In the opening to Ben Graham and David Dodd’s book, Security Analysis, the two wrote:

‘Many shall be restored that now are fallen, and many shall fall that now are in honour.’

The quote was originally from the Roman poet, Horace.

His career coincided with the momentous change from the Roman republic to the Roman empire. But the words above had little to do with a changing political landscape.

Horace was in fact referring to words. Many out of favour words will soon come back into circulation and others that are commonly used shall soon fall out of favour.

Not only does this sentence apply to words, it applies to capitalism. Hence why it kicks off the bible of value investing (Security Analysis).

Mediocrity rules

While he didn’t know it, Horace articulated an effect which works on words, business and even population heights.

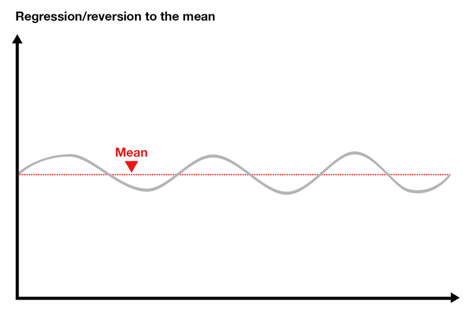

Horace was describing mean regression.

For the non-statisticians out there, mean regression is when variables move towards the mean. Let’s use population heights as a quick demonstration.

In the 16th Century, Sir Francis Galton decided to perform a test. He wanted to see if there was a relationship between the heights of parents and their children.

You might assume taller parents have taller kids and smaller parents have smaller kids. Surely height is genetic?

However when Galton looked at the results he found that children did not tend to resemble their parents height.

Rather the children will always be more mediocre. So if their parents were large, most kids tended to be smaller. And if their parents were small, most kids tended to be larger.

And just as it was true in the 16th Century, the height of most children today tends to regress to the mean.

|

Source: The Conversation |

How does this apply to capitalism?

Capitalism is all about protecting your castle.

I’ll use REA Group Ltd [ASX:REA] to demonstrate.

The castle for REA Group is the massive profits they earn from their real estate classified site, realeastate.com.au.

There are a lot of people that want the same castle. The group at Domain.com.au is one such business.

To protect their castle, REA Group has developed a wide deep moat. Think of this moat as REA’s huge network of buyers and sellers.

Realestate.com.au has established themselves as the platform for property buyers and sellers.

Because sellers list their properties on the site, it draws in more buyers. And because more buyers are coming to the site more sellers list their property on realesate.com.au. It’s a self-sustaining cycle.

And it’s up to the knight of the castle (CEO of REA, Tracey Fellows) to make this moat deeper and wider each year.

But nothing can last forever. [openx slug=inpost]

Competition will eventually learn how to jump the moat and seize the castle. As a rule of thumb, competition usually tries to break into high returning industries.

And over time, due to competition, superior returns will turn into mediocre returns.

The opposite generally applies to industries will terrible returns. Competitors will either jump out or fail, leaving few companies left.

But because competition has left, the few surviving companies now have the market all to themselves. All it takes is time before industry returns rise from terrible to mediocre.

It was this principle that helped Graham build a fortune in the stock market.

The company he looked for had to be cheap, and I mean really cheap. Sometimes he found stocks trading for less than the cash on their balance sheet.

The reason these stocks were so cheap is because they had problems. Most had terrible returns. They were going through a rough patch or their industry had declined for years.

While Graham could pick individual winners, he used a blanket approach.

He would buy a group of 20 to 30 really cheap stocks and sit on them. Some went bankrupt. Others remained at the same price. And a few ran up exponentially.

What were once terrible businesses in low return industries turned into mediocre businesses in average industries. That change from terrible to mediocre sometimes causes stocks to run up 1,000% or more.

The problem today is finding stocks trading at such discounts. There are some out there. But they’re extremely hard to come by.

But you can still apply mean regression to wonderful businesses like REA Group.

Where you should put your savings

If you’re going to invest a majority of your net wealth in stocks, it’s best to understand what you’re buying.

After hearing about mean regression, it’s probably not the wisest to invest in the hot industry of the day or the business earning super ordinary returns (assuming they have no moat).

All it takes is time for those returns and the glamour of your stock to wear off. Competition will come into the industry, cutting prices and your once prized stock with it.

But the idea isn’t to ignore high returning businesses. The idea is to invest in high returning businesses that can resist mean regression for a long period of time.

Essentially you’re looking for a high returning business with a strong moat and an intelligent knight.

They’re not always easy to find, but they’re the best bets to stake a majority of your savings on.

Your friend,

Harje Ronngard

Harje Ronngard is one of the editors at Money Morning New Zealand. With an academic background in finance and investments, Harje knows how difficult investing is. He has worked with a range of assets classes, from futures to equities. But he’s found his niche in equity valuation. There are two questions Harje likes to ask of any investment. What is it worth? And how much does it cost? These two questions alone open up a world of investment opportunities which Harje shares with Money Morning New Zealand readers.