If you read and believe the mainstream press, the top news of the week was US President, Donald Trump’s meeting with Queen Elizabeth II and British PM, Theresa May last week.

His visit was marked by some backseat Brexit driving, villainising of the EU, and a giant inflatable ‘Trump Baby’ blimp…

Unsurprisingly, anti-Trump media outlets like the BBC and The Guardian openly condemned his visit saying, ‘President’s extraordinary visit marked by flouted protocol and enthusiastic protest.’

While I have no doubt that the President made his way through Windsor Castle like an orange bull in a china shop, I would recommend taking your British news with a pinch of salt.

This week, Trump will visit with Vladimir Putin…maybe they’ll start planning Trump’s mid-term election together. Only kidding.

And of course, there was the culmination of the FIFA World Cup. France beat Croatia.

But Trump and the World Cup may be interesting at some level, we believe there are far more important stories for New Zealanders.

What, exactly? I’m glad you asked. Here, I’ll explain…

New Zealand at risk

In other news, I read an unnerving article in the Wall Street Journal this morning titled ‘To Spot the Next Financial Crisis, Look Who Was Spared by the Last One’.

Author James Mackintosh believes that the countries least affected by the Great Financial Crisis (GFC) are primed to suffer the worst in the next crisis. Here are the five countries he views as the most at-risk markets in the world:

- Australia

- Canada

- Sweden

- Norway

- New Zealand

Why is New Zealand on this list?

When the rest of the world was collapsing in 2008 and 2009, New Zealand managed to avoid the crunch mainly through steady exports to China. Sure, there was a short period of contraction, but it was nothing compared to the economy-wide correction in Europe and the United States.

GDP, employment, and surplus budgets bounced back in New Zealand by 2011.

While that was happening, the central banks around the developed world were dropping interest rates to historical lows.

And New Zealand benefited without the correction to our markets, especially housing.

In other words, we’ve been overpaid…and soon the invisible hand will be knocking on our door to collect what it’s due.

Mackintosh argues that New Zealand’s borrowing binge over the past decade makes us first in line for a credit-squeeze induced crash.

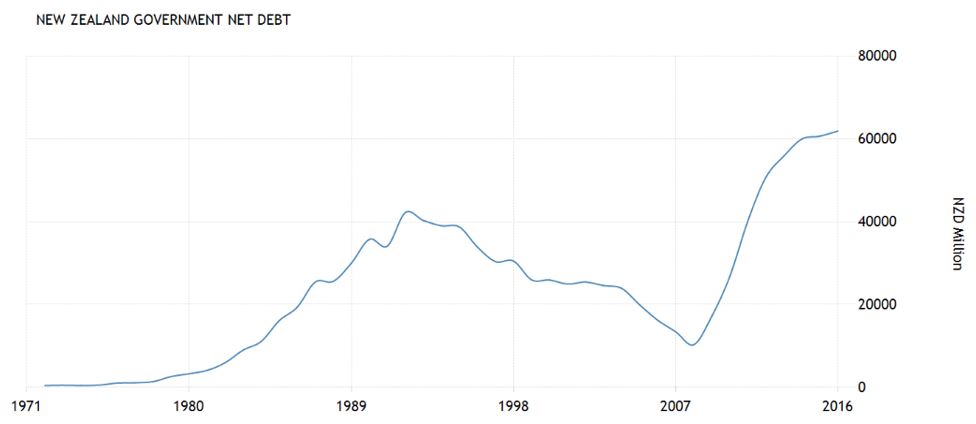

If you doubt that we’ve been binging on debt, see below:

|

Source: Trading Economics |

See that steep incline starting just after 2007?

That’s the binge that Mackintosh is talking about.

It’s hard to argue that it was all necessary. Like mentioned before, New Zealand’s correction was more or less finished by 2011. And yet, government borrowing continued to skyrocket.

The result is an artificial market boom. Or what many in NZ call the ‘rock star economy’.

It’s dangerous because this artificial boom is built on a foundation of ‘easy money’ or borrowing at super low rates.

