There’s an old time-tested financial idea that things move in cycles.

Boom and bust.

Up and down.

The theory was popularised by economists like Joseph Schumpeter and Jean Charles Léonard de Sismondi during the early 19th century.

They argued that the cyclical patterns are the result of human psychology.

When things are going well, people take on more and more risk.

Eventually it becomes unsustainable and tumbles.

People revert to more conservative approaches, until they slowly start to build up confidence again.

And it all starts over.

It’s a well-researched and thoroughly back-tested concept.

In fact, even back in the book of Genesis, you have the story of Joseph (The many-coloured coat Joseph).

The Pharaoh of Egypt had a dream and Joseph interpreted it by saying:

Seven years of great abundance are coming throughout the land of Egypt, but seven years of famine will follow them. Then all the abundance in Egypt will be forgotten, and the famine will ravage the land.

Genesis 41:29-30

Joseph was tasked with preparing for the upcoming famine so he built up great stores of resources to tide them over until the abundance returned.

Seven years of abundance.

Seven years of famine.

Thousands of years later, a different Joseph – Joseph Schumpeter – theorised that all economies and businesses follow a similar pattern. Seven up and seven down.

It’s held mostly true since then.

[openx slug=inpost]

Easy, Simple and Reliable

For investors interested in a long-term strategy, this concept of the business cycle can provide you with a reliable investing approach.

It’s called the “Dogs” strategy.

A man named Michael O’Higgins popularised it in 1991.

He figured out that if you picked the ten worst performers of the DOW index and put equal investments into each, they would typically bounce back the next year.

He researched backwards for decades and found that his theory worked.

That theory is now called the “Dogs of the Dow” strategy and it’s a favorite for many American investors.

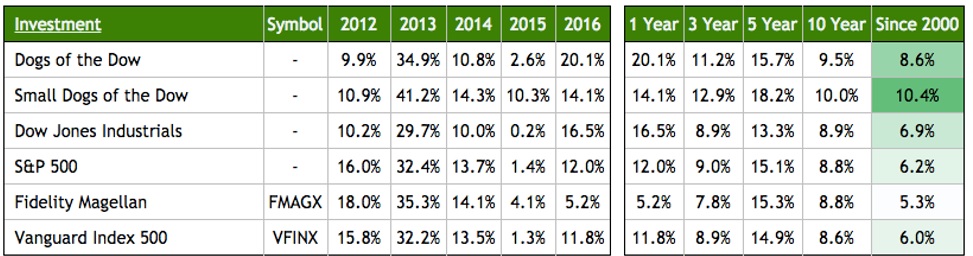

If you want to know if it works, here the annual dividend-adjusted returns from a few “Dogs of the Dow” from 2016:

- Caterpillar +49%

- Chevron +32%

- IBM +24%

- Walmart +18%

- Merck +16%

Now, of course there are always winners and losers as well as up years and down years. No strategy is 100% successful.

But in general, this strategy beats the market by several percentage points at the time…

Source: DogsoftheDow.com

If you’re wondering about the “Small Dogs of the Dow”, that’s the five lowest priced stocks from the “Dogs of the Dow” ten.

Dogs of the NZX

For most Kiwis, you won’t be investing on the DOW… you’ll be investing in the listed companies on the New Zealand Stock Exchange (NZX).

It’s a bit smaller, but the same concepts will hold true.

Here are the “Dogs of the NZX”:

Source: DogsoftheDow.com

These ten businesses currently offer the highest dividend yield out of the NZX50.

According to the “Dogs” theory, these companies will likely rise in price over the next year.

It’s an odd looking lot.

These businesses have been hounded over the past year… but that’s the point.

Businesses go down then they go back up.

It’s part of the cycle.

And for investors, it means opportunity. .

The top “Dog”, Hallenstein Glasson, is a fashion and clothing retailer. They run over 120 locations around New Zealand and Australia.

They recently took on a new CEO, Mark Goddard, who has since focused on profitability and new marketing channels.

While the trading environment has been tough on the company, its corporate developments look to be heading in the right direction.

Bargain-shopping company, Warehouse Group, has been in the news lately with rumors of some major changes.

The changes might include laying off nearly 1,000 workers in an attempt to trim the fat. While layoffs are often a red flag, it could mean that the business will reemerge leaner and stronger. We’ll wait and see.

Metro Performance Glass is an interesting contender.

The Auckland-based company had a rough start to the year due to an extensive capital investment programme. It’s likely that these new additions will help boost profits in the upcoming year. For investors, a good sign.

One group that I’m worried about is Tegel Group. Over the past year, its profit has tanked, going from $34 million to $26 million. They blamed the regulatory environment and restructuring, but it’s hard to tell if that’s the true reason.

There’s an active takeover attempt being made by Philippines-based Bounty Fresh Foods… and it’s likely that it will go through by the deadline in August.

An all-around messy situation that you may want to avoid.

While I don’t know for sure which of these will go up and which will go down, I do know that the odds are on my side.

Best,

Taylor Kee

Editor, Money Morning New Zealand

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.