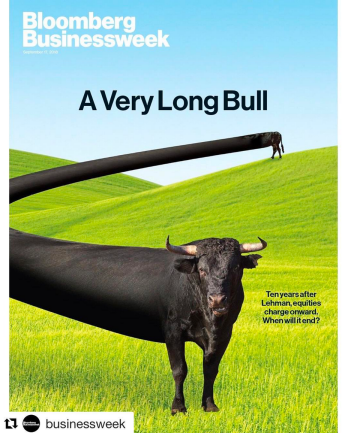

This has been a seriously long bull market.

Bloomberg Businessweek captures it quite well in one of their September covers:

|

Source: Bloomberg Businessweek |

Yet things aren’t well.

We haven’t truly recovered from the 2008 crash…but we have accumulated a lot more debt.

We have been warning for a while now that we are heading for a major crash, one that could be much worse than what we saw in 2008.

Of course, we could be wrong, but…

…in the last month we have heard a series of warnings.

In a recent article, Yale Professor Robert Schiller warns these are risky times. Schiller explains investors are pushing up the stock market based on earnings. Yet, these can change at any time.

‘With prices and earnings moving together on a nearly one-for-one basis, one might conclude that the US stock market is behaving sensibly, simply reflecting the US economy’s growing strength.

‘But it is important to bear in mind that earnings are highly volatile. Sudden sharp increases tend to be reversed within a few years. This has happened dramatically more than a dozen times in the US stock market’s history…

‘Apparently, investors believe that this boom is going to last, or at least that other investors think it should last, which is why they are bidding up stock prices in a dramatic response to the earnings increase.

‘A bear market could come without warning or apparent reason, or with the next recession, which would negatively affect corporate earnings. That outcome is hardly assured, but it would fit with a historical pattern of overreaction to earnings changes.’

While the economy has been quite slow to recover since 2008, housing and the US stock markets have seen a boom. This has been fed by low interest rates.

We have already lowered interest rates to minimums. The US has already used tax cuts to spur the economy. [openx slug=inpost]

The next recession could be the worst one

And, as we heard from Professor Martin Feldstein, the next one could be worse, much worse.

As reported by the New Zealand Herald (emphasis mine):

‘”We have no ability to turn the economy around,” said Martin Feldstein, President of the US National Bureau of Economic Research.

‘”When the next recession comes, it is going to be deeper and last longer than in the past. We don’t have any strategy to deal with it,“…

‘He warned that a decade of super-low interest rates and monetary stimulus by the US Federal Reserve has pushed Wall Street equities to nose-bleed levels that no longer bear any relation to historic fundamentals. Stock prices will inevitably come plummeting back down to earth.

‘Prof Feldstein said the next bear market – most likely triggered by a spike in 10-year Treasury yields – risks setting off a US$10 trillion (NZ$15 trillion) crash in US household assets. The cascading ‘wealth effects’ will drain the retail economy of US$300bn to US$400bn a year, causing recessionary forces to mestasasize [sic].’

Claudio Borio, head of the Monetary and Economic department at the Bank of International Settlements (BIS), is also concerned we are well unprepared for the next one.

‘What happens next is, as always, hard to tell. Will the patient continue to mend, as looked likely until the first quarter of this year, or will there be a relapse? What one can say is that the patient’s full recovery will not be smooth. On the financial side, things look rather fragile. Markets in advanced economies are still overstretched and financial conditions still too easy. Above all, there is too much debt around: in relation to GDP, globally, overall (private and public) debt is now considerably higher than pre-crisis. Ironically, too much debt was at the heart of the crisis, and now we have more of it – although, fortunately, banks have reduced their leverage thanks to financial reform. With interest rates still unusually low and central banks’ balance sheets still bloated as never before, there is little left in the medicine chest to nurse the patient back to health or care for him in case of a relapse.’

And, in recent weeks, the International Monetary Fund (IMF) has issued not one, but two warnings.

In their latest World Economic Outlook report, the fund downgraded growth expectations for the global economy to 3.7% this year and next.

The second warning came on their Global Financial Stability Report of October 2018. The fund sees risks everywhere, in emerging markets, trade tensions, Brexit, rising rates…and is concerned that market investors are ‘complacent’ and underestimating risks.

These warnings are not coming from the fringes anymore, but from world economists and global organisations.

Markets are recovering today. For now, the bulls are still running.

Yet the question is, for how long?

We are not sure, but our bet is that there isn’t too much left to the finish line.

That’s why this is time to prepare. Revise positions. Buy some insurance.

Don’t say nobody warned you.

Best,

Selva Freigedo