebies just typing it out.

So let me clarify — this concept has nothing to do with the state. If anything, it’s taking a potentially state-run solution and putting it in the hands of individuals.

And it has nothing to do with income distribution or paying your ‘fair share’. You could own a unit next to PayPal founder Peter Thiel…and it would cost you both the same.

You could opt in — or out — as you please. No person or organisation forces you to participate.

It’s the power of the free market finding an innovative solution to a problem.

All it takes is a few savvy housing investors coming together.

And that’s precisely why many New Zealanders won’t like this idea. They remember the state-built houses that baby boomers grew up in. They remember how affordable those mortgages were.

And, perhaps most importantly, the state getting involved would in all likelihood mean higher taxes…which would most likely affect the wealthier Kiwis as opposed to younger, less-fortunate ones.

To a pro-government interventionist, a state-run programme like this could knock out two birds with one stone — more affordable housing and less wealth inequality.

But, in the end, it might not be that different from the housing market today.

You’d still have a landlord; only he or she would be managed by the state. Who’s to say they’d be any better?

And the state would still be incentivised by rental/mortgage income. They might lower costs when it pleases them…but they could also bump it up whenever they want.

I’d imagine they’d find some new project that needs funding…and their tenants would be their cash cows.

Would you rather be the state’s cash source? Or a shareholder in your own co-op corporation?

The choice could soon be yours.

Best,

Taylor Kee

Editor, Money Morning New Zealand

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.