Interesting results from the US midterm elections. The Republicans continue to hold the Senate, while the Democrats took a strong majority in the House of Representatives.

While President Trump was quick to hail the results as a ‘big victory’, the new changes will mean that he’ll struggle to get Congressional approval in the coming years. Perhaps this will mean that we’ll see an uptick in executive orders…even though Trump’s recently been happy to use that power despite holding both sides of Congress.

Perhaps the most interesting story of the midterm elections was that of Republican Dennis Hof. He ran for a legislative seat in Nevada and won…despite being dead for nearly a month. Hof owned a chain of legal brothels around Carson City and starred in an HBO adult reality series, ‘Cathouse’.

He was found dead in his Love Ranch brothel after a four-day party/orgy for his 72nd birthday.

Three weeks later, Nevadans voted him into office.

If that’s not a testament to the current state of American politics, I don’t know what is….

Today, we’ll dive into another freaky world…the world of money.

Innovation at the frontier

As we try to connect the dots, we seem to rip open more questions than we answer…but we keep pushing forward.

One of the murkiest corners that we venture into is the area of emerging trends — new and fringy ideas that could make it into the mainstream…a financial terra incognita.

From an investor’s perspective, these up-and-coming themes could offer massive early-adopter returns.

Think social media…or electric cars…or cloud-based platforms like Xero.

But many of these shooting stars burn out before they ever come across the mainstream…

Take Google Glass, for example.

The idea was to build futuristic glasses that gave wearers a sort of augmented reality…where they could read the news, watch videos, share to social media…all through the clear lenses of their special glasses.

The Star Trek-esque idea stole headlines for a couple months in 2014, then sputtered to death.

The world wasn’t ready for it…and it wasn’t ready for the mainstream.

So it died.

Sadly, heaps of other ideas — even entire industries — follow the same path.

Here at Money Morning New Zealand, we try to sift through the silty waters of innovative ideas and identify the gold nuggets that will last and provide investors with returns.

Bitcoin’s big brother

One of the new innovations we’ve been exploring is that of blockchain.

Blockchain is a new technology closely related to bitcoin…but has far wider implications.

It’s essentially an Excel spreadsheet with a bunch of data in it…that’s synced and verified by thousands of computers around the world instantaneously.

The data in it can be anything: financial transactions, medical records, supply chain documentation, lemonade stand sales, Simon Bridges’ travel expenses. Anything.

The value of it is being able to verify data in a decentralised way.

To picture it, think about clock towers.

In the past, if people in a village wanted to know what time it was, they had to go to a central clock tower. Clock towers were big, bulky, expensive and hard to maintain. Because of that, only the wealthiest central authority in town could provide it.

Everyone had to use and trust the clock tower.

But then pocket watches came around.

Suddenly everyone could own their own miniature ‘clock tower’. They were cheaper and more efficient. And, most importantly, it means that everyone had a reliable source for telling what time it was.

Instead of having to go to the town centre to tell what time it was, you could ask anyone on the street.

That’s called ‘decentralisation’.

What blockchain does is decentralise everything.

It’s basically about giving everyone pocket watches in the world of big data.

And like the invention of the watch, it could easily push most centralised platforms the way of the dodo.

But, right now, we’re still very early on the timeline for this nascent trend. Most of the activity in the blockchain world happens in little pockets of forward-thinking techies…typing away on their laptops…working from trendy co-working spaces.

Any attention that the mainstream has given blockchain has been mostly negative.

It’s too new…too radical…too different…and for many, too hard to understand.

That’s a natural reaction, isn’t it? To be cynical of the new and untested.

But that’s not necessarily the right reaction.

Sceptics — specifically sceptical investors — have been late to heaps of parties over the years…and have missed out on incredible returns…simply because they were pessimistic or doubtful of innovative change. [openx slug=inpost]

Blockchain’s latest sceptic: Nouriel Roubini

If there’s anything I’m immediately sceptical of, it’s academics, economists and psychics.

And blockchain’s latest doubting Thomas claims to be all three.

Nouriel Roubini is a professor at New York University teaching international economics. He’s got quite the CV:

- Doctorate from Harvard

- Academic at Yale

- Adviser at the IMF

- Adviser at the Federal Reserve

- Adviser for the World Bank

- Senior Economist for Clinton’s Council of Economic Advisers

- Senior Adviser to former Treasury Secretary, Timothy Geithner

Seems like he’s well-qualified to give advice.