Even the Reserve Bank of New Zealand admits it. They state that net funding from abroad is roughly 55% of GDP and exposes New Zealand to exceptional risk if lending rates change.

And at this point, with basement-bottom rates around the world…the only way rates can go is up. [openx slug=inpost]

This indicator is at red alert…

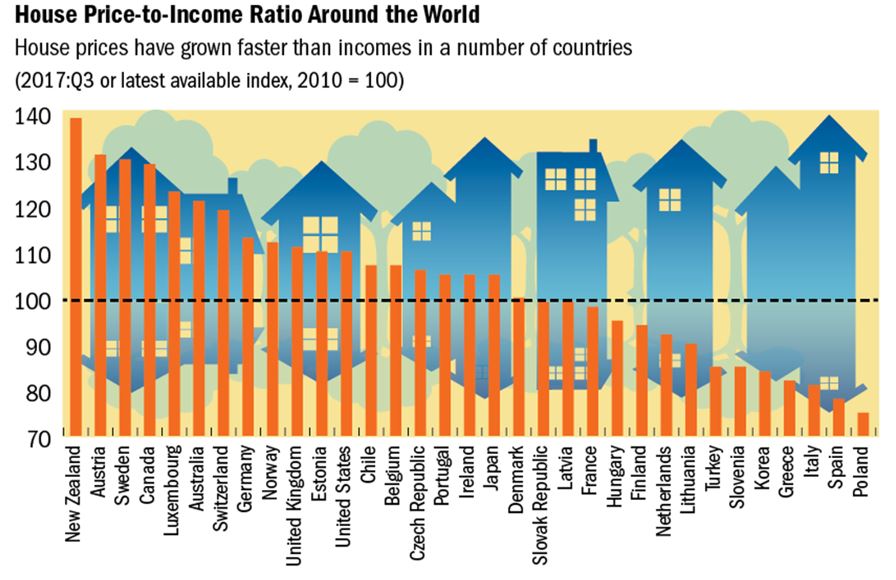

One of the clearest indicators of this threat is the house price to income ratio.

In 2007, Ireland and Spain had the highest ratios the world. You know what happened to them.

They imploded. Bailouts. Bankruptcy. Strikes. Riots. Government collapse. It will take decades and billions upon billions of euros before they’re back on track.

Today, guess who’s leading the pack? That’s right — You are.

|

Source: IMF |

This should alarm you.

We already realise that we’re at the peak of a major housing bubble, but Mackintosh’s research implies that this bubble could take down the entire economy as it did in the US in 2007.

The IMF seems to confirm his suspicions, in that all five of Mackintosh’s at-risk economies are in the top ten highest ratios.

What happens next?

Since New Zealand seems to be following the footsteps of pre-2007 Ireland, let’s look at how their bubble popped.

Their economic bull run was called the ‘Celtic Tiger’. It was not unlike our ‘rock star economy’.

Home prices were high and rising. Incomes weren’t keeping up, but that didn’t seem to stop the speculative borrowing and construction in the housing market.

The government backed the growth of the housing market by opening up zoning and offering tax incentives.

The country was one of the Eurozone’s quickest growing economies.

Even though most analysts acknowledged the formation of the bubble, no one wanted to be the one who clamped down on the growth.

Eventually, supply caught up with demand. Prices began to plateau. The press called it a ‘market softening’.

In 2007, credit around the world was tightened. It was the needle that popped the bubble.

Within five years, house prices in Dublin were down 56% and apartments down over 62%.

Over 47% of outstanding loans were found to be in negative equity. In other words, the homeowners were under water on their mortgages.

The national debt rose to 105.5% of GDP.

That’s where New Zealand stands today…at the precipice of one of the greatest crashes this country has ever faced.

And not unlike the situation in Ireland, nobody wants to be the bearer of bad news.

If Mackintosh and the IMF are correct, Kiwis could see their home values cut in half within the next decade.

And it won’t stop there. This crash could topple the entire economy. It could erase the savings and retirements of millions of New Zealanders.

And the ‘rock star economy’ will only be a distant memory.

Are you ready?

Sincerely,

Taylor Kee

Editor, Money Morning New Zealand

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.