People only see what they want to…

US officials are looking at Facebook’s cryptocurrency, Libra, and can only see one thing.

Danger!

What about the consumers, senator Sherrod Brown says.

‘Facebook is already too big and too powerful,’ she added. Oh and he thinks he’s the one to make that call…

‘We cannot allow Facebook to run a risky new cryptocurrency [which is backed by stable devaluating dollars] out of a Swiss bank account without oversight. I’m calling on our financial watchdogs to scrutinise this closely to ensure users protection.’

Seems like yet another polly jumping on the ‘down with tech’ bandwagon looking to stir up some news and win some votes.

Today, I’d like to talk briefly about Libra.

Tell you what it is, what it’s not and maybe what it could be.

Brown, are you listening?

A crypto? Or a payment platform?

OK.

What is Libra?

Rather than a crypto, think of it like an online payment platform.

Just like PayPal, you can hook up your bank details with Libra, buy goods and services online (using Libra), and receive payment in whatever denomination you’d like.

That’s Libra…a payment platform for the largest social network in the world.

There are benefits of course.

With Libra, transaction costs are almost, if not, zero. Payments are received instantly. Once you have Libra, you don’t need a bank.

You can simply send and receive money via Facebook Messenger, WhatsApp, Instagram or the Libra app.

What’s more, Libra is backed by a group of currencies, making the digital coin as stable as that basket.

I say Libra is more of a payment system than a crypto because there are key differences.

One, for example, is the blockchain Libra operates on.

It’s a digital ledger made and controlled by Facebook and a few friends. It’s not currently distributed to a large group, like the decentralised one bitcoin transacts through.

And thus, Facebook, if they wish, could go in and mess with the data.

Tribune Magazine reminds us:

‘Every user in the network retains a copy of the database — a public ledger. To update or alter the database requires consensus across the network. Once data is added to the blockchain, it cannot be modified or changed without mutual consent of all parties — it becomes, in the jargon, ‘immutable’. There is no single point of control. No single point of failure.’

What’s more, unlike bitcoin Libra is backed by paper money.

This might be a pro or a con, I guess it depends on who you ask. It is one way to make the digital coin as stable as fiat money, though.

And with stability, users are more likely to feel comfortable using it. [openx slug=inpost]

Others are talking about Facebook’s potential move into lending. With all this asset backing, Facebook’s Calibre will have a fat chunk of change to lend out to the people.

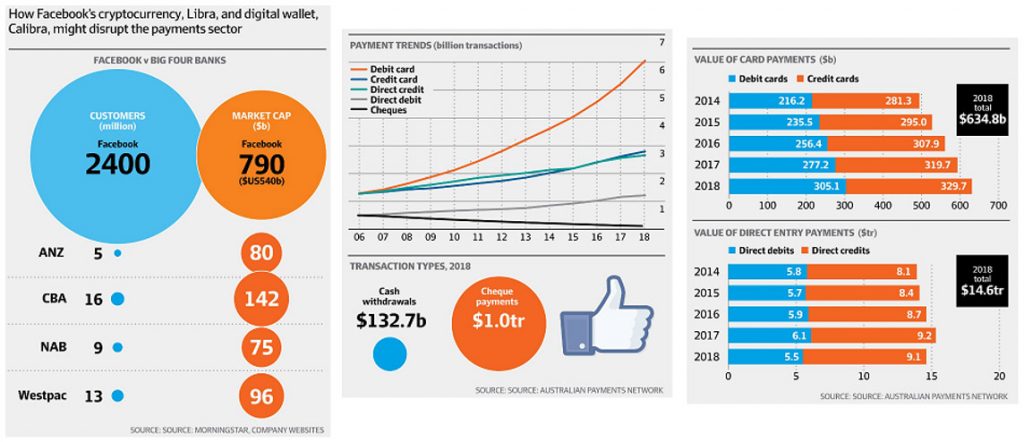

Such ideas has got reporters comparing FB to the Aussie Big Four banks. Here are a couple of infographics reposted by the Australian Financial Review:

Yet I doubt this would ever happen.

I think it’s far more likely this remains a payment platform and an avenue for Facebook to create a dominant e-commerce division.

Anyone going to short Amazon now?

Facebook and Google are the platforms a lot of businesses rely on. I don’t go straight to Amazon to buy anything…do you?

I go to Google first. And if I’m led to Amazon, so be it.

It’s the same for a lot of Millennials and the clothes they buy.

Do they go straight to Amazon or The Iconic to look for clothes? Maybe some go to the latter.

But I’ll bet a fat chunk of people first search for new styles and outfits on Instagram (Facebook’s picture platform).

And if they happen to click through to a website to buy something, so be it.

It’s important to note that it’s Google and Facebook that create opportunities for these businesses. They control the user.

And if they had stores, checkouts and a payment system in place, you’d be out of luck trying to get users off those platforms.

Well, now Facebook has Libra, the new way to instantly pay for goods and send money through Facebook’s platform.

This might be disastrous news for companies like Amazon.

Anyone want to short the stock?

Your friend,

Harje Ronngard

Harje Ronngard is one of the editors at Money Morning New Zealand. With an academic background in finance and investments, Harje knows how difficult investing is. He has worked with a range of assets classes, from futures to equities. But he’s found his niche in equity valuation. There are two questions Harje likes to ask of any investment. What is it worth? And how much does it cost? These two questions alone open up a world of investment opportunities which Harje shares with Money Morning New Zealand readers.