However, he’s focused his efforts in 2018 to scorning blockchain.

Interest.co.nz recently republished one of his articles. Here’s what he said:

‘As should be clear, the claim of “decentralisation” is a myth propagated by the pseudo-billionaires who control this pseudo-industry. Now that the retail investors who were suckered into the crypto market have all lost their shirts, the snake-oil salesmen who remain are sitting on piles of fake wealth that will immediately disappear if they try to liquidate their “assets.”’

Punchy. I admire his zeal.

However, I’m not exactly sure his tirade has much behind it.

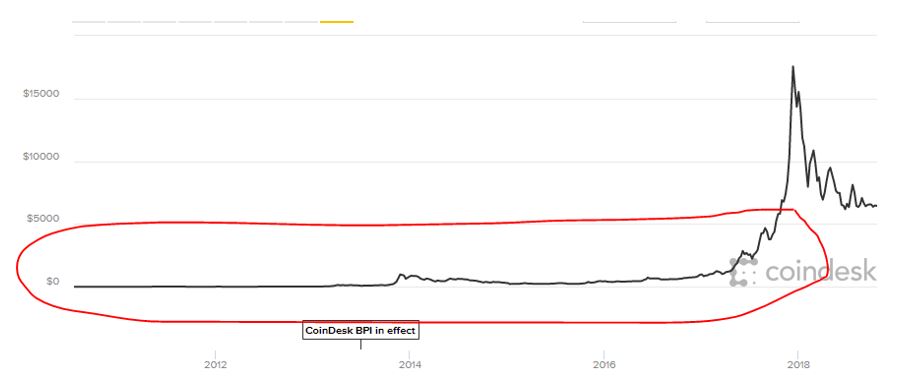

‘Now that the retail investors who were suckered into the crypto market have all lost their shirts…’

All lost their shirts? As a retail investor who was ‘suckered’ into the crypto market myself, I still have my shirt. And so does every single other investor who bought in before the end of 2017. See the red oval below which covers everyone who is still sitting on a profit:

|

Source: CoinDesk |

Roubini also talks of pseudo-billionaires and pseudo-industries. I’d be interested what he thinks of today’s tech sector. Jeff Bezos and Amazon. Mark Zuckerberg and Facebook. Reed Hastings and Netflix.

They are all billionaires, but only because their stock holdings have been heavily inflated by the Fed’s prolonged ‘easy money’ policy. And when stocks tumble, these guys see billions of their ‘wealth’ disappear…

If anyone’s sitting on piles of fake wealth, it’s these guys. Not the geeky blockchain-coders sitting behind their laptops.

But you won’t hear Roubini acknowledging that. He worked for the Fed, after all…the same Fed responsible for dozens of pseudo-billionaires born from FAANGs and friends.

His biggest argument against blockchain is that it’s ‘buggy’ and ‘hacked on a regular basis’.

If I had to agree with anything he said, it would be this. Yes, current blockchain projects are buggy and seem to be hacked somewhat often. But I fully believe these are growing pains of a brand-new technology. Find me an innovation that was perfect out of the box and I’ll eat my words.

Basing your dismissal of blockchain as a whole because of these growing pains would be a mistake.

But, hey, what do I know…

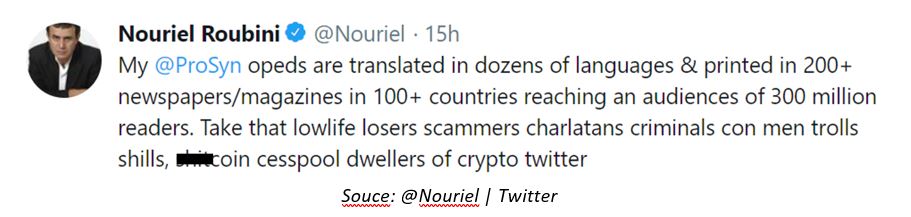

Take a look at Roubini’s incendiary Trump-like Twitter feed to see what he thinks of those optimistic of this new technology:

|

Souce: @Nouriel | Twitter |

If that doesn’t persuade you to forget about blockchain forever, I don’t know what will…

Best,

Taylor Kee

Lowlife, Loser, Troll, and Editor of Money Morning New Zealand

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.