People used to make things.

When I was a kid, growing up in small-town NZ, someone was always building something of note. A boat in the back shed capable of sailing the world. A video-game console that could plug into the TV and play tennis. Go-karts, welded helmets, elaborate pieces of furniture…you name it.

Today, nobody around me seems to make anything anymore.

It’s easier to buy cheap goods — from electronics, to tools, to furnishings — from China.

And countless manufacturing jobs from the West have moved there.

But in NZ, we’re still insulated. As China is a significant consumer of our commodity exports — from dairy to logs.

We’re about to get caught in the middle of a high-stakes trade war. So here’s how to look at investing.

Mainstream media commentators have been criticising the tariffs

From September 1, Trump ups the ante on China, slapping 10% tariffs on China’s remaining $300 billion of exports to the US. He overruled nearly his entire trade team on this — arguing that China had not made good on a promise to buy American agricultural goods in large quantities.

Commentators argue that it’s the American consumer who will pay for the tariffs. Not China. And thus, ordinary Americans will be worse off.

This is short-sighted.

Starting this week, certain large asset managers said they would increase their short position on industrial commodities.

This is a sign those watching the numbers are about to see the productive base of China get pulled down.

Simply put, if Chinese goods are suddenly 10% or 20% more expensive, retailers start looking for other alternatives to meet consumer demand.

Now, some argue that China has a competitive advantage in manufacturing, and the economy of the goods they export cannot be replaced.

The dark side of this competitive advantage is round-the-clock factories with poor worker conditions and pay. And in some cases, questionable transfers of technology and intellectual property from the US and other countries.

So you could argue that competitive advantage is unfair. And the tariffs are right to handicap it.

Yet, one thing is inarguable. China has done a phenomenal job of growing and lifting millions out of poverty. It has become the world’s largest exporter. But the tide is turning. And now it’s time for someone else to have a turn.

Watching Walmart

Walmart [NYSE:WMT] sells a significant amount of goods sourced from China. It announced that higher tariffs will increase prices for US shoppers — but that it also had a strategy in time to blunt this. It will work to obtain products from different countries and work with suppliers.

The numbers tell the story. If Walmart, a key purveyor of Chinese goods in the States, had no other option but to ramp up prices and see sales slow — the share price should theoretically tank.

At the time of writing, it’s holding at a near all-time high of around $110.

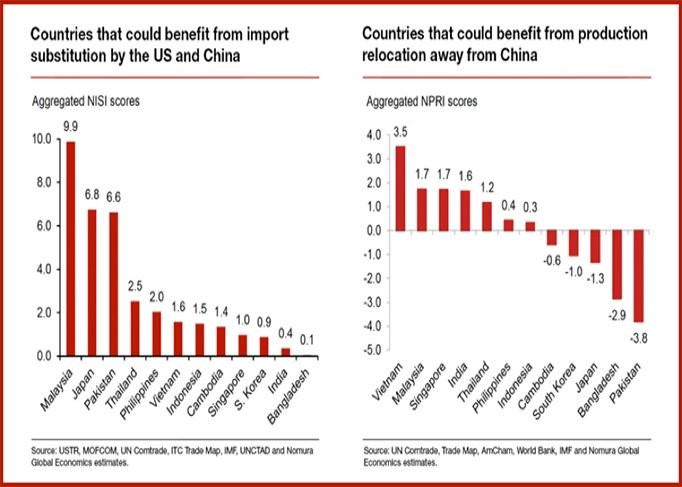

Walmart and the American consumer have other options. There are numerous developing countries who would like a share of China’s exports.

Thailand and Malaysia are luring electronics and computer makers.

Cambodia, Philippines and Bangladesh are increasing their share of the apparel and footwear markets.

And Thailand and Vietnam are ramping up their production of household consumer goods like washing machines and refrigerators.

Moreover, Trump more than anything is pit bull focused on ‘bringing back American jobs.’

The US is the world’s second-largest manufacturer (after China). Recent initiatives could see it once again become the largest, using industrial technologies and restoration of manufacturing jobs in rust-belt communities to resurge.

Writing tariffs off as bad for the consumer and economy is not the whole picture

Over the longer run, tariffs can help rebalance trade and allow other developing countries a go. And allow some local manufacturers to once again start building things at home.

There are key industries and areas that could benefit from the worsening trade outlook. The Shanghai composite is probably going to come under pressure. As likely will the Dow in the shorter term.

Yet, there will be net beneficiaries. Certain US domestic focused makers and sellers. EU manufacturers likely to capture billions in new trade. And rising economies in South East Asia:

At the centre of the ASEAN countries is Singapore. A developed market with a sophisticated stock exchange.

I plan on looking into some specific opportunities there as part of our new Lifetime Wealth Investor news service.

Keep building…

Regards,

Simon Angelo

Editor, WealthMorning.com

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.