I stuffed up. I admit it.

You see, I keep a close eye on several growing trends around the world. I’m constantly devouring the latest info, data or rumours…trying to get an as-complete-as-possible perspective on where it’s going.

And if you’re a regular reader, you’ll know that cannabis investing is one of those trends.

Despite my efforts, this week I was caught completely unaware by a MAJOR update…one that has massive implications for cannabis stocks in North America…and at another level, one that could obliterate crime rings around the world.

It’s big. Maybe even bigger than Canada’s recent legalisation. And I had no idea it was coming.

Last week, Mexico’s Supreme Court ruled that prohibiting recreational marijuana was unconstitutional.

And that ruling is final. The Mexican Congress, the president, the president-elect…none of them can change it. Additionally, legislators now have a short 90 days to come up with a new regulatory framework in line with the Supreme Court’s position.

In other words, by this Valentine’s Day, Mexico will have fully legalised recreational marijuana.

The United States, then, will be sandwiched between two legalised territories…which puts a greater pressure on nationwide reform.

And Mexican cartels, which have long thrived on the flow of illegal cannabis through Mexico and into the United States, will have lost an important foothold.

In New Zealand, the effect will be less direct, but the evidence is there — this is a global trend…and it will hit our shores soon enough.

Through the eyes of an Austrian

From an economic perspective, a brand-new industry like cannabis can ignite a period of prosperity.

It falls in line with the economic theory of one of the world’s greatest economists, Joseph A Schumpeter.

As an explanation for economic cycles, Schumpeter suggested that innovation triggers an upswing in the cycle.

Innovation could mean a new product, opening of a new market, reorganisation of an industry or development of a new method of production.

As it becomes successful, more entrepreneurs will copy the innovation or produce something similar. This leads to a market expansion…and prosperity.

Eventually the market will start to be saturated. Prices will fall. Many firms will fail. Employment, output and income all tumble…setting off the contractionary period.

That’s the cycle, according to Schumpeter, anyways.

You see this happen all the time on a minor scale. [openx slug=inpost]

Remember hoverboards?

|

Source: Flickr |

You’d stand on them and lean forward. Away you go!

Personally, I never tried one. I knew that if I did, I’d become one of those viral videos where the rider zooms into a fountain or off a cliff.

But they sure were popular. They were considered the ‘hottest, hardest-to-get gift’ for Christmas 2015.

Within six months, the fad would be dead in the water.

What happened?

It started in Las Vegas in early 2015, at the International Consumer Electronics Show. The IO Hawk made its debut in the halls of the Venetian, wowing spectators and riders alike.

It was soon followed by a range of lookalikes built by inspired entrepreneurs. By mid-year, the innovation stage was wrapping up. The saturation stage was beginning.

Millions of them, produced by Chinese knock-off companies, flooded stores. It stabilised prices…then began to decrease them. There were so many competitors, and very little differentiation, that the market began to crash.

It didn’t help that regulators in the US and UK finally tossed in their two cents, warning that the products were unsafe.

The hoverboard followed the exact innovation cycle laid out by Joseph Schumpeter (100 years before, mind you)…and died a fiery death.

|

Source: Mashable |

An investor’s GPS

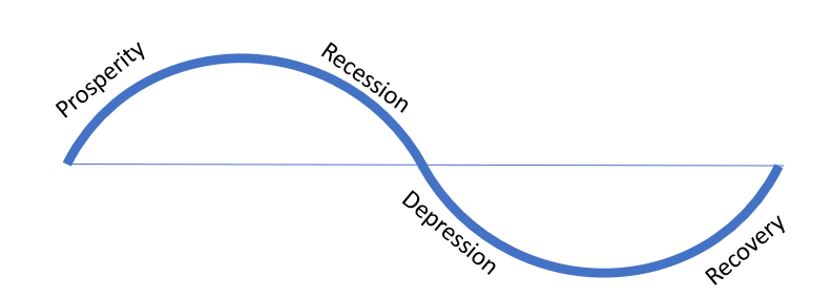

In Schumpeter’s cycle, he says that it starts with prosperity — an upswing in the market. Recession follows the prosperity. Once the innovation’s gains have almost all been wiped away, he suggests we enter a phase of depression, followed by recovery. Like this:

|

Source: Taylor Kee |

Unless you’ve been living under a rock, this won’t be news to you. You’ve probably seen dozens of these cycles occur at a macro scale…and thousands more at an industry, company, or product level.

What we do here at Money Morning New Zealand is try to place us on that oscillating cycle — to determine how we should adjust our finances accordingly.

Housing, for example, we place at the 1PM mark in the Recession stage.

Tech, on the other hand, we’d put at the 4PM mark in the Recovery stage.

With those sorts of ballpark waypoints, we can tune in our portfolios to capitalise on — or avoid — different stages.

However, in today’s world, the meddling of regulators tends to disrupt this natural flow, often minimising the depression phase at the cost of the eventual prosperity phase…so it may not be as defined as what you see above.

Other factors, like the employment level…and the innovation’s source of funding…allocation of capital…affect the cycle as well.

But if you printed Schumpeter’s cycle on a transparency, then laid that over any market chart, you’d find that it generally lines up.

That’s where we differ from your mainstream talking heads. Lots of those folks — especially those that live in the theoretical bubble of academia — seem to think that it’s not a cycle at all. Instead it’s a line, tilted upwards.

They think that downturns aren’t natural…and ought to be destroyed by a heavy-handed monetary guardian.

That’s why they were caught unawares when the GFC hit…and we were sitting pretty, out of stocks and in gold.

We knew it was coming. It had to. Schumpeter said so.

Best,

Taylor Kee

Editor, Money Morning New Zealand

PS: If you’re following Kiwi cannabis start-up Hikurangi, you might be scratching your head right now. We highlighted them months ago…and since then, they’ve had a couple rounds of fundraising, a potential mother-lode partnership, and now, it seems that the partnership has fallen through. We’re expecting an announcement from director Manu Caddie any day now. We’ll keep you updated.

Taylor Kee is the lead Editor at Money Morning NZ. With a background in the financial publishing industry, Taylor knows how simple, yet difficult investing can be. He has worked with a range of assets classes, and with some of the world’s most thought-provoking financial writers, including Bill Bonner, Dan Denning, Doug Casey, and more. But he’s found his niche in macroeconomics and the excitement of technology investments. And Taylor is looking forward to the opportunity to share his thoughts on where New Zealand’s economy is going next and the opportunities it presents. Taylor shares these ideas with Money Morning NZ readers each day.