For Jackie and Mike, one of the best things they ever did was bet on their son, Jeff. Some would never have taken the risk. But Jackie and Mike encouraged their son to quit a high paying job and follow his dream.

That dream turned into Amazon.com, Inc. [NASDAQ:AMZN].

Jackie and Mike Bezos put up US$245,573 into Jeff’s small project.

It was a big gamble, Mike recalled. Jeff had highlighted the risk when he took the cheque from his parents:

‘I want you to know how risky this is…because I want to come home at dinner for Thanksgiving and I don’t want you to be mad at me.’

It’s unclear how much of the company Jeff’s parents still own. But The Australian Financial Review (AFR) suggests they still control a healthy chunk of it.

‘Their total return in that case would be about 12,000,000 per cent, a performance that would make even the most celebrated venture capitalists blush,’ The AFR wrote.

While you might never see returns on the scale of 12,000,000%, there are some 10-baggers out there waiting for you.

Three things to help you nab 10-baggers

There are three reasons most investors never see really big gains. Forget 100% or 200%. I’m talking about 1,000% or more.

To explain the first reason, let’s look at the hedge fund Greenlight Capital.

For a while, Greenlight had amazing returns.

It was only recently that investors have decided to throw Greenlight and its manager, David Einhorn, aside.

There’s nothing that makes investors more upset than losing money. And Einhorn has been losing a fair bit of it while the S&P 500 is down 4.5% for the year.

From Bloomberg:

‘Greenlight Capital’s main hedge funds fell 5.4 percent in the second quarter, according to the letter, bringing the year-to-date loss to 18.3 percent.

‘…Hedge fund managerDavid Einhornsaid his firm’s results for the second quarter were “far worse than we could have imagined” but he hasn’t lost faith in value investing.’

‘Right now the market is telling us we are wrong, wrong, wrong about nearly everything,’ Einhorn said. ‘And yet, looking forward from today we think this portfolio makes a lot of sense.’

Why do I bring this up?

To do better than the market, and to generate 10X gains, you’ve got to do something different.

That means you’re going to buy stocks which the market doesn’t like in the interim. And unless you have a crystal ball, you have no guarantee of accurately picking the bottom or top tick of any stock.

This effectively means you’ll eventually have losers, at some point or another.

And that’s ok. There’s a big difference between holding losers and selling losers.

The idea is that you hold onto stocks which you believe will rise substantially over time. So while you might be holding a loser today, in 24–48 months’ time, you could have yourself a 10-bagger.

Of course, if you keep selling losers when they dip 10–20%, you’ll have a slim chance of ever generating those kinds of returns.

At the moment, Chinese investors mimic many of Greenlight’s former investors.

[openx slug=inpost]

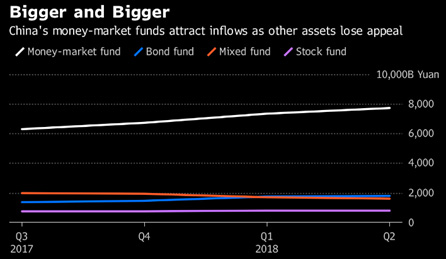

Many investors have chosen to get out of a falling market and jump into short-term debt securities. Reported by Bloomberg:

‘After a shadow banking crackdown shrank the pool of investment products in China, money market funds are seen as a safer investment as trade war uncertainties weigh on stocks, while offering returns close to those of bonds.

‘While Chinese equities have rebounded from their lows and corporate notes jumped last month amid a government shift toward easing, analysts say money-market funds will continue to be attractive to retail investors.’

Source: Bloomberg

Again, it’s these jumpy investors that might never see 10X gains. They simply don’t have the emotional stability to take an opposite view to the majority.

Before moving onto the second point, it’s worth mentioning that not all losers are worth holding onto. I’ll repeat what David Einhorn told his investors, because it’s important.

‘Right now the market is telling us we are wrong, wrong, wrong about nearly everything…And yet, looking forward from today we think this portfolio makes a lot of sense.’

If you’re confident about a company’s (and therefore its stock’s) future, that’s when you should hold on. It’s a different story if you’ve just bought the stock to speculate on the price.

The second reason most investors never really see big gains is because they sell winners far too early.

If a stock has done nothing, or has risen to a point and stopped, most investors will sell out and move on. Hardly anyone is really thinking long-term when they buy a stock.

Usually most investors think about 12 months ahead.

But the problem is, there are too many stocks rising 1,000% or more within such a short time. If you believe stocks are just proportional interests in a business, then surely it would take more than 12 months to see truly massive gains.

It takes time for earnings and business economics to reach multiples. While the wait isn’t as exciting as jumping in and out of volatile stocks, the reward for your patience is more than worth it.

The last reason…

The third and final reason more investors don’t see massive gains is because they buy BHP or CBA. Sure, you might not see you’re positions drop 50% within a week.

But you’re not going to see massive gains either.

To really put your money to work, you’ve got to jump into the small end of the market. There, you can find plenty of small growing stocks with massive potential.

Your friend,

Harje Ronngard

Harje Ronngard is one of the editors at Money Morning New Zealand. With an academic background in finance and investments, Harje knows how difficult investing is. He has worked with a range of assets classes, from futures to equities. But he’s found his niche in equity valuation. There are two questions Harje likes to ask of any investment. What is it worth? And how much does it cost? These two questions alone open up a world of investment opportunities which Harje shares with Money Morning New Zealand readers